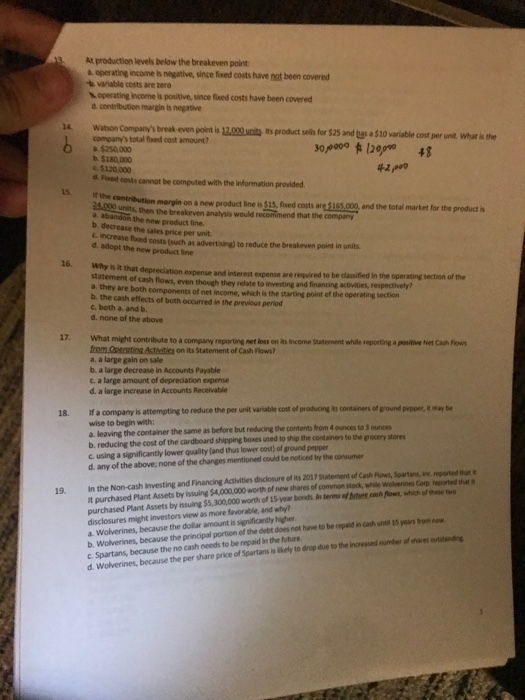

At production levels below the breakeven point a eperating income is negative, since fixed costs have not been covered -b variable costs are zero operating income is positive, since fixed costs have been covered e contribution margin is nepative 14 Watson Company's break even point is 12,000 Mit ts product sels for $25 and tbas a $10 varisble cost per unt whar k the companys total flxed cost amount? a $250,000 b$180,000 $120,000 d Fiwed costs cannot be computed with the information provided 15. if he contribution margin on a new product line in $15, fised costs are 5365,000, and the total market for the product is the breakeven analysis would recomimend that the company a. abandon the new product line b decrease the sales price per unit , increase fixed costs (such as advertisingl to reduce the breakeven point in units d. adopt the new product ine 16. Why is it that depreciation expense and interest expense are required to be classified in the operating section of the statement of cash flows, even though they relate to investing and financing activilies, a they are both components of net income, which is the starting point of the operating section b. the cash effects of both occurred in the previbus period c. both a and b. d. none of the above t contribute to a company reporting net loss on its income Statement while reporting a positive Net Cash flows on its Statement of Cash Flows? a, a large gain on sale b. a large decrease in Accounts Payable c. a large amount of depreciation expense d. a large increase in Accounts Recelvable 18. If a company is attempting to reduce the per unit variable cost of producing ts containers of ground pepper, k may be wise to begin with: a leaving the container the same as before but reducing the contents from 4 ounces to 3 ounces b. reducing the cost of the cardboard shipping boxes used to ship the containers to the g c using a significantly lower quality (and thus lower cost) of ground pepper d. any of the above; none of the changes mentioned could be noticed by the consumer ocery stores it purchased Plant Assets by issuing $4,000,000 worth of new shares of common stock, wide Woberines Cop orted tht purchased Plant Assets by issuing $5,300,000 worth of 15-year bonds tn terms of fetucosh flows, which of hese two disclosures might investors view as more favorable, and why a. Wolverines, because the dolar amount is significantly high b. Wolverines, because the principal portion of the debt does not have to be repaid in cash until 15 yean c. Spartans, because the no cash needs to be repaid in the future. d. Wolverines, because the per share price of Spartans is lkely to drop due to the incressed number of shaves artstandie 19. In the Non-cash Iinvesting and Financing Activities discdosure of its 2017 statement of Cash Flows, Spartans, ec reported thet e