Answered step by step

Verified Expert Solution

Question

1 Approved Answer

at does a hurdle rate of 3% mean for the manager of a hedge fund? a) The manager earns an incentive fee only if the

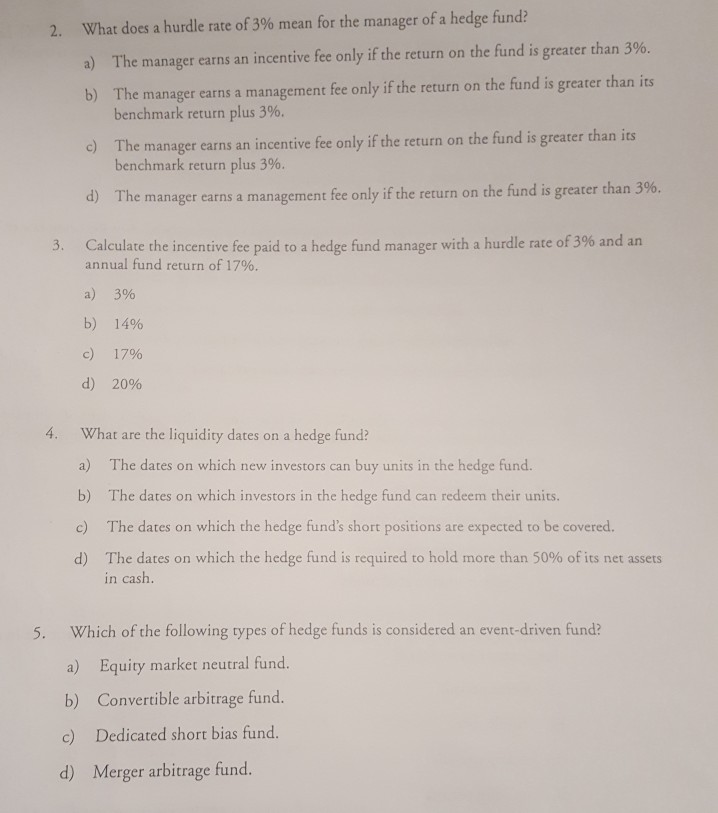

at does a hurdle rate of 3% mean for the manager of a hedge fund? a) The manager earns an incentive fee only if the return on the fund is greater than 396. b) The manager earns a management fee only if the return on the fund is greater than its 2, Wh benchmark return plus 3%. c) he manager earns an incentive fee only if the return on the fund is greater than its T benchmark return plus 3%. d) The manager earns a management fee only if the return on the fund is greater than 3%. 3. Calculate the incentive fee paid to a hedge fund manager with a hurdle rate of 3% and an annual fund return of 17%. a) 3% b) 1406 c) 17% d) 20% 4. What are the liquidity dates on a hedge fund? a) The dates on which new investors can buy units in the hedge fund. b) The dates on which investors in the hedge fund can redeem their units. c) The dates on which the hedge fund's short positions are expected to be covered. d) The dates on which the hedge fund is required to hold more than 50% of its net assets in cash. 5. Which of the following types of hedge funds is considered an event-driven fund a) Equity market neutral fund. b) Convertible arbitrage fund. c) Dedicated short bias fund d) Merger arbitrage fund

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started