Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At halftime of the NCAA Women's Championship Game, while on Zoom with your cousin Mary from Palo Alto (and a fan of Stanford), you discuss

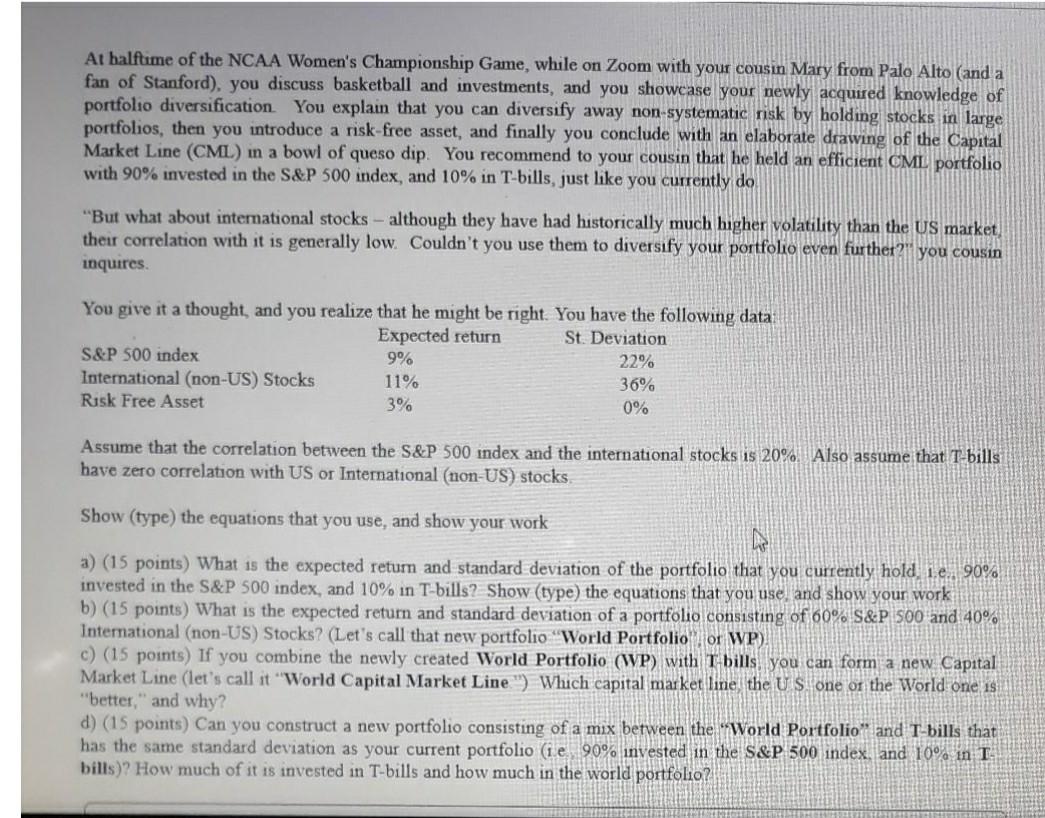

At halftime of the NCAA Women's Championship Game, while on Zoom with your cousin Mary from Palo Alto (and a fan of Stanford), you discuss basketball and investments, and you showcase your newly acquired knowledge of portfolio diversification. You explain that you can diversify away non-systematic risk by holding stocks in large portfolios, then you introduce a risk-free asset, and finally you conclude with an elaborate drawing of the Capital Market Line (CML.) in a bowl of queso dip. You recommend to your cousin that he held an efficient CML portfolio with 90% invested in the S&P 500 index, and 10% in T-bills, just like you currently do "But what about international stocks - although they have had historically much higher volatility than the US market, their correlation with it is generally low. Couldn't you use them to diversify your portfolio even further you cousin inquires You give it a thought, and you realize that he might be right. You have the following data: Expected return St. Deviation S&P 500 index 9% 22% International (non-US) Stocks 11% 36% Risk Free Asset 3% 0% Assume that the correlation between the S&P 500 index and the international stocks is 20%. Also assume that T bills have zero correlation with US or International (non-US) stocks Show (type) the equations that you use, and show your work a) (15 points) What is the expected return and standard deviation of the portfolio that you currently hold 1.e. 90% invested in the S&P 500 index, and 10% in T-bills? Show (type) the equations that you use, and show your work b) (15 points) What is the expected return and standard deviation of a portfolio consisting of 60% S&P 500 and 40% International (non-US) Stocks? (Let's call that new portfolio World Portfolio or WP) c) (15 points) If you combine the newly created World Portfolio (WP) with T-bills, you can form a new Capital Market Line (let's call it "World Capital Market Line") Which capital market line the US one of the World one is "better," and why? d) (15 points) Can you construct a new portfolio consisting of a mix between the "World Portfolio" and T bills that has the same standard deviation as your current portfolio (ie 90% invested in the S&P 500 index, and 10% in T- bills)? How much of it is invested in T-bills and how much in the world portfolio? At halftime of the NCAA Women's Championship Game, while on Zoom with your cousin Mary from Palo Alto (and a fan of Stanford), you discuss basketball and investments, and you showcase your newly acquired knowledge of portfolio diversification. You explain that you can diversify away non-systematic risk by holding stocks in large portfolios, then you introduce a risk-free asset, and finally you conclude with an elaborate drawing of the Capital Market Line (CML.) in a bowl of queso dip. You recommend to your cousin that he held an efficient CML portfolio with 90% invested in the S&P 500 index, and 10% in T-bills, just like you currently do "But what about international stocks - although they have had historically much higher volatility than the US market, their correlation with it is generally low. Couldn't you use them to diversify your portfolio even further you cousin inquires You give it a thought, and you realize that he might be right. You have the following data: Expected return St. Deviation S&P 500 index 9% 22% International (non-US) Stocks 11% 36% Risk Free Asset 3% 0% Assume that the correlation between the S&P 500 index and the international stocks is 20%. Also assume that T bills have zero correlation with US or International (non-US) stocks Show (type) the equations that you use, and show your work a) (15 points) What is the expected return and standard deviation of the portfolio that you currently hold 1.e. 90% invested in the S&P 500 index, and 10% in T-bills? Show (type) the equations that you use, and show your work b) (15 points) What is the expected return and standard deviation of a portfolio consisting of 60% S&P 500 and 40% International (non-US) Stocks? (Let's call that new portfolio World Portfolio or WP) c) (15 points) If you combine the newly created World Portfolio (WP) with T-bills, you can form a new Capital Market Line (let's call it "World Capital Market Line") Which capital market line the US one of the World one is "better," and why? d) (15 points) Can you construct a new portfolio consisting of a mix between the "World Portfolio" and T bills that has the same standard deviation as your current portfolio (ie 90% invested in the S&P 500 index, and 10% in T- bills)? How much of it is invested in T-bills and how much in the world portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started