Answered step by step

Verified Expert Solution

Question

1 Approved Answer

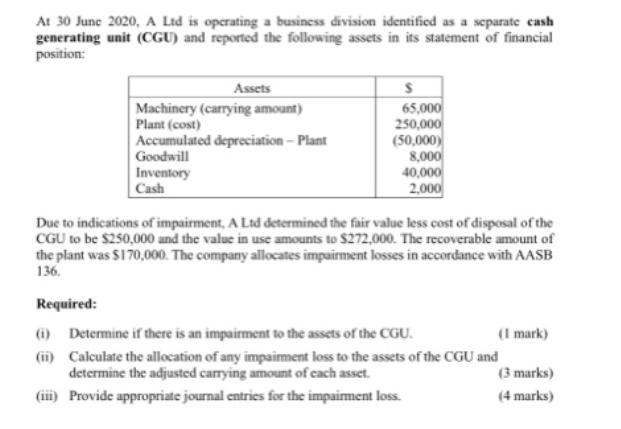

At 30 June 2020, A Ltd is operating a business division identified as a separate cash generating unit (CGU) and reported the following assets

At 30 June 2020, A Ltd is operating a business division identified as a separate cash generating unit (CGU) and reported the following assets in its statement of financial position: Assets S Machinery (carrying amount) 65,000 Plant (cost) 250,000 Accumulated depreciation - Plant (50,000) Goodwill 8,000 40,000 Inventory Cash 2,000 Due to indications of impairment, A Ltd determined the fair value less cost of disposal of the CGU to be $250,000 and the value in use amounts to $272,000. The recoverable amount of the plant was $170,000. The company allocates impairment losses in accordance with AASB 136. Required: (i) Determine if there is an impairment to the assets of the CGU. (I mark) (ii) Calculate the allocation of any impairment loss to the assets of the CGU and determine the adjusted carrying amount of each asset. (3 marks) (iii) Provide appropriate journal entries for the impairment loss. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Determine if there is an impairment to the assets of the CGU Yes there is an indication of impairm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started