At point A, B, C, and D, what should we do? The chart shows the recent Bank of America stock price.

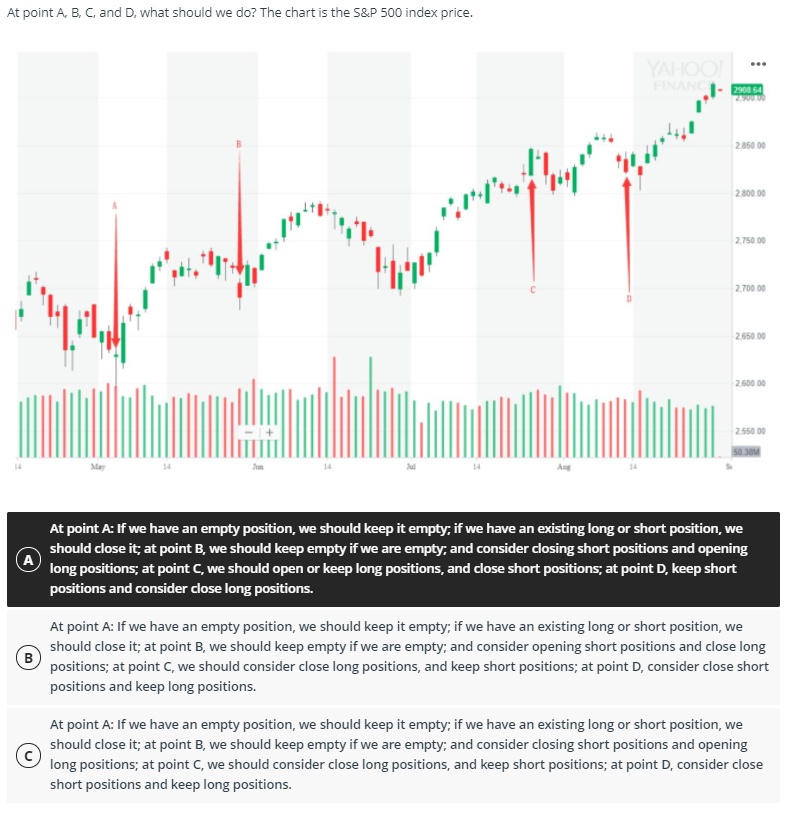

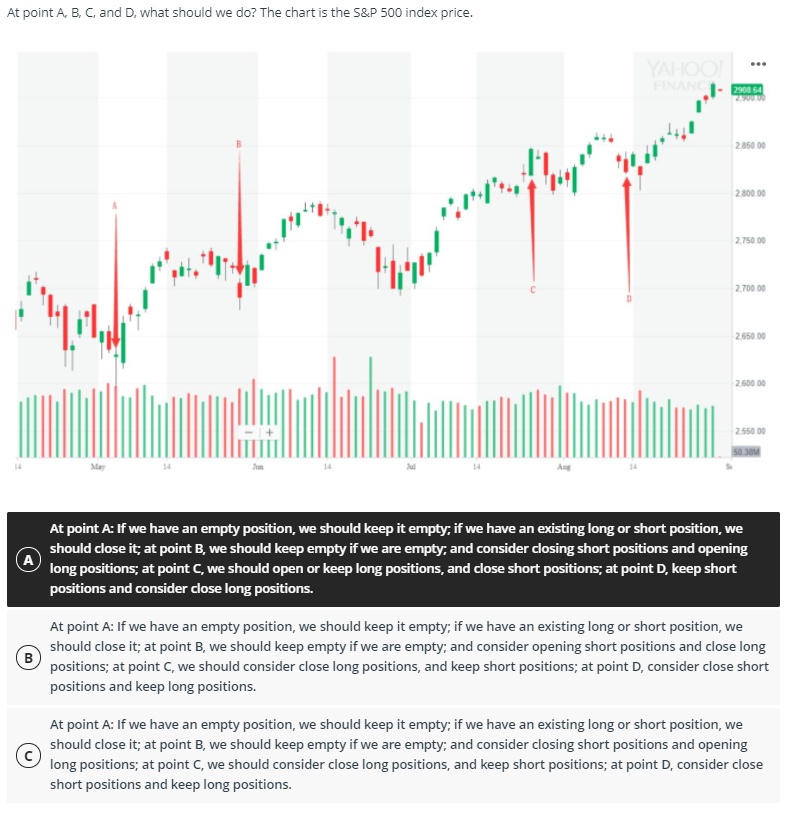

At point A, B, C, and D, what should we do? The chart is the S&P 500 index price.

At point A, B, C and D, what should we do? The chart shows the recent Bank of America stock price. 2 BOLLINGER BROS IC22.2MAXX 1300 31 31.10 hyperating Martha ww/ 1,3;/ ny 2300 . * * 3,00, ; 2700 2000 Insp. At point A, in an upward trend, we should avoid taking short positions. Though the price goes through the upper bound of the BB, we should not take action; at point B, there is no significant trend. The BB is rather flat. We should A not take action; at point C, there is no significant trend. The BB is rather flat. We should not take action; at point D, in a downward trend, when the price is touching the moving average line or even the upper bound, so we should not take action. At point A, in an upward trend, we should avoid taking short positions. Though the price goes through the upper bound of the BB, we should not take action; at point B, there is no significant trend. The BB is rather flat. We should B not take action; at point C, there is no significant trend. The BB is rather flat. We should not take action; at point D, in a downward trend, when the price is touching the moving average line or even the upper bound, we should take a short position. At point A, in an upward trend, we should avoid taking short positions. Though the price goes through the upper bound of the BB, we should not take action; at point B, there is no significant trend. The BB is rather flat. The price is touching the lower bound and we should take a long position; at point C, there is no significant trend. The BB is rather flat. The price is touching the upper bound and we should take a short position; at point D, in a downward trend, when the price is touching the moving average line or even the upper bound, we should take a short position. At point A, B, C and D, what should we do? The chart is the S&P 500 index price. VAROO 2908 64 ZULU 2.850.00 Tempel 2.800.00 1:"A 2.750.00 themed 2.700.00 2.650.00 2600.00 2550.00 5038 M A At point A: If we have an empty position, we should keep it empty; if we have an existing long or short position, we should close it; at point B, we should keep empty if we are empty, and consider closing short positions and opening long positions; at point C, we should open or keep long positions, and close short positions; at point D, keep short positions and consider close long positions. B At point A: If we have an empty position, we should keep it empty; if we have an existing long or short position, we should close it; at point B, we should keep empty if we are empty; and consider opening short positions and close long positions; at point C, we should consider close long positions, and keep short positions; at point D, consider close short positions and keep long positions. At point A: If we have an empty position, we should keep it empty; if we have an existing long or short position, we should close it; at point B, we should keep empty if we are empty; and consider closing short positions and opening long positions; at point C, we should consider close long positions, and keep short positions; at point D, consider close short positions and keep long positions