Answered step by step

Verified Expert Solution

Question

1 Approved Answer

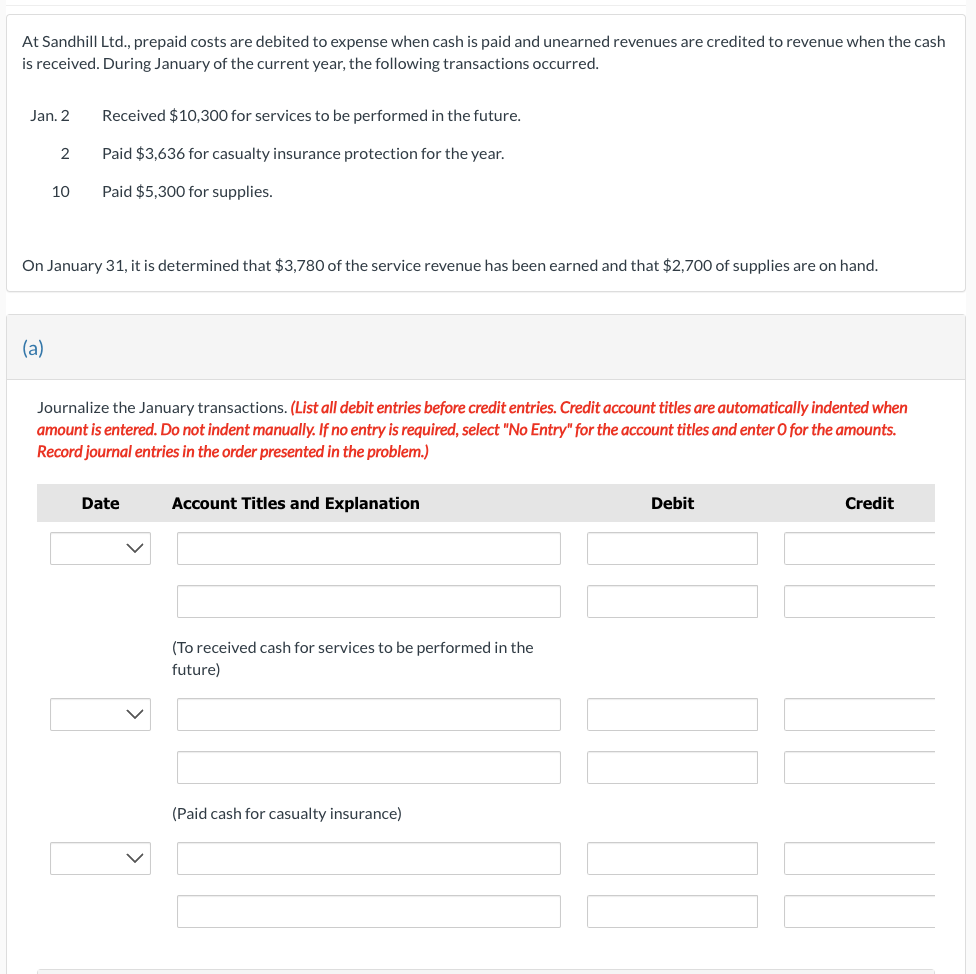

At Sandhill Ltd., prepaid costs are debited to expense when cash is paid and unearned revenues are credited to revenue when the cash is

At Sandhill Ltd., prepaid