Answered step by step

Verified Expert Solution

Question

1 Approved Answer

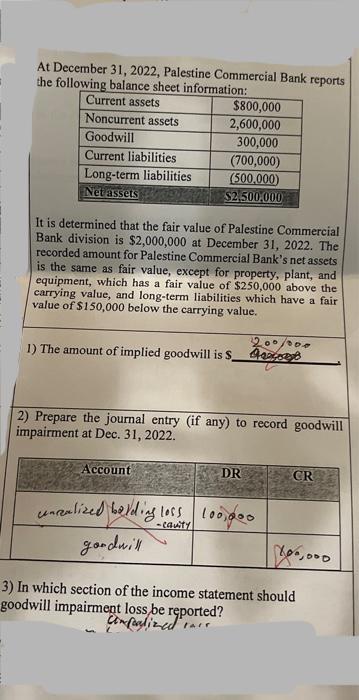

At December 31, 2022, Palestine Commercial Bank reports the following balance sheet information: Current assets $800,000 Noncurrent assets 2,600,000 Goodwill 300,000 Current liabilities (700,000)

At December 31, 2022, Palestine Commercial Bank reports the following balance sheet information: Current assets $800,000 Noncurrent assets 2,600,000 Goodwill 300,000 Current liabilities (700,000) Long-term liabilities (500,000) Net assets $2.500.000 It is determined that the fair value of Palestine Commercial Bank division is $2,000,000 at December 31, 2022. The recorded amount for Palestine Commercial Bank's net assets is the same as fair value, except for property, plant, and equipment, which has a fair value of $250,000 above the carrying value, and long-term liabilities which have a fair value of $150,000 below the carrying value. 1) The amount of implied goodwill is S 200/000 2) Prepare the journal entry (if any) to record goodwill impairment at Dec. 31, 2022. Account DR CR unrealized balding loss 100,000 -cavity goodwill 400,000 3) In which section of the income statement should goodwill impairment loss be reported? confalized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets walk through the steps to solve the problem and prepare the journal entry Step 1 Calculate the Total Carrying Value of Net Assets From the provid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started