Answered step by step

Verified Expert Solution

Question

1 Approved Answer

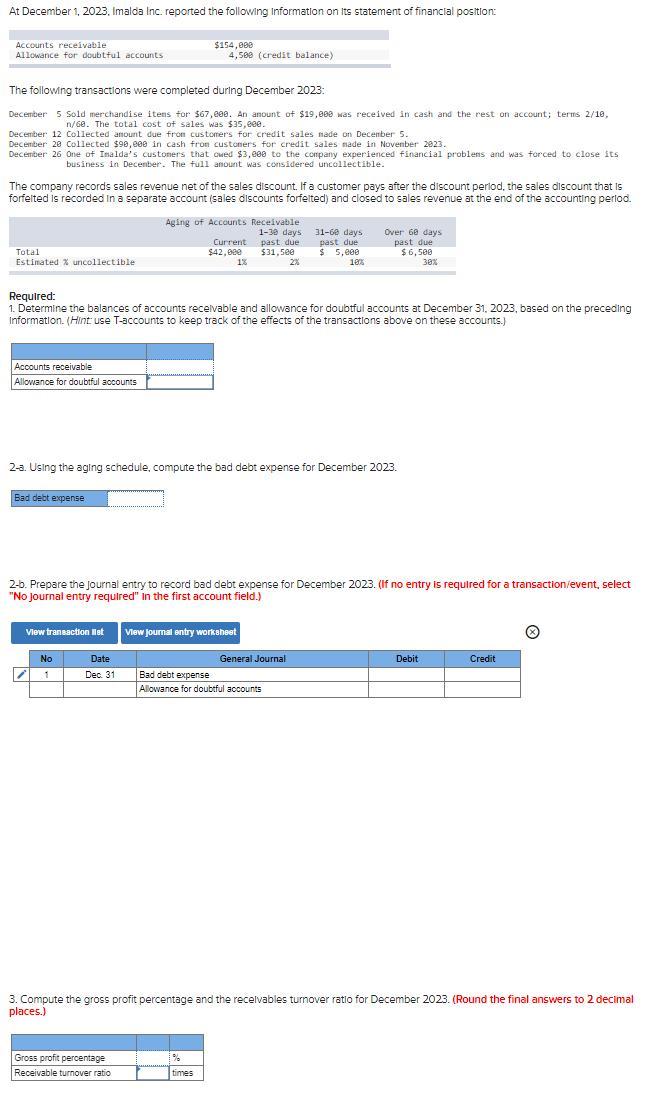

At December 1, 2023, Imalda Inc. reported the following Information on its statement of financial position: Accounts receivable Allowance for doubtful accounts $154,000 4,500

At December 1, 2023, Imalda Inc. reported the following Information on its statement of financial position: Accounts receivable Allowance for doubtful accounts $154,000 4,500 (credit balance) The following transactions were completed during December 2023: December 5 Sold merchandise items for $67,000. An amount of $19,000 was received in cash and the rest on account; terms 2/10, n/60. The total cost of sales was $35,000. December 12 Collected amount due from customers for credit sales made on December 5. December 20 Collected $90,000 in cash from customers for credit sales made in November 2023. December 26 One of Imalda's customers that owed $3,000 to the company experienced financial problems and was forced to close its business in December. The full amount was considered uncollectible. The company records sales revenue net of the sales discount. If a customer pays after the discount period, the sales discount that is forfeited is recorded in a separate account (sales discounts forfelted) and closed to sales revenue at the end of the accounting period. Total Estimated % uncollectible Aging of Accounts Receivable Current $42,000 1-30 days past due $31,500 31-60 days past due $ 5,000 1% 2% 10% Over 60 days past duel $6,500 30% Required: 1. Determine the balances of accounts receivable and allowance for doubtful accounts at December 31, 2023, based on the preceding Information. (Hint use T-accounts to keep track of the effects of the transactions above on these accounts.) Accounts receivable Allowance for doubtful accounts 2-a. Using the aging schedule, compute the bad debt expense for December 2023. Bad debt expense 2-b. Prepare the journal entry to record bad debt expense for December 2023. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction st View journal entry worksheet No Date General Journal Debit Credit 1 Dec. 31 Bad debt expense Allowance for doubtful accounts 3. Compute the gross profit percentage and the receivables turnover ratio for December 2023. (Round the final answers to 2 decimal places.) Gross profit percentage Receivable turnover ratio % times

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started