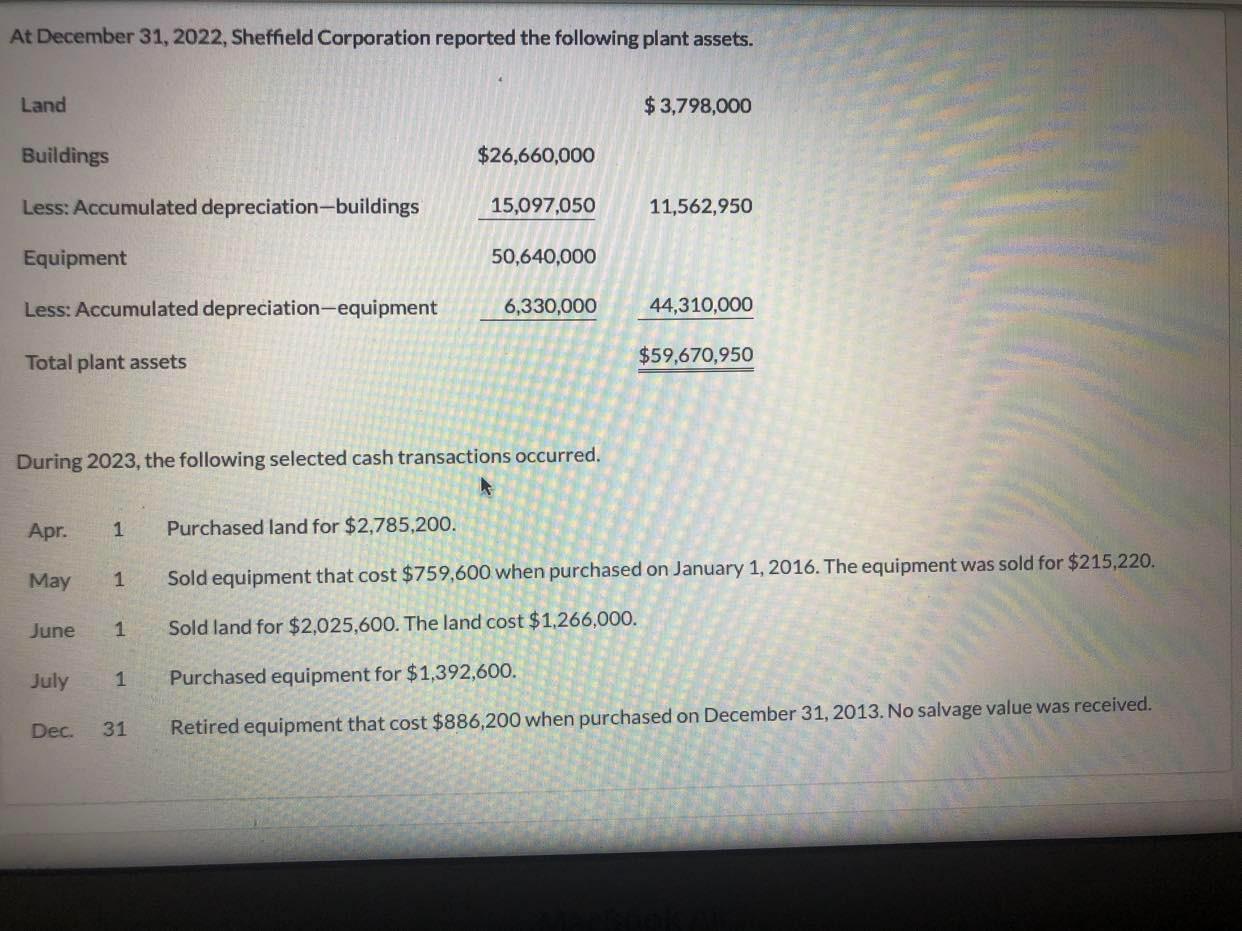

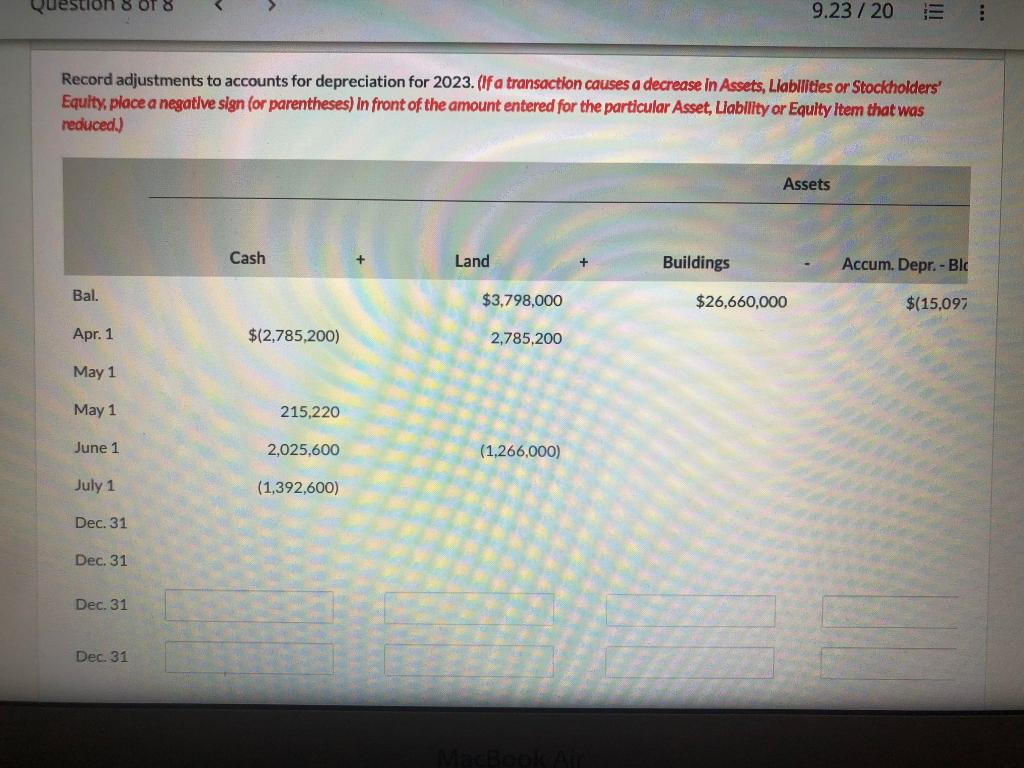

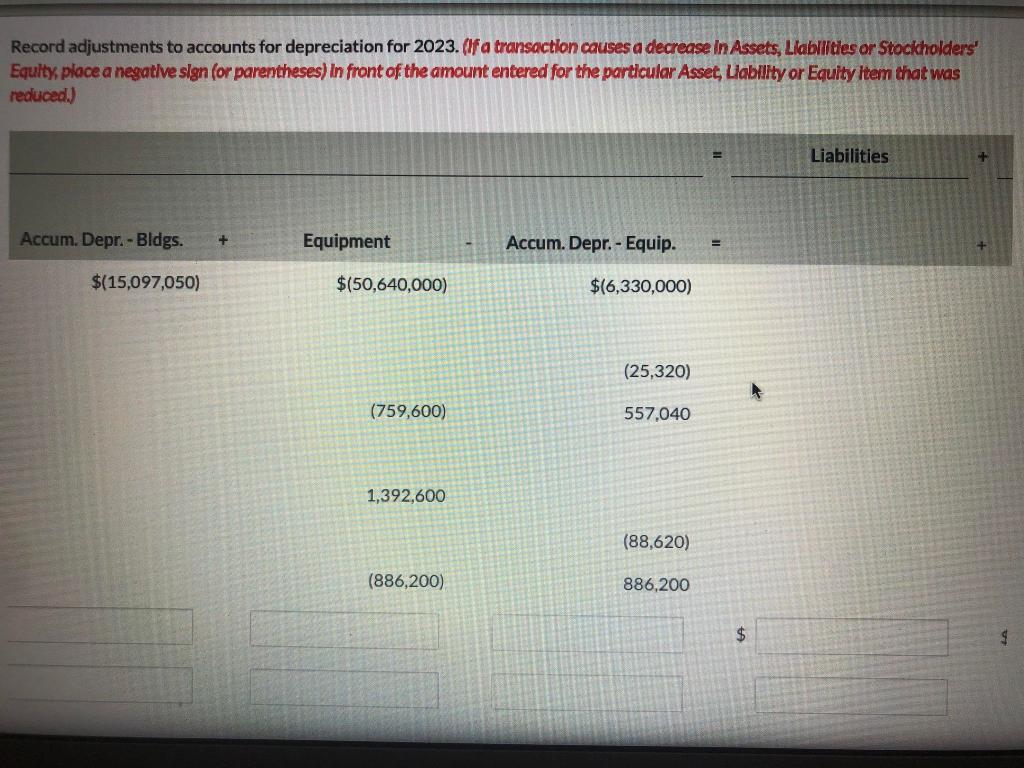

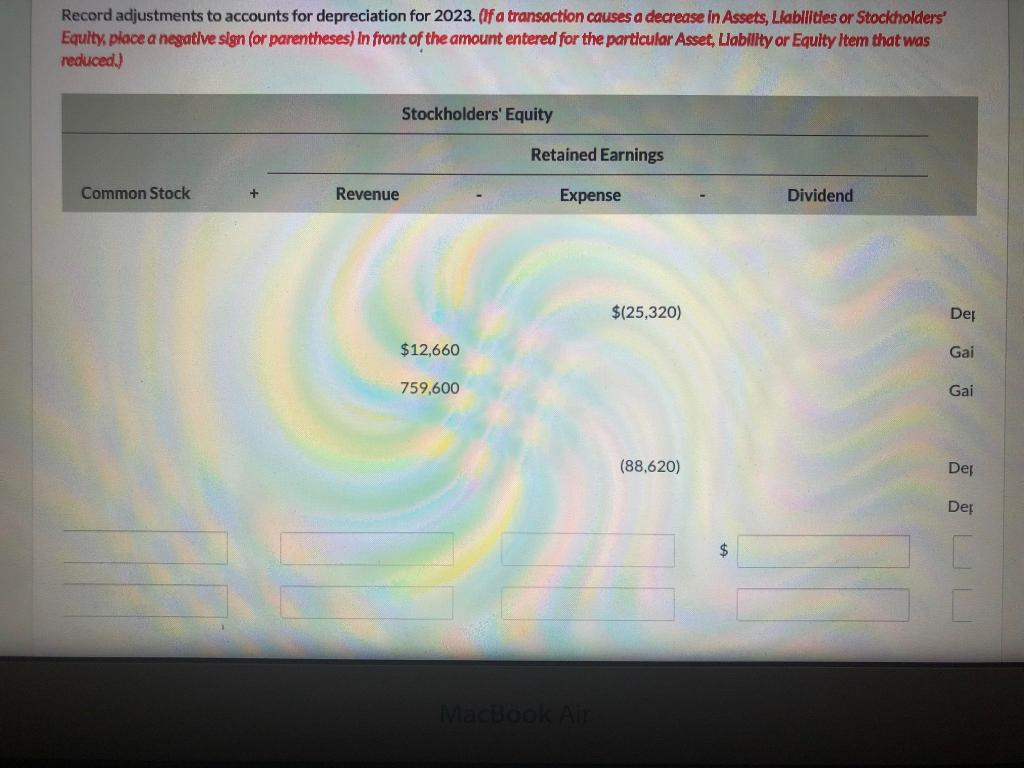

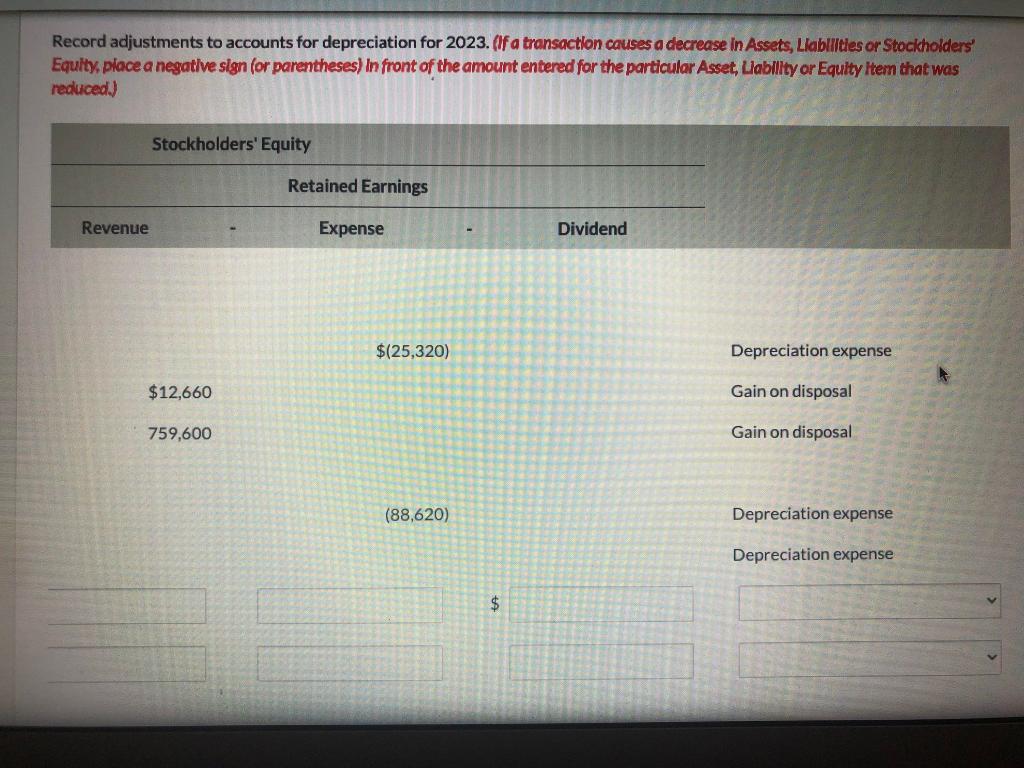

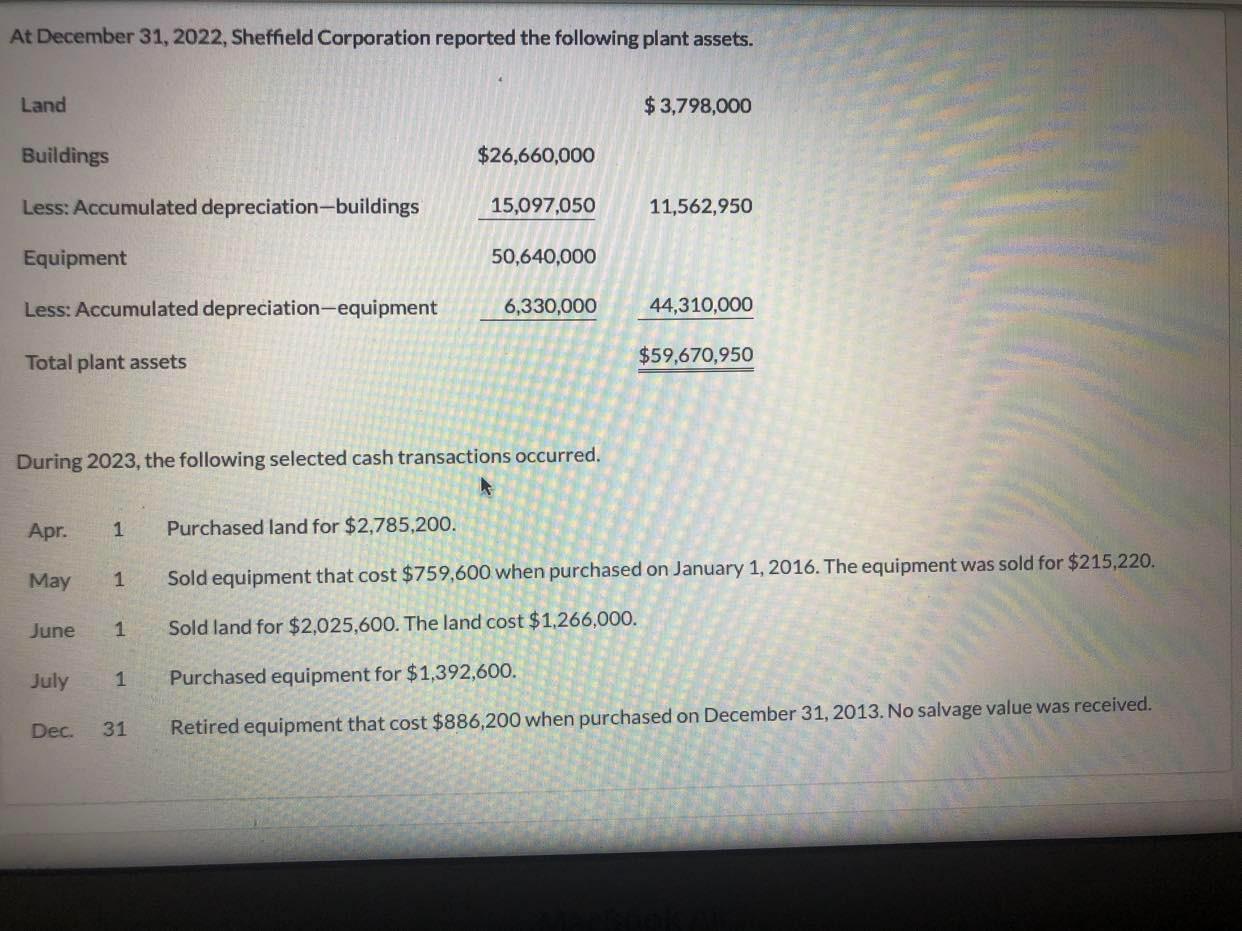

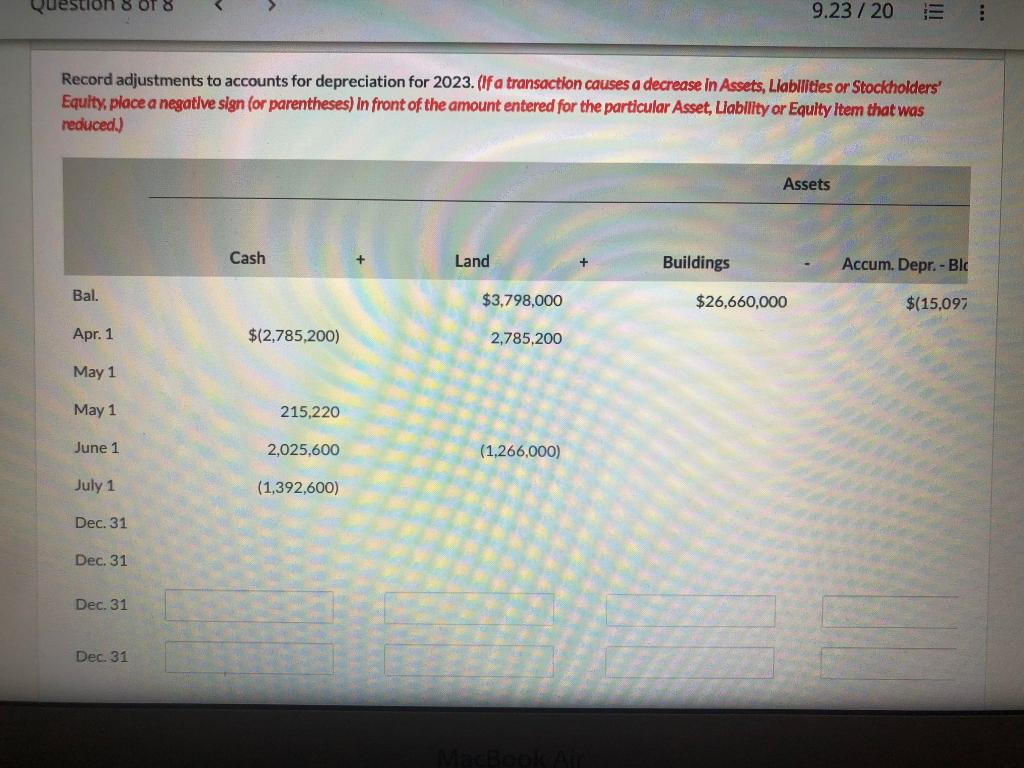

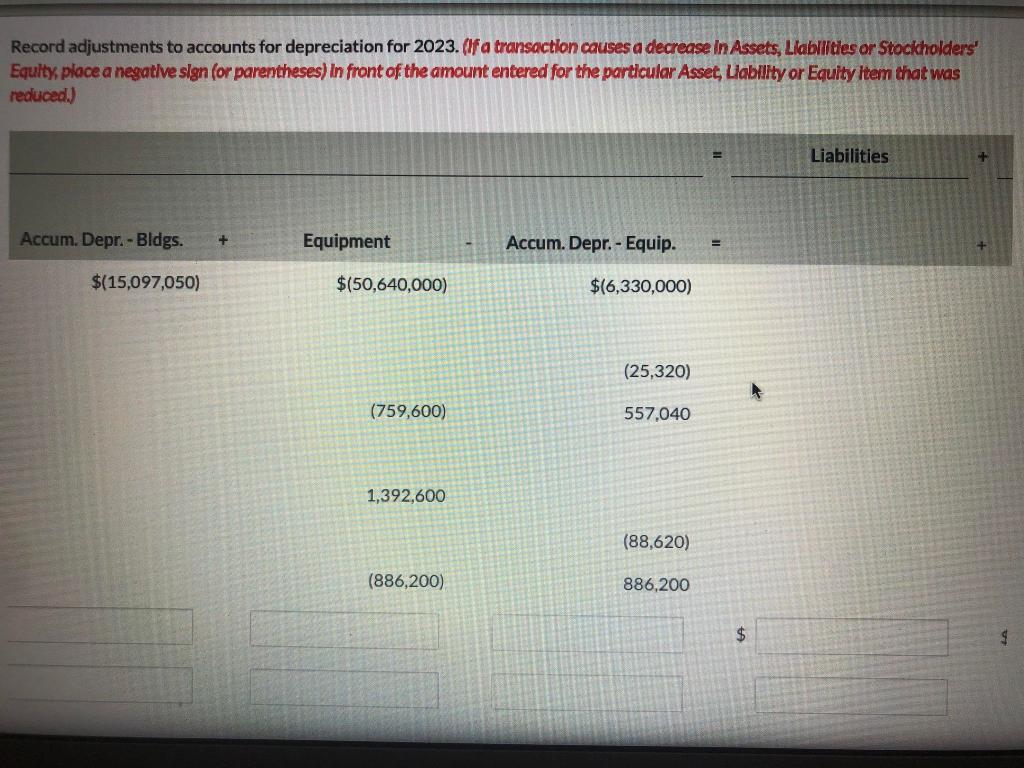

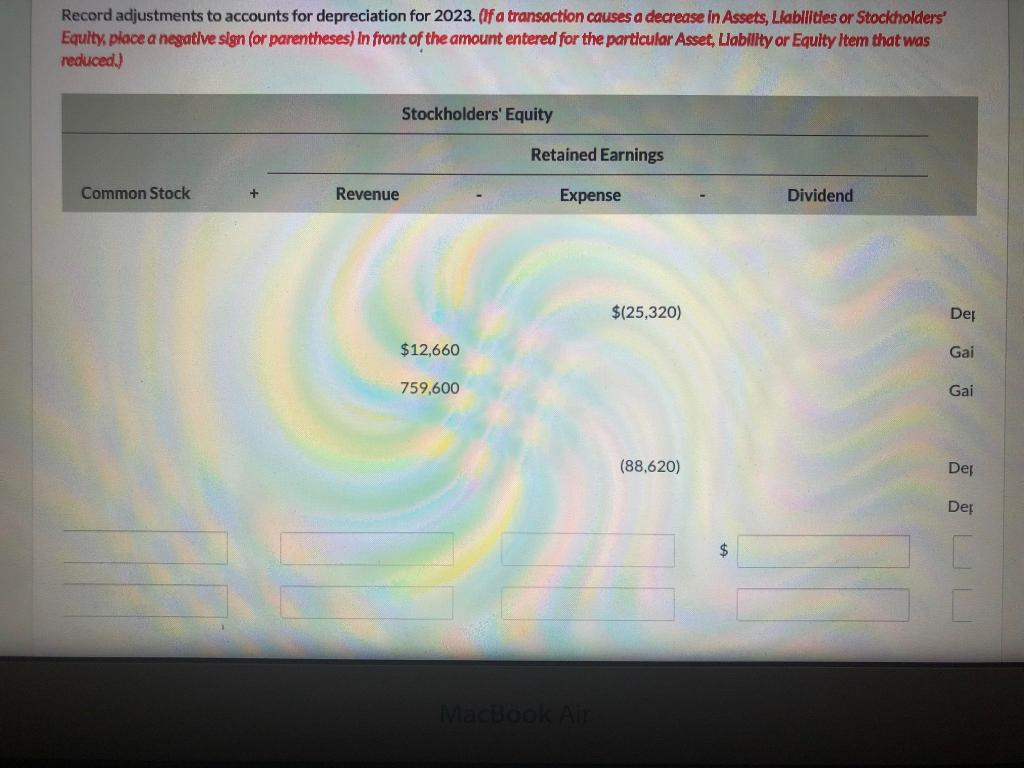

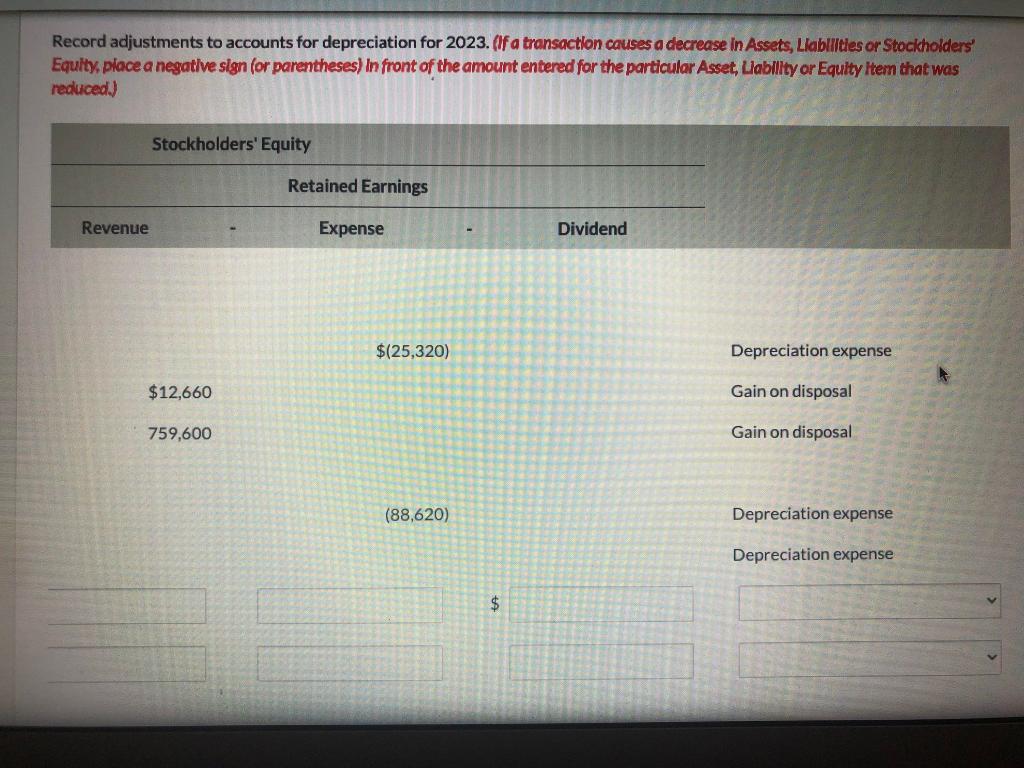

