Answered step by step

Verified Expert Solution

Question

1 Approved Answer

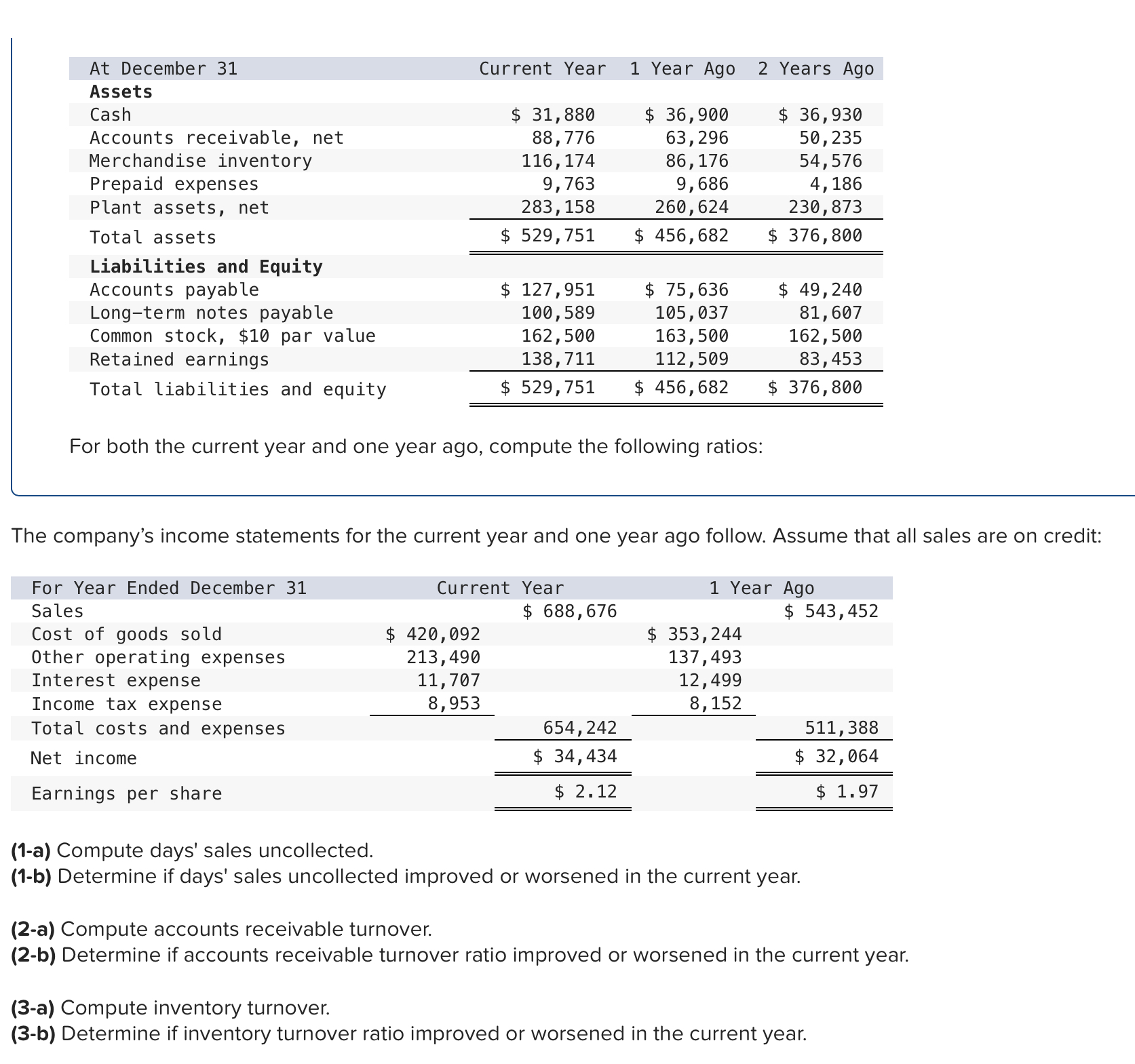

At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total

At December 31 Assets Current Year 1 Year Ago 2 Years Ago Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity $ 31,880 $ 36,900 63,296 $ 36,930 50,235 88,776 116,174 9,763 283,158 86,176 9,686 260,624 $ 456,682 $ 529,751 Accounts payable $ 127,951 Long-term notes payable 100,589 $ 75,636 105,037 Common stock, $10 par value Retained earnings Total liabilities and equity 162,500 138,711 163,500 112,509 $ 529,751 $ 456,682 For both the current year and one year ago, compute the following ratios: 54,576 4,186 230,873 $ 376,800 $ 49,240 81,607 162,500 83,453 $ 376,800 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Interest expense Other operating expenses Income tax expense Total costs and expenses Net income Current Year 1 Year Ago $ 688,676 $ 543,452 $ 420,092 213,490 11,707 8,953 $ 34,434 $ 353,244 137,493 12,499 8,152 654,242 511,388 $ 32,064 $ 2.12 $ 1.97 Earnings per share (1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts receivable turnover. (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started