Question

MFI Holdings Inc. follows IFRS and applies the FV-OCI model with recycling and has adopted the option to show dividends received as operating activities. MFI's

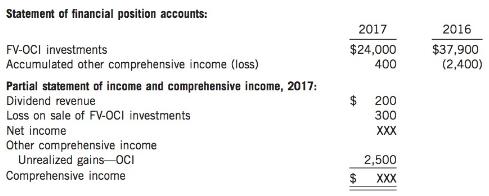

At December 31, 2017, the following information is available:

1. MFI Holdings had a single investment in shares at December 31, 2016. The investment cost $40,300 and was sold during 2017 for $40,000.

2. During 2017, dividends of $200 were received on shares classified as investments at fair value with gains and losses in OCI.

3. Another investment, with the same classification, was purchased at a cost of $23,600. The fair value of this new investment at December 31, 2017 was $24,000.

4. MFI Holdings classifies dividends received as operating cash flows.

Instructions

(a) Prepare the 2017 journal entries to record the sale of the investment including the recycling entry. Ignore any income tax effects.

(b) Calculate and reconcile the transactions that were recorded to the accounts Fair Value through Other Comprehensive Income Investments and Accumulated Other Comprehensive Income.

(c) Using the direct and indirect methods, prepare a table that contrasts the presentation of all transactions related to the above financial statements and related investment transactions on MFI's statement of cash flows. Be specific about the classification within the statement for each item that is reported.

(d) How would your answer to parts (a) and (b) above change if the investments were accounted for using the fair value through net income model?

(e) Under what circumstances would MFI not be allowed to use the fair value through other comprehensive income model?

Statement of financial position accounts: 2017 2016 FV-OCI investments Accumulated other comprehensive income (loss) $24,000 $37,900 (2,400) 400 Partial statement of income and comprehensive income, 2017: Dividend revenue $ 200 Loss on sale of FV-OCI investments 300 Net income XXX Other comprehensive income Unrealized gains-OCI 2,500 Comprehensive income 2$ XXX

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer a FVOCI Investments 2100 Unrealized Gain or Loss x OCI 1 2100 1 40000 37900 To record fair value adjustment to date of sale Cash 40000 FVOCI In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e217918e44_181700.pdf

180 KBs PDF File

635e217918e44_181700.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started