Answered step by step

Verified Expert Solution

Question

1 Approved Answer

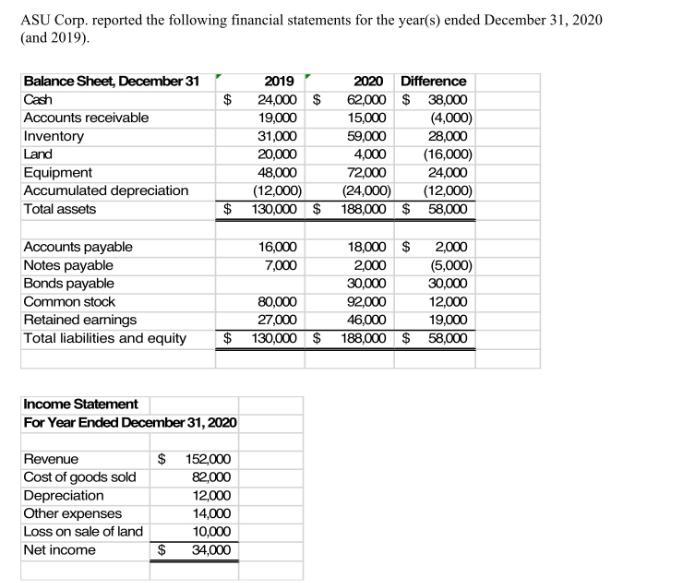

ASU Corp. reported the following financial statements for the year(s) ended December 31, 2020 (and 2019). Balance Sheet, December 31 2019 2020 Difference Cash

ASU Corp. reported the following financial statements for the year(s) ended December 31, 2020 (and 2019). Balance Sheet, December 31 2019 2020 Difference Cash Accounts receivable Inventory Land Equipment Accumulated depreciation Total assets $ $ 24,000 $ 62,000 $ 38,000 19,000 15,000 (4,000) 31,000 59,000 28,000 20,000 4,000 (16,000) 48,000 72,000 24,000 (12,000) (24,000) (12,000) 130,000 $188,000 $58,000 Accounts payable Notes payable Bonds payable Common stock 16,000 18,000 $ 2,000 7,000 2,000 (5,000) 30,000 30,000 80,000 92,000 12,000 Retained earnings 27,000 46,000 19,000 Total liabilities and equity $ 130,000 $ 188,000 $ 58,000 Income Statement For Year Ended December 31, 2020 Revenue $ 152,000 Cost of goods sold 82,000 Depreciation 12,000 Other expenses 14,000 Loss on sale of land 10,000 Net income $ 34,000 Additional information For Year 2020, cash dividends declared and paid were $15,000. Hint: How much cash is received from the sale of land, which is reported in cash flows from investing activities?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided financial statements here is the analysis 1 Changes in the Balance Sheet from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started