Question

Managers in a variety of design and technical divisions are concerned that a project of this magnitude will strain resources available to other projects. As

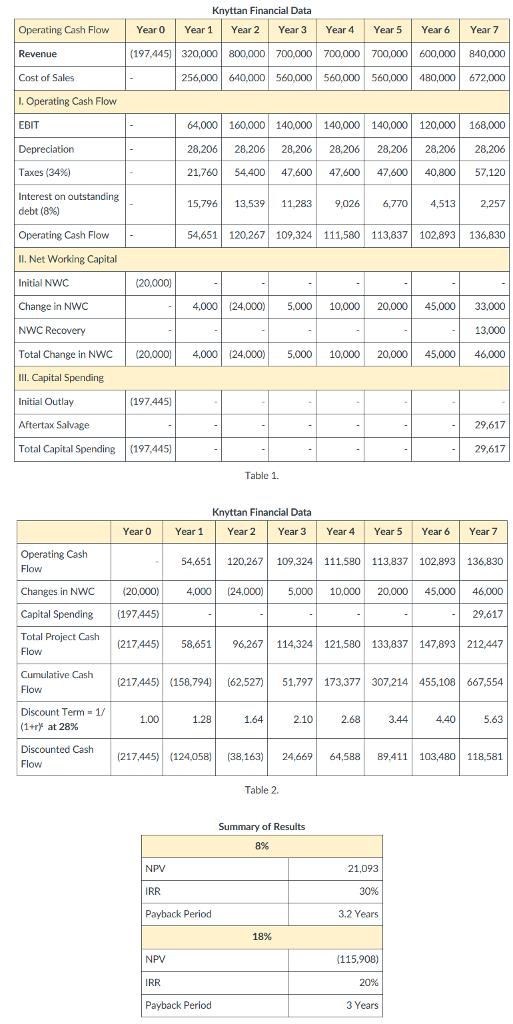

Managers in a variety of design and technical divisions are concerned that a project of this magnitude will strain resources available to other projects. As manager of technology acquisition, you have been invited to share a summary of major issues involved in a decision to adopt new technology of this nature, at a financial level, with key management peers. You understand that this may be challenging because your audience is non-financial, and so you plan to outline central financial issues involved in this decision to adopt a Knyttan, in partnership with Unmade. Jon Smedley’s chief executive officer has agreed to this approach, and has instructed you, as manager of technology acquisition at Jon Smedley, to determine whether the project will be acceptable should interest rates increase as expected, and financing for the Knyttan device will consist of debt, on which the firm will be charged a market rate of interest. Assume that you have prepared the summaries of financial data included below, using an interest rate of 8% (Tables 1 and 2). Table 3 summarizes the results.

A) At interest rates of 8% and 18%, analyze project finances using Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Criteria as these may be used to determine the acceptability of the proposed project, under the assumption that the project is standalone and will not draw resources from other areas of the firm. Include analysis of all components of project cash flow.

B) Recalling that (EBIT + Depreciation - Interest - Taxes) = Operating Cash Flow, evaluate the role of net working capital, depreciation and taxation in determining project cash flows.

Knyttan Financial Data Operating Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Revenue (197,445) 320,000| 800,000 700,000 700,000 700,000 600,000 840,000 Cost of Sales 256,000 640,000 560,000 560,000 560,000 480,000 672,000 1. Operating Cash Flow EBIT 64,000 160,000 140,000 140,000 140,000 120,000 168,000 Depreciation 28,206 28,206 28,206 28,206 28,206 28,206 28,206 Taxes (34%) 21,760 54.400 47,600 47,600 47,600 40,800 57,120 Interest on outstanding debt (8%) 15,796 13,539 11,283 9,026 6,770 4,513 2,257 Operating Cash Flow 54,651 120,267 109,324 111,580 113,837 102,893 136,830 II. Net Working Capital Initial NWC (20,000) Change in NWC 4,000 (24,000) 5,000 10,000 20,000 45,000 33,000 NWC Recovery 13,000 Total Change in NWC (20.000| 4,000 (24,000) 5,000 10,000 20,000 45,000 46,000 III. Capital Spending Initial Outlay (197.445) Aftertax Salvage 29,617 Total Capital Spending (197,445) 29,617 Table 1. Knyttan Financial Data Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Operating Cash 54,651 120,267 109,324 111,580 113.837 102,893 136,830 Flow Changes in NWC (20,000) 4,000 (24,000 5,000 10,000 20.000 45,000 46,000 Capital Spending (197,445) 29,617 Total Project Cash (217,445) 58,651 96,267 114,324 121,580 133,837 147,893 212,447 Flow Cumulative Cash (217445) (158,794) (62,527) 51,797 173,377 307,214 455,108 667,554 Flow Discount Term - 1/ 1.00 1.28 1.64 2.10 2.68 3.44 4.40 5.63 (1+ry at 28% Discounted Cash (217,445) (124,058) (38,163) 24,669 64,588 89,411 103,480 118,581 Flow Table 2. Summary of Results 8% NPV 21,093 IRR 30% Payback Period 3.2 Years 18% NPV (115,908) IRR 20% Payback Period 3 Years

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

If the results under 8 and 18 are compared we can see that the NPV is positive under ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635de8d7b5c4a_179894.pdf

180 KBs PDF File

635de8d7b5c4a_179894.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started