Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At December 31, 2020, the available-for-sale debt portfolio for Pearl Corp. is as follows. Unrealized Gain Securities Cost Fair Value (Loss) Good Co. Bonds

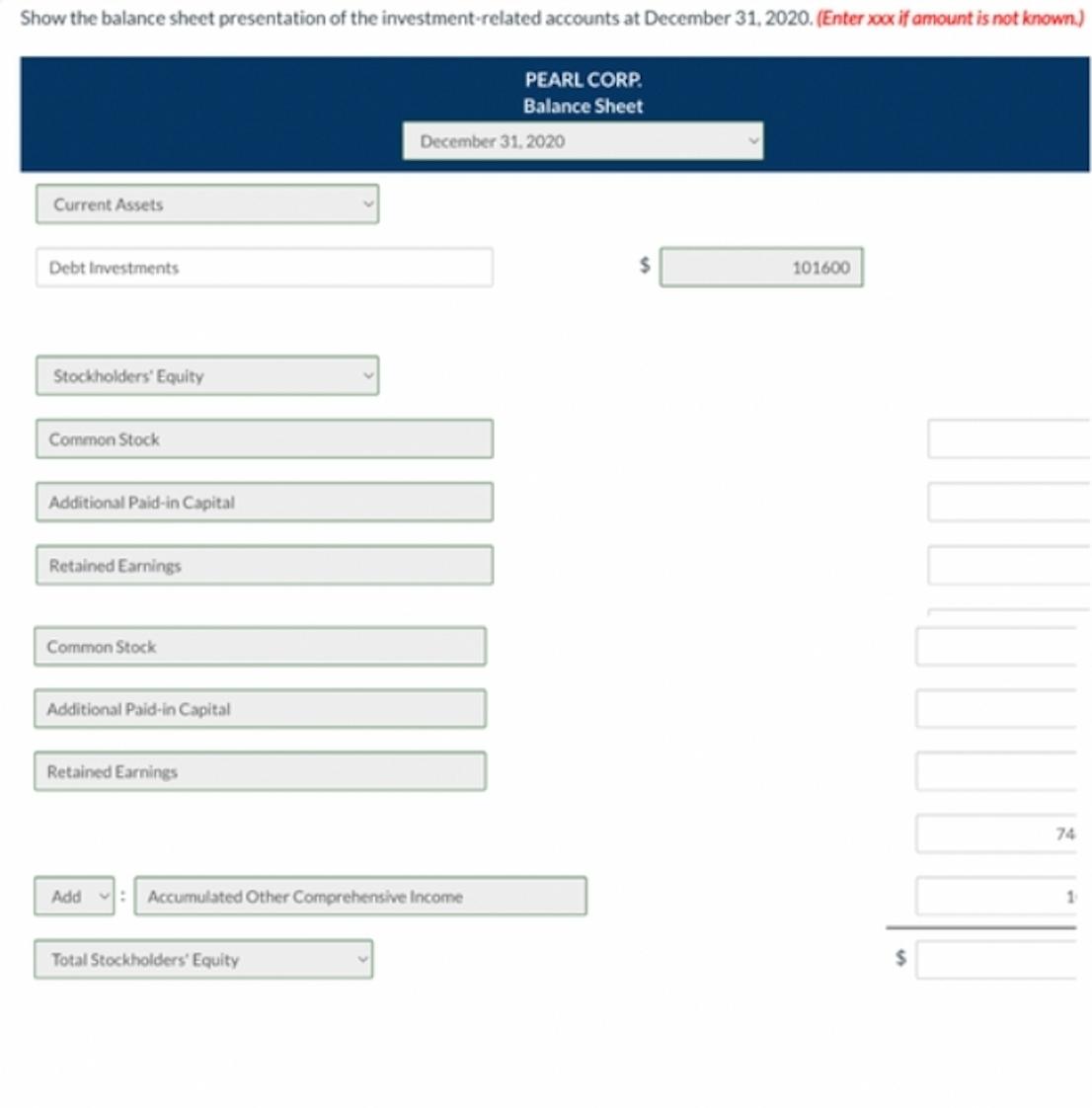

At December 31, 2020, the available-for-sale debt portfolio for Pearl Corp. is as follows. Unrealized Gain Securities Cost Fair Value (Loss) Good Co. Bonds $30,400 $28,300 $(2,100) Home Co. Bonds 27,800 29,400 1,600 Grand Inc. Debentures 42,800 43,900 1,100 101,000 101,600 600 Before an adjusting entry on December 31, 2020, the fair value adjustment account contained a credit balance of $480. Pearl Corp. reported net income of $74,400 for 2020. Show the balance sheet presentation of the investment-related accounts at December 31, 2020. (Enter xxx if amount is not known.) PEARL CORP. Current Assets Debt Investments Stockholders' Equity Common Stock Additional Paid-in Capital Retained Earnings Common Stock Additional Paid-in Capital Retained Earnings Add Balance Sheet December 31, 2020 $ 101600 74 Accumulated Other Comprehensive Income 1 Total Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record the adjusting entry for the availableforsale debt portfolio of Pearl Corp on December 31 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started