Question

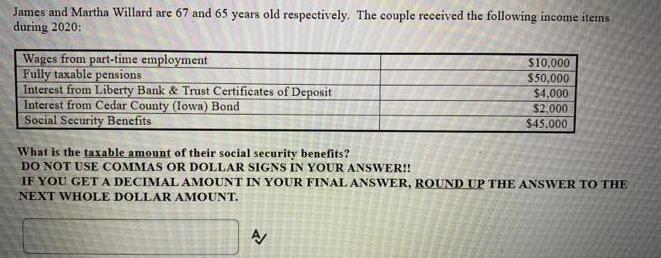

James and Martha Willard are 67 and 65 years old respectively. The couple received the following income items during 2020: Wages from part-time employment

James and Martha Willard are 67 and 65 years old respectively. The couple received the following income items during 2020: Wages from part-time employment Fully taxable pensions Interest from Liberty Bank & Trust Certificates of Deposit Interest from Cedar County (Iowa) Bond Social Security Benefits What is the taxable amount of their social security benefits? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! $10,000. $50,000 2 $4,000 $2,000 $45.000 IF YOU GET A DECIMAL AMOUNT IN YOUR FINAL ANSWER, ROUND UP THE ANSWER TO THE NEXT WHOLE DOLLAR AMOUNT.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Sep196 2121 Answer is highlighted in yellow Solution Answ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Accounting

Authors: Belverd E. Needles, Marian Powers and Susan V. Crosson

12th edition

978-1133603054, 113362698X, 9781285607047, 113360305X, 978-1133626985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App