Answered step by step

Verified Expert Solution

Question

1 Approved Answer

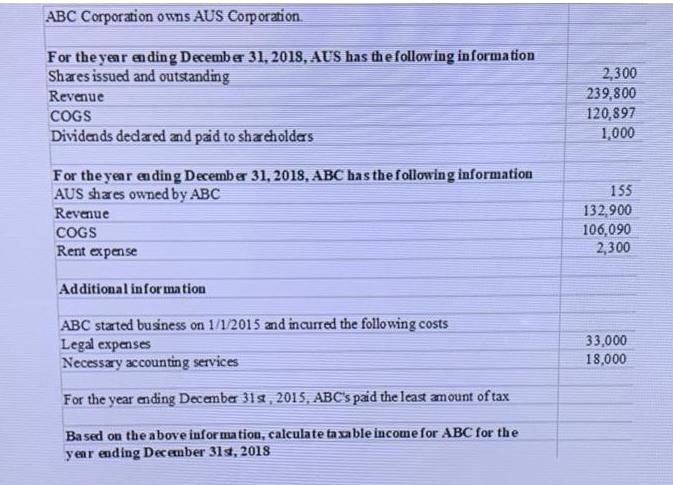

ABC Corporation owns AUS Corporation. For the year ending December 31, 2018, AUS has the following information Shares issued and outstanding Revenue COGS Dividends

ABC Corporation owns AUS Corporation. For the year ending December 31, 2018, AUS has the following information Shares issued and outstanding Revenue COGS Dividends declared and paid to shareholders For the year ending December 31, 2018, ABC has the following information AUS shares owned by ABC Revenue COGS Rent expense Additional information ABC started business on 1/1/2015 and incurred the following costs Legal expenses Necessary accounting services For the year ending December 31st, 2015, ABC's paid the least amount of tax Based on the above information, calculate taxable income for ABC for the year ending December 31st, 2018 2,300 239,800 120,897 1,000 155 132,900 106,090 2,300 33,000 18,000

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Given preliminary expenses of ABC corporation are 3300018000 51000 This preliminary expenses ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started