Answered step by step

Verified Expert Solution

Question

1 Approved Answer

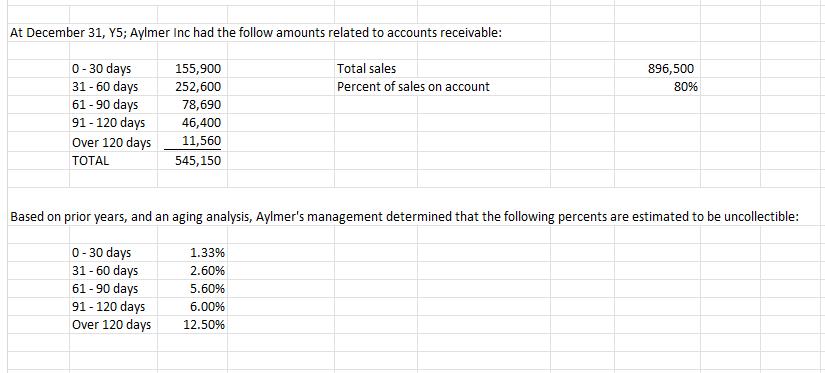

At December 31, Y5; Aylmer Inc had the follow amounts related to accounts receivable: 0-30 days 155,900 31 - 60 days 252,600 61-90 days

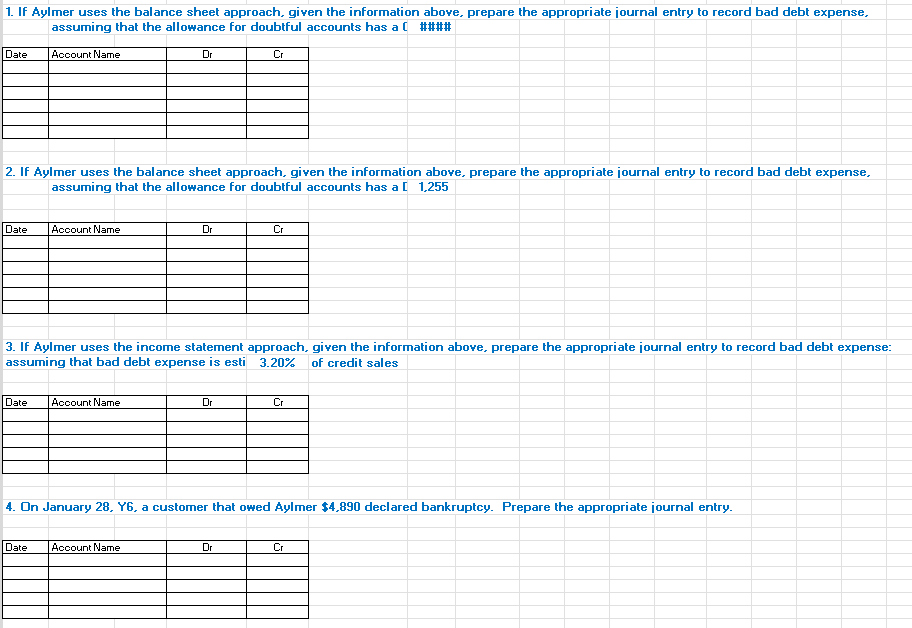

At December 31, Y5; Aylmer Inc had the follow amounts related to accounts receivable: 0-30 days 155,900 31 - 60 days 252,600 61-90 days 78,690 91-120 days 46,400 Over 120 days TOTAL 11,560 545,150 Total sales Percent of sales on account 896,500 80% Based on prior years, and an aging analysis, Aylmer's management determined that the following percents are estimated to be uncollectible: 1.33% 0-30 days 31 - 60 days 2.60% 61-90 days 5.60% 91-120 days 6.00% Over 120 days 12.50% 1. If Aylmer uses the balance sheet approach, given the information above, prepare the appropriate journal entry to record bad debt expense, assuming that the allowance for doubtful accounts has a (#### Date Account Name Dr Cr 2. If Aylmer uses the balance sheet approach, given the information above, prepare the appropriate journal entry to record bad debt expense, assuming that the allowance for doubtful accounts has a [ 1,255 Date Account Name Dr Cr 3. If Aylmer uses the income statement approach, given the information above, prepare the appropriate journal entry to record bad debt expense: assuming that bad debt expense is esti 3.20% of credit sales Date Account Name Dr Cr 4. On January 28, Y6, a customer that owed Aylmer $4,890 declared bankruptcy. Prepare the appropriate journal entry. Date Account Name Dr Cr

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the estimated amount of uncollectible accounts for Aylmer Inc we need to apply the esti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started