Answered step by step

Verified Expert Solution

Question

1 Approved Answer

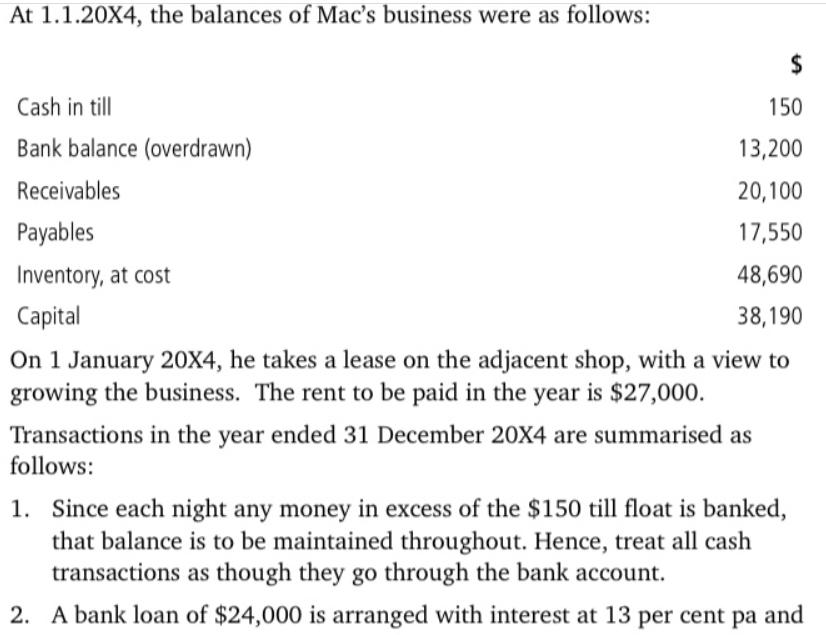

At 1.1.20X4, the balances of Mac's business were as follows: Cash in till Bank balance (overdrawn) $ 150 13,200 Receivables 20,100 Payables 17,550 Inventory,

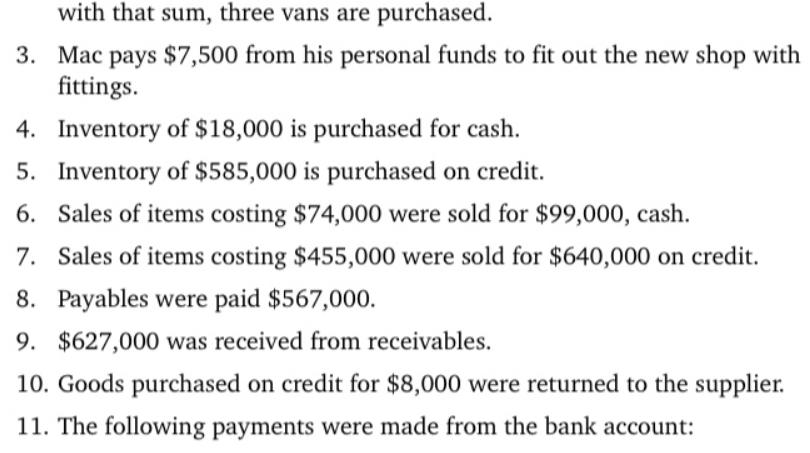

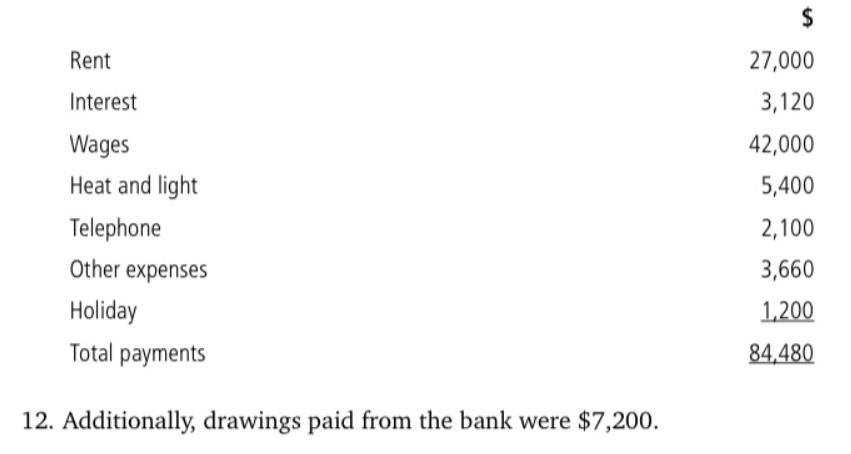

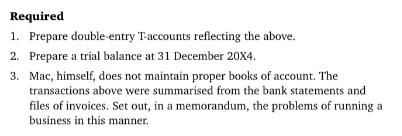

At 1.1.20X4, the balances of Mac's business were as follows: Cash in till Bank balance (overdrawn) $ 150 13,200 Receivables 20,100 Payables 17,550 Inventory, at cost 48,690 Capital 38,190 On 1 January 20X4, he takes a lease on the adjacent shop, with a view to growing the business. The rent to be paid in the year is $27,000. Transactions in the year ended 31 December 20X4 are summarised as follows: 1. Since each night any money in excess of the $150 till float is banked, that balance is to be maintained throughout. Hence, treat all cash transactions as though they go through the bank account. 2. A bank loan of $24,000 is arranged with interest at 13 per cent pa and with that sum, three vans are purchased. 3. Mac pays $7,500 from his personal funds to fit out the new shop with fittings. 4. Inventory of $18,000 is purchased for cash. 5. Inventory of $585,000 is purchased on credit. 6. Sales of items costing $74,000 were sold for $99,000, cash. 7. Sales of items costing $455,000 were sold for $640,000 on credit. 8. Payables were paid $567,000. 9. $627,000 was received from receivables. 10. Goods purchased on credit for $8,000 were returned to the supplier. 11. The following payments were made from the bank account: Rent Interest Wages Heat and light Telephone Other expenses Holiday Total payments 12. Additionally, drawings paid from the bank were $7,200. $ 27,000 3,120 42,000 5,400 2,100 3,660 1,200 84,480 Required 1. Prepare double-entry T-accounts reflecting the above. 2. Prepare a trial balance at 31 December 20X4. 3. Mac, himself, does not maintain proper books of account. The transactions above were summarised from the bank statements and files of invoices. Set out, in a memorandum, the problems of running a business in this manner.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Doubleentry Taccounts Cash in Till Debit Opening Balance 150 Credit Sales 99000 cash Other Expenses 3660 Drawings 7200 109860 Debit Closing Balance 109860 150 Bank Balance Debit Opening Bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started