Answered step by step

Verified Expert Solution

Question

1 Approved Answer

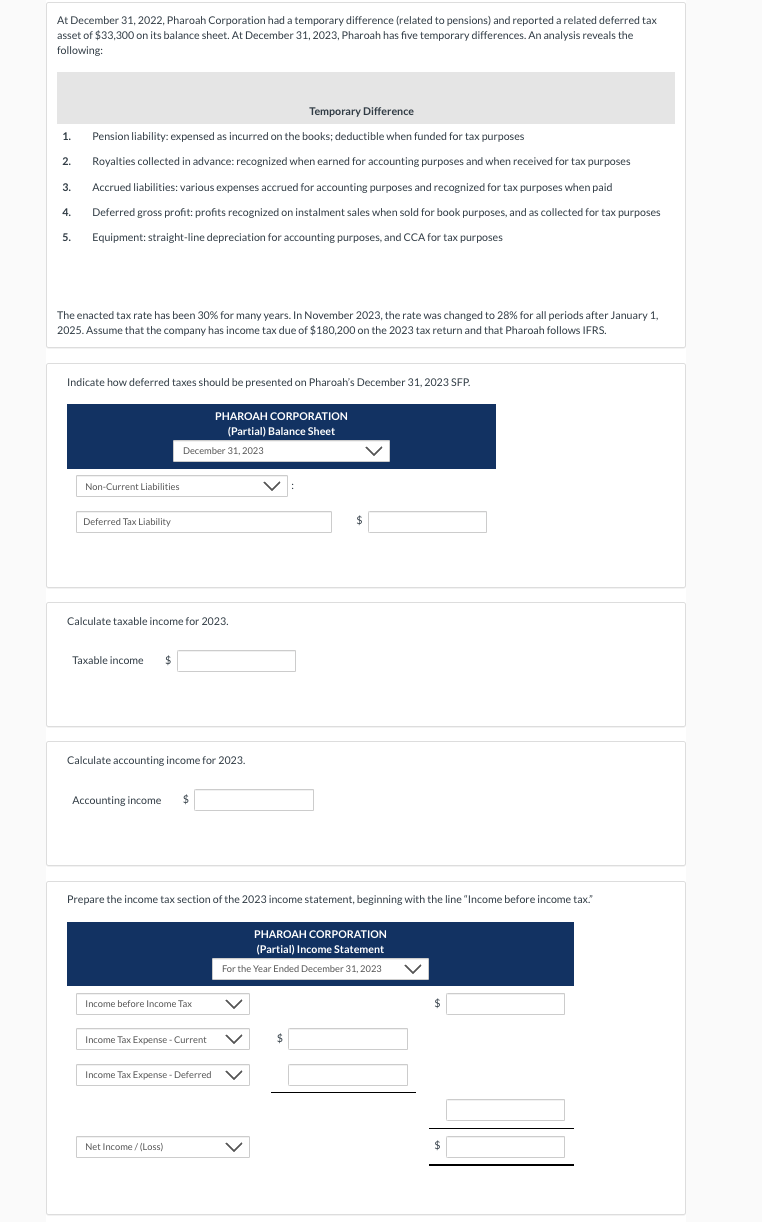

At December 3 1 , 2 0 2 2 , Pharoah Corporation had a temporary difference ( related to pensions ) and reported a related

At December Pharoah Corporation had a temporary difference related to pensions and reported a related deferred tax

asset of $ on its balance sheet. At December Pharoah has five temporary differences. An analysis reveals the

following:

Temporary Difference

Pension liability: expensed as incurred on the books; deductible when funded for tax purposes

Royalties collected in advance: recognized when earned for accounting purposes and when received for tax purposes

Accrued liabilities: various expenses accrued for accounting purposes and recognized for tax purposes when paid

Deferred gross profit: profits recognized on instalment sales when sold for book purposes, and as collected for tax purposes

Equipment: straightline depreciation for accounting purposes, and CCA for tax purposes

The enacted tax rate has been for many years. In November the rate was changed to for all periods after January

Assume that the company has income tax due of $ on the tax return and that Pharoah follows IFRS.

Indicate how deferred taxes should be presented on Pharoah's December SFP

PHAROAH CORPORATION

Partial Balance Sheet

December

NonCurrent Liabilities

Deferred Tax Liability

$

Calculate taxable income for

Taxable income $

Calculate accounting income for

Accounting income $

Prepare the income tax section of the income statement, beginning with the line "Income before income tax."

PHAROAH CORPORATION

Partial Income Statement

For the Year Ended December

Income before Income Tax

$

Income Tax Expense Current

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started