Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At age 39, Barbara and John are mortgage-free with money in the bank, good professional jobs, a young child and a strong desire to

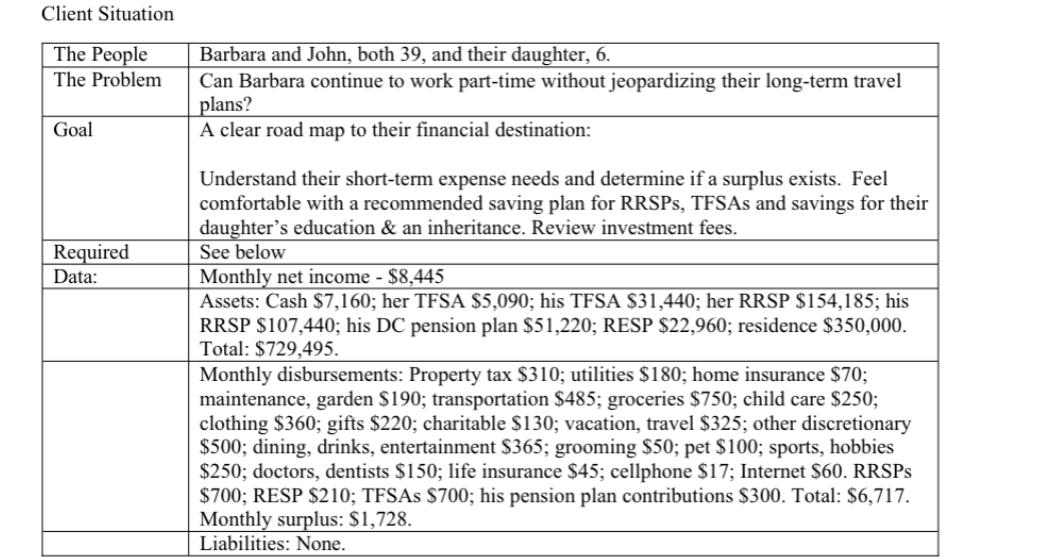

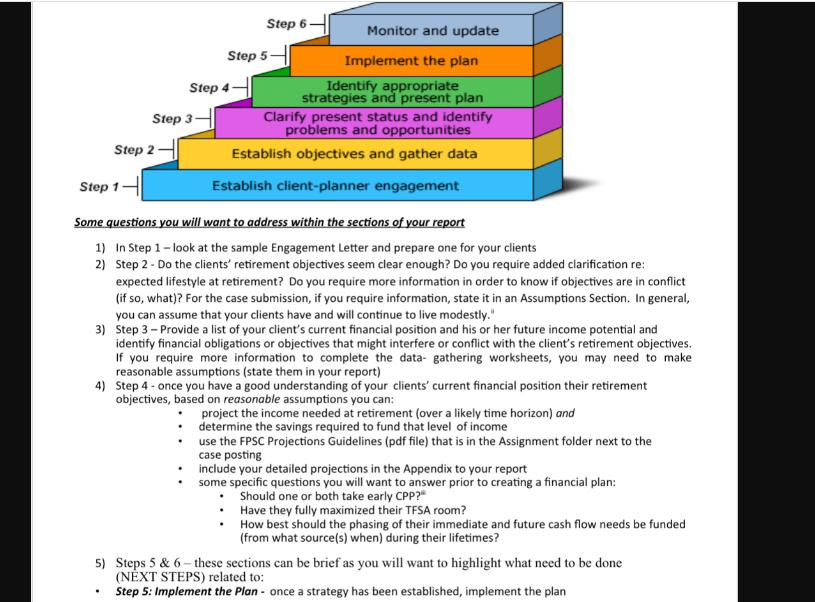

At age 39, Barbara and John are mortgage-free with money in the bank, good professional jobs, a young child and a strong desire to see the world. John earns about $97,000 a year, while Barbara brings in $39,120, on average, working part-time. They wonder whether she can continue to work part-time until John semi-retires at age 55, and then spend the next 15 years travelling the world together and working part-time. "We think the world is going to change and travel will become an extreme luxury item, Barbara says, adding, international travel will not be a valid option after 70." The Ontario couple have already given in to their wanderlust, travelling extensively over the past two years, but they realize they have to pare back a bit. They need to do some work on their house and save for their daughter's postsecondary education. They want to spend $18,000 in 2022, $6,000 in 2023 and $6,000 in 2024 on travel, plus $10,000 for new floors in 2023 and $10,000 for a new furnace and air conditioning unit in 2024. They show a surplus of $20,700 a year, more than enough to cover these expenses. When they semi-retire at age 55, they plan to spend $60,000 a year after tax in today's dollars (close to what they are spending today after savings are removed) plus an additional $20,000 a year in today's dollars on travel. John is saving 4 per cent of his income, plus a 4-per-cent matching contribution from his employer, to his defined- contribution pension plan, adding $2,400 a year to his tax-free savings account and $7,200 a year to his registered retirement savings plan. Barbara is contributing $6,000 to her TFSA and $1,200 to her RRSP. John asks "Are we okay if Barbara works part-time from now until full retirement at age 70?" Client Situation The People The Problem Goal Required Data: Barbara and John, both 39, and their daughter, 6. Can Barbara continue to work part-time without jeopardizing their long-term travel plans? A clear road map to their financial destination: Understand their short-term expense needs and determine if a surplus exists. Feel comfortable with a recommended saving plan for RRSPs, TFSAs and savings for their daughter's education & an inheritance. Review investment fees. See below Monthly net income - $8,445 Assets: Cash $7,160; her TFSA $5,090; his TFSA $31,440; her RRSP $154,185; his RRSP $107,440; his DC pension plan $51,220; RESP $22,960; residence $350,000. Total: $729,495. Monthly disbursements: Property tax $310; utilities $180; home insurance $70; maintenance, garden $190; transportation $485; groceries $750; child care $250; clothing $360; gifts $220; charitable $130; vacation, travel $325; other discretionary $500; dining, drinks, entertainment $365; grooming $50; pet $100; sports, hobbies $250; doctors, dentists $150; life insurance $45; cellphone $17; Internet $60. RRSPs $700; RESP $210; TFSAs $700; his pension plan contributions $300. Total: $6,717. Monthly surplus: $1,728. Liabilities: None. Required: Individually, prepare a professionally typed financial plan following the CIFP 6-steps. Remember that the financial planning process is meant to provide you with an opportunity to take what they have learned in this Retirement Planning course and demonstrate your financial planning skills. Step 6- Monitor and update Step 5 Implement the plan Step 4- Step 3- Identify appropriate strategies and present plan Clarify present status and identify problems and opportunities Step 2 Establish objectives and gather data Step 1- Establish client-planner engagement Some questions you will want to address within the sections of your report 1) In Step 1-look at the sample Engagement Letter and prepare one for your clients 2) Step 2 - Do the clients' retirement objectives seem clear enough? Do you require added clarification re: expected lifestyle at retirement? Do you require more information in order to know if objectives are in conflict (if so, what)? For the case submission, if you require information, state it in an Assumptions Section. In general, you can assume that your clients have and will continue to live modestly." 3) Step 3 - Provide a list of your client's current financial position and his or her future income potential and identify financial obligations or objectives that might interfere or conflict with the client's retirement objectives. If you require more information to complete the data- gathering worksheets, you may need to make reasonable assumptions (state them in your report) 4) Step 4 - once you have a good understanding of your clients' current financial position their retirement objectives, based on reasonable assumptions you can: project the income needed at retirement (over a likely time horizon) and determine the savings required to fund that level of income use the FPSC Projections Guidelines (pdf file) that is in the Assignment folder next to the case posting include your detailed projections in the Appendix to your report some specific questions you will want to answer prior to creating a financial plan: Should one or both take early CPP?" Have they fully maximized their TFSA room? How best should the phasing of their immediate and future cash flow needs be funded (from what source(s) when) during their lifetimes? 5) Steps 5 & 6-these sections can be brief as you will want to highlight what need to be done (NEXT STEPS) related to: . Step 5: Implement the Plan - once a strategy has been established, implement the plan What specialists, if any, would you want to consult at this stage Step 6: Monitor & Update - how often would you want to conduct periodic reviews and updates to evaluate progress towards your clients' retirement objectives

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started