Answered step by step

Verified Expert Solution

Question

1 Approved Answer

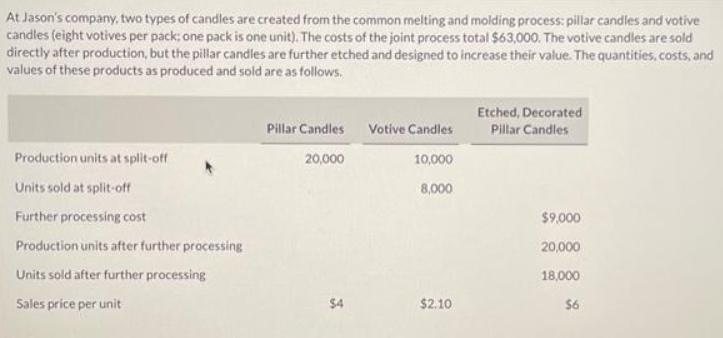

At Jason's company, two types of candles are created from the common melting and molding process: pillar candles and votive candles (eight votives per

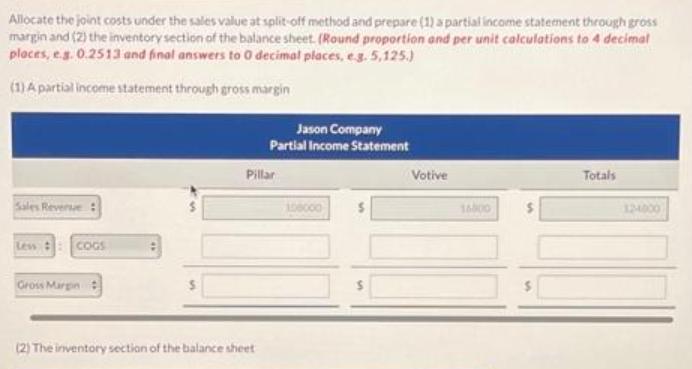

At Jason's company, two types of candles are created from the common melting and molding process: pillar candles and votive candles (eight votives per pack; one pack is one unit). The costs of the joint process total $63,000. The votive candles are sold directly after production, but the pillar candles are further etched and designed to increase their value. The quantities, costs, and values of these products as produced and sold are as follows. Production units at split-off Units sold at split-off Further processing cost Production units after further processing Units sold after further processing Sales price per unit Pillar Candles 20,000 $4 Votive Candles 10,000 8,000 $2.10 Etched, Decorated Pillar Candles $9,000 20,000 18,000 $6 Allocate the joint costs under the sales value at split-off method and prepare (1) a partial income statement through gross margin and (2) the inventory section of the balance sheet. (Round proportion and per unit calculations to 4 decimal places, e.g. 0.2513 and final answers to 0 decimal places, e.g. 5,125.) (1) A partial income statement through gross margin Sales Revenue : Less COGS Gross Margin Jason Company Partial Income Statement Pillar (2) The inventory section of the balance sheet 100000 Votive Totals 124000

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Allocate Joint Costs Total Joint Costs 63000 Sales Value at Splitoff Pillar Candles 8000 unit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started