Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At MM Productions, it costs $98 per unit ($40 variable and $58 fixed) to make a headphone that normally sells for $150. A foreign

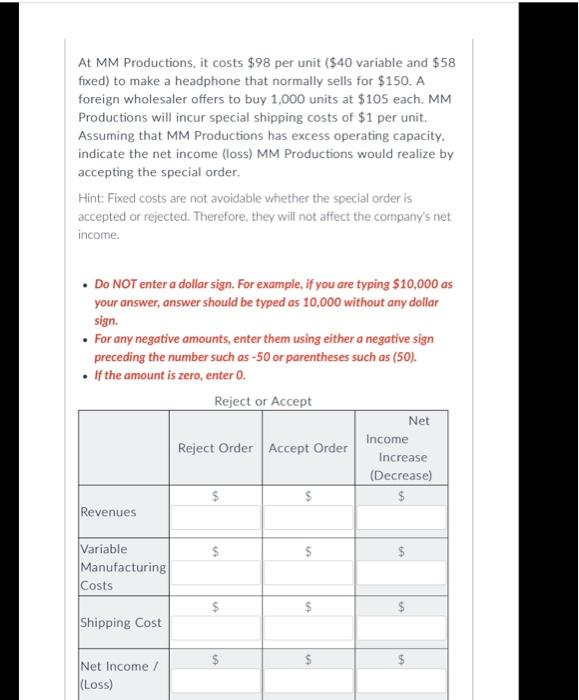

At MM Productions, it costs $98 per unit ($40 variable and $58 fixed) to make a headphone that normally sells for $150. A foreign wholesaler offers to buy 1,000 units at $105 each. MM Productions will incur special shipping costs of $1 per unit. Assuming that MM Productions has excess operating capacity. indicate the net income (loss) MM Productions would realize by accepting the special order. Hint: Fixed costs are not avoidable whether the special order is accepted or rejected. Therefore, they will not affect the company's net income. Do NOT enter a dollar sign. For example, if you are typing $10,000 as your answer, answer should be typed as 10,000 without any dollar sign. For any negative amounts, enter them using either a negative sign preceding the number such as -50 or parentheses such as (50). . If the amount is zero, enter 0. Reject or Accept Net Income Reject Order Accept Order Increase (Decrease) $ $ $ Revenues $ $ $ Variable Manufacturing Costs $ $ Shipping Cost $ Net Income / (Loss) $ $ LA

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Reject order Accept order Net Income increase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started