Question

At its January 15 meeting, the board of directors of Omega Consolidated Industries made a decision to build a new manufacturing facility in China and

At its January 15 meeting, the board of directors of Omega Consolidated Industries made a decision to build a new manufacturing facility in China and approved funding up to $180 million for construction and start-up activities. It wants the new facility completed within two years from the date that a contractor is selected to design and build the facility. Omega is a worldwide corporation with its headquarters in London.

The board asked I. M. Uno, Omega's president, to assign a team to develop a request for proposal (RFP) and solicit proposals from contractors to design and build the facility, including installation of all production equipment, offices, and an integrated information system. The team would also be responsible for monitoring the performance of the selected contractor to ensure the contractor fulfills all contractual requirements and performance specifications.

Ms. Uno selected four members of her management team:

?Alysha Robinson, who will be the plant manager of the new facility

?Jim Stewart, Chief Financial Officer

?Olga Frederick, Vice President of Engineering

?Willie Hackett, Procurement Manager

The team chose Alysha as their team leader. By April 30, they developed a comprehensive RFP that included:

?A statement of work describing the major tasks that the contractor must complete, as well as the performance specifications for the production capacity of the facility

?A requirement that the contractor complete the project within 24 months after a contract is signed

?Criteria by which the team would evaluate proposals:

Related experience 30 points

Cost 30 points

Schedule 30 points

Innovative design 30 points

?That the contract would be a fixed-price contract

The RFP did not state how much funding Omega had available for the project.

On May 15, the team announced the RFP in various trade publications and websites and required that interested contractors submit a proposal no later than June 30.

On June 30, the Omega team received three proposals:

1.J&J, Inc. an American firm, submitted a proposal for $150 million. However, the proposal stated that they would require 30 months to complete the project.

2.ROBETH Construction Company of Ireland submitted a proposal for $175 million. They had built several other facilities for Omega in the past, and its officers felt they had a good relationship with Ms. Uno, Jim Stewart, and Olga Frederick's predecessor, who recently left Omega to become president of one of Omega's competitors, which is also considering building a facility in China.

3.Kangaroo Architects and Engineers of Australia submitted a proposal for $200 million. Although Kangaroo has never done a project for Omega, they are one of the largest contractors in the world, have designed and built many and various types of facilities, and have a great reputation for innovative concepts, such as "green" environmentally friendly designs, and for building award-winning showcase facilities. They had built facilities for several of Omega's competitors.

The team was disappointed that they received only three proposals; they had expected at least eight.

On July 5, a fourth proposal was received from Asia General Contractors, a company based in China. The proposal was for $160 million. They had built many facilities in China for other global corporations and stated that they have good knowledge of many credible trade subcontractors in China that would be needed to build the facility. The proposal also stated that they could complete the project in 20 months.

The team scheduled a meeting for July 15 to discuss the proposals and, as a team, to score each of the proposals with respect to the evaluation criteria. That provided the team members with two weeks to individually read the proposals and develop their individual comments about each proposal, but they agreed not to individually score the proposals prior to the July 15 meeting.

At the July 15 meeting, Alysha opened the meeting and stated, "I like the proposal from Kangaroo because it would provide a showcase state-of-the-art facility."

Jim interrupted her, saying, "Their proposal is for more than the board has allocated for this project, I don't think we should consider them any further. In my mind, they are out."

Alysha responded, "Even though it would require some additional funding beyond what the board originally approved, I feel confident that I can persuade I. M. and the board to approve the additional amount required."

Jim said, "I like the proposal from ROBETH. We have worked with them in the past during my 30 years here at Omega, and their proposal cost is just about what the board has allocated. I know a lot of the people at ROBETH."

Olga mentioned, "I have only been here at Omega for less than a year, but I took it upon myself to review the final reports of the previous projects that ROBETH did for Omega and found that ROBETH missed their proposed schedules on most of the projects or that some of the production systems never met all the performance specifications." She continued, "I am also concerned about ROBETH's continuing relationship with my predecessor who is now president at one of our major competitors and the potential conflict of interest if they would also be the contractor selected by our competitor to build the plant they are considering in China. They might use some of our proprietary processes in their design for our competitor's facility. I think it would be too risky to use them."

She continued, "I think the proposal from Asia General Contractors should be seriously considered, even though it arrived a few days after the required due date."

Willie spoke up. "I strongly disagree. It would be unfair to the other three contractors."

Olga replied, "I think it is our job to select the contractor that will provide the best value and not be concerned about some silly rules about being a few days late; who cares? Besides, they state that they can complete the project in 20 months, which means we will get the facility fully operational sooner than with any of the other contractors. And that means more products out the door sooner, more revenues and cash flow earlier, and a better return on our investment."

After everyone's initial comments, Alysha stated, "Okay, I guess we have to score these four proposals against the evaluation criteria."

Jim interrupted, "You mean three proposals."

Olga spoke up loudly, "I think she said the four proposals, not three. Let's not get bogged down in bureaucratic games; we have an important decision to make."

I. M. Uno is expecting the team to recommend a contractor to her by July 31 so that she can review it and present it to the board of directors at their August 15 meeting.

Directions: Read through the case study "New Manufacturing Facility in China" on pages 96 - 98 in the textbook and answer the questions below in essay format.

Is there anything the team should have done when they received only three proposals by June 30?

Should the team consider the proposal from Asia General Contractors? Why or why not?

How could the selection process have been improved? Is there anything the board, I. M. Uno, Alysha, or the team could have done differently?

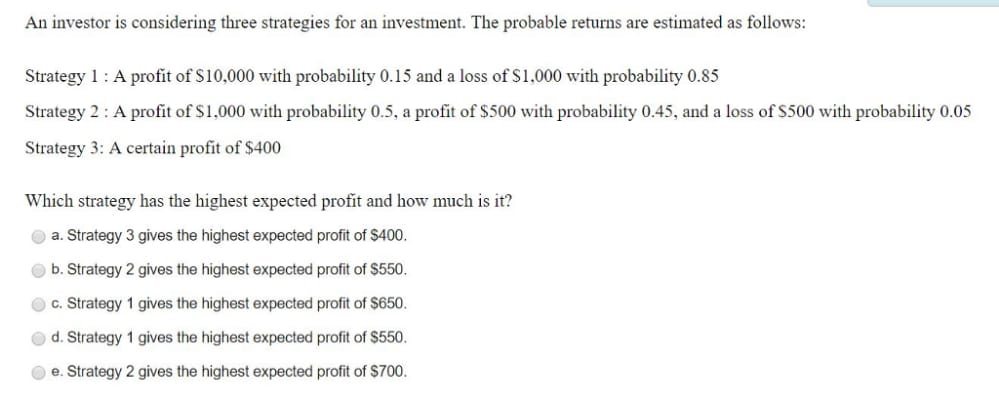

An investor is considering three strategies for an investment. The probable returns are estimated as follows: Strategy 1: A profit of $10,000 with probability 0.15 and a loss of $1,000 with probability 0.85 Strategy 2: A profit of $1,000 with probability 0.5, a profit of $500 with probability 0.45, and a loss of $500 with probability 0.05 Strategy 3: A certain profit of $400 Which strategy has the highest expected profit and how much is it? a. Strategy 3 gives the highest expected profit of $400. b. Strategy 2 gives the highest expected profit of $550. c. Strategy 1 gives the highest expected profit of $650. d. Strategy 1 gives the highest expected profit of $550. e. Strategy 2 gives the highest expected profit of $700.

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 When the team received only three proposals by June 30 they should have taken proactive steps to ensure they received more proposals This could have included extending the deadline for submission re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started