Question

At present, Raven Ltd is currently operating in a capital rationing situation and is planning its investment programme for the forthcoming year. The total capital

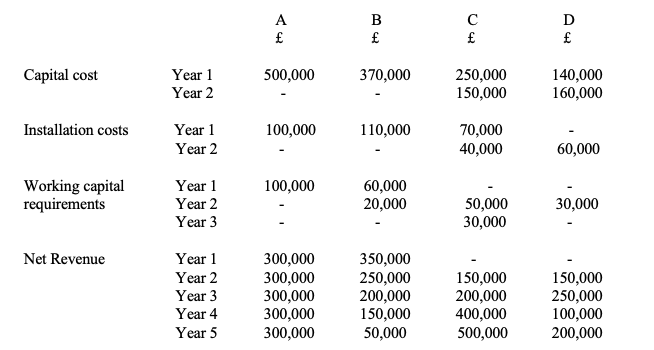

At present, Raven Ltd is currently operating in a capital rationing situation and is planning its investment programme for the forthcoming year. The total capital available for investment in the year is 900,000. The company estimates that its cost of capital is 15%. No capital shortage is expected in subsequent years. The capital costs and expected earnings for the projects under consideration are:

No part of the capital or installation costs is expected to be recouped at the end of a project's life. For the purposes of your calculations, assume that expenditures are made at the beginning of the year and revenue is received at the end of the year.

(i) Calculate the net present value of each project. (ii) Calculate the index of profitability of each project. (iii) Assuming that the projects are infinitely divisible, advise the directors of Raven Ltd as to the optimal investment programme, showing the expected net present value from this plan. (iv) If only complete projects can be accepted, how would that change your answer to (a)(iii) above?

A B D Capital cost 500,000 370,000 Year 1 Year 2 250,000 150,000 140,000 160,000 Installation costs 100,000 110,000 Year 1 Year 2 70,000 40,000 60,000 100,000 Working capital requirements Year 1 Year 2 Year 3 60,000 20,000 30,000 50,000 30,000 Net Revenue Year 1 Year 2 Year 3 Year 4 Year 5 300,000 300,000 300,000 300,000 300,000 350,000 250,000 200,000 150,000 50,000 150,000 200,000 400,000 500,000 150,000 250,000 100,000 200,000 A B D Capital cost 500,000 370,000 Year 1 Year 2 250,000 150,000 140,000 160,000 Installation costs 100,000 110,000 Year 1 Year 2 70,000 40,000 60,000 100,000 Working capital requirements Year 1 Year 2 Year 3 60,000 20,000 30,000 50,000 30,000 Net Revenue Year 1 Year 2 Year 3 Year 4 Year 5 300,000 300,000 300,000 300,000 300,000 350,000 250,000 200,000 150,000 50,000 150,000 200,000 400,000 500,000 150,000 250,000 100,000 200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started