Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At 31 December 2009 the debtors amounted to 50,000. Based on this the provision for doubtful debts is equal to 5% x 50,000 -

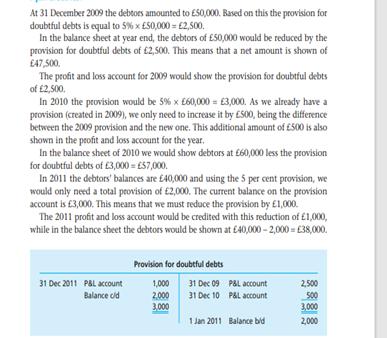

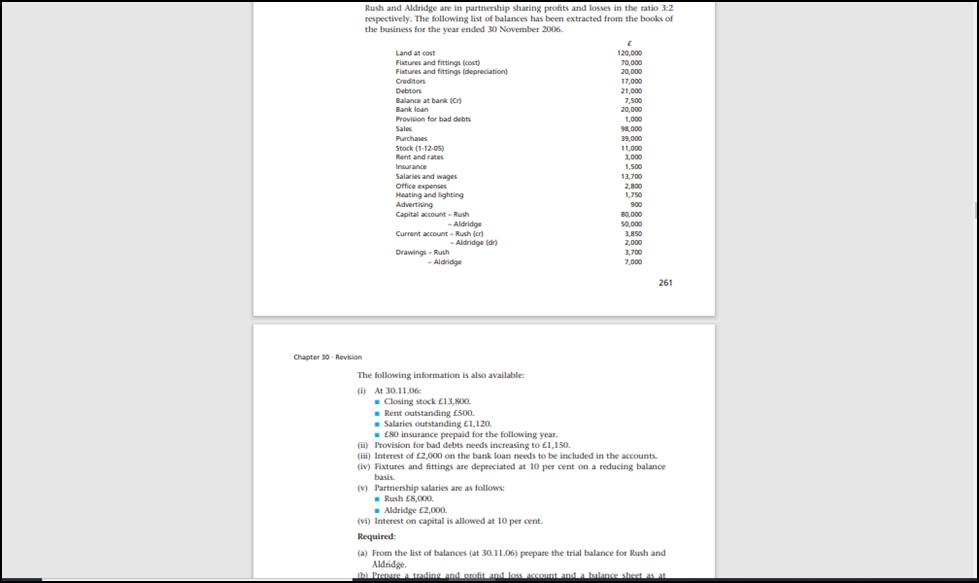

At 31 December 2009 the debtors amounted to 50,000. Based on this the provision for doubtful debts is equal to 5% x 50,000 - 2,500. In the balance sheet at year end, the debtors of 50,000 would be reduced by the provision for doubtful debts of 2,500. This means that a net amount is shown of 47,500. The profit and loss account for 2009 would show the provision for doubtful debts of 2,500. In 2010 the provision would be 5% x 60,000 3,000. As we already have a provision (created in 2009), we only need to increase it by 500, being the difference between the 2009 provision and the new one. This additional amount of 500 is also shown in the profit and loss account for the year. In the balance sheet of 2010 we would show debtors at 60,000 less the provision for doubtful debts of 3,000 = 57,000. In 2011 the debtors' balances are 40,000 and using the 5 per cent provision, we would only need a total provision of 2,000. The current balance on the provision account is 3,000. This means that we must reduce the provision by 1,000. The 2011 profit and loss account would be credited with this reduction of 1,000, while in the balance sheet the debtors would be shown at 40,000-2,000-38,000. Provision for doubtful debts 31 Dec 2011 P&L account 1,000 31 Dec 09 P&L account 2,500 Balance cid 2,000 31 Dec 10 P&L account 500 3,000 3,000 1 Jan 2011 Balance bid 2,000 Rush and Aldridge are in partnership sharing profits and losses in the ratio 3:2 respectively. The following list of balances has been extracted from the books of the business for the year ended 30 November 2006. Land at cost Fixtures and fittings (cost) Fixtures and fittings (depreciation) Creditors Debton Balance at bank (Cr) Bank loan Provision for bad debts Sales Purchases Stock (1-12-05) 120,000 70,000 20,000 17,000 21,000 7,500 20,000 1,000 58,000 39,000 11,000 3,000 1,500 13,700 2,800 Heating and lighting 1,750 Advertising 900 Capital account-Rush 80,000 -Aldridge 50,000 Current account-Rush (cr) 3.850 -Aldridge (dr) Drawings-Ruth 2,000 3,700 -Aldridge 7,000 Rent and rates Insurance Salaries and wages Office expenses 261 Chapter 30 Revision The following information is also available: (i) At 30.11.06 Closing stock 13,800. Rent outstanding 500. Salaries outstanding 1,120. 80 insurance prepaid for the following year. (ii) Provision for bad debts needs increasing to 1,150. (iii) Interest of 2,000 on the bank loan needs to be included in the accounts. (iv) Fixtures and fittings are depreciated at 10 per cent on a reducing balance basis. (v) Partnership salaries are as follows: Rush 8,000. Aldridge 2,000. (vi) Interest on capital is allowed at 10 per cent. Required: (a) From the list of balances (at 30.11.06) prepare the trial balance for Rush and Aldridge, (b) Prenare a trading and profit and loss account and a balance sheet as at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Trial Balance for Rush and Aldridge as at 30 November 2006 Trial Balance Account Debit Credit Land ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started