Answered step by step

Verified Expert Solution

Question

1 Approved Answer

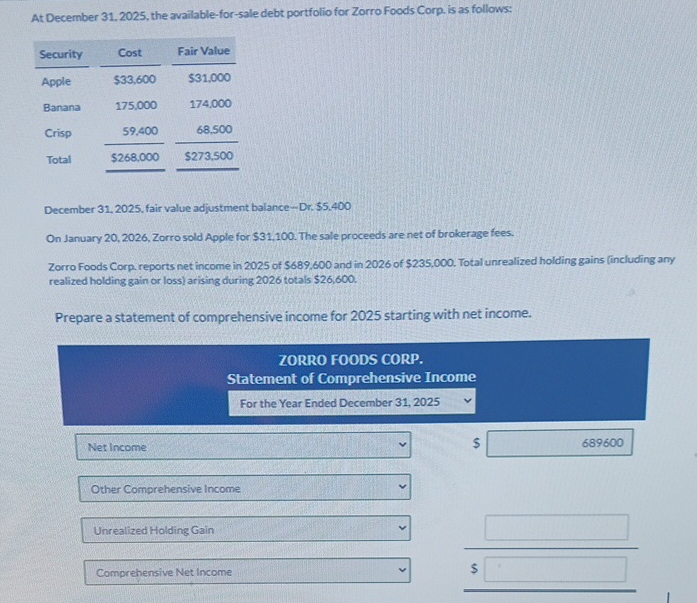

At December 31, 2025, the available-for-sale debt portfolio for Zorro Foods Corp. is as follows: Security Cost Fair Value Apple $33,600 $31,000 Banana 175,000

At December 31, 2025, the available-for-sale debt portfolio for Zorro Foods Corp. is as follows: Security Cost Fair Value Apple $33,600 $31,000 Banana 175,000 174,000 Crisp 59,400 68.500 Total $268,000 $273,500 December 31, 2025, fair value adjustment balance-Dr. $5.400 On January 20, 2026, Zorro sold Apple for $31.100. The sale proceeds are net of brokerage fees. Zorro Foods Corp. reports net income in 2025 of $689,600 and in 2026 of $235,000. Total unrealized holding gains (including any realized holding gain or loss) arising during 2026 totals $26,600. Prepare a statement of comprehensive income for 2025 starting with net income. ZORRO FOODS CORP. Statement of Comprehensive Income For the Year Ended December 31, 2025 Net Income Other Comprehensive Income Unrealized Holding Gain Comprehensive Net Income 689600

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ZORRO FOODS CORP Statement of Comprehensive Income For the Yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started