Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At December 31, 2011, Pandora Incorporated issued 40,000 shares of its $20 par common stock for all the outstanding shares of the Sophocles Company.

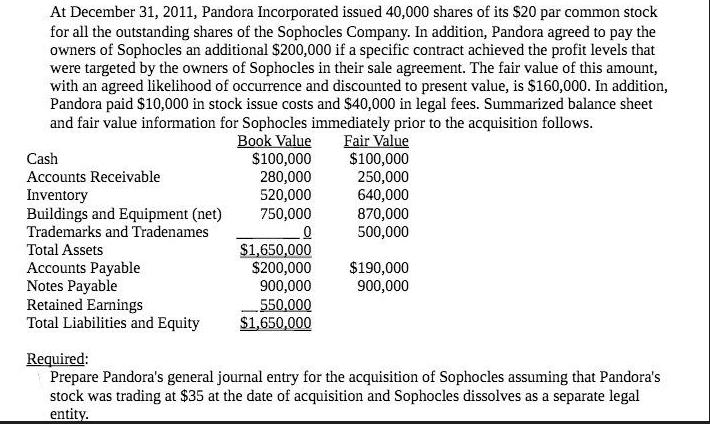

At December 31, 2011, Pandora Incorporated issued 40,000 shares of its $20 par common stock for all the outstanding shares of the Sophocles Company. In addition, Pandora agreed to pay the owners of Sophocles an additional $200,000 if a specific contract achieved the profit levels that were targeted by the owners of Sophocles in their sale agreement. The fair value of this amount, with an agreed likelihood of occurrence and discounted to present value, is $160,000. In addition, Pandora paid $10,000 in stock issue costs and $40,000 in legal fees. Summarized balance sheet and fair value information for Sophocles immediately prior to the acquisition follows. Book Value Fair Value $100,000 280,000 520,000 750,000 0 Cash Accounts Receivable Inventory Buildings and Equipment (net) Trademarks and Tradenames Total Assets Accounts Payable Notes Payable Retained Earnings Total Liabilities and Equity $100,000 250,000 640,000 870,000 500,000 $1,650,000 $200,000 $190,000 900,000 900,000 550,000 $1,650,000 Required: Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles dissolves as a separate legal entity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step1 Calculation of Share capital issue at 35 per share Number of Pandoras shares issued Issue pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started