At December 31, 2022, Sheffield Corporation reported the following plant assets. During 2023, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,785,200. May 1 Sold equipment that cost $759,600 when purchased on January 1,2016 . The equipment was sold for $215,220. June 1 Sold land for $2,025,600. The land cost $1,266,000. July 1 Purchased equipment for $1,392,600. Dec. 31 Retired equipment that cost $886,200 when purchased on December 31,2013 . No salvage value was received. Record adjustments to accounts for depreciation for 2023. (If a transaction causes a decrease in Assets, Llabilities or Stocicholders" Equity, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. Af a transaction causes a decrease in Assets, Llablitites or Stocicholders' Equlty, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Lability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. (ff a transaction causes a decrease in Assets, Llabllitles or Stocitholders' Equlty place a negative slgn (or parentheses) In front of the amount entered for the particular Asset, Llability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. (If a transactlon causes a decrease in Assets, Llablittes or Stockholders' Equity, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llabillty or Equity ltem that was reduced.) At December 31, 2022, Sheffield Corporation reported the following plant assets. During 2023, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,785,200. May 1 Sold equipment that cost $759,600 when purchased on January 1,2016 . The equipment was sold for $215,220. June 1 Sold land for $2,025,600. The land cost $1,266,000. July 1 Purchased equipment for $1,392,600. Dec. 31 Retired equipment that cost $886,200 when purchased on December 31,2013 . No salvage value was received. Record adjustments to accounts for depreciation for 2023. (If a transaction causes a decrease in Assets, Llabilities or Stocicholders" Equity, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. Af a transaction causes a decrease in Assets, Llablitites or Stocicholders' Equlty, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Lability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. (ff a transaction causes a decrease in Assets, Llabllitles or Stocitholders' Equlty place a negative slgn (or parentheses) In front of the amount entered for the particular Asset, Llability or Equity ltem that was reduced.) Record adjustments to accounts for depreciation for 2023. (If a transactlon causes a decrease in Assets, Llablittes or Stockholders' Equity, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llabillty or Equity ltem that was reduced.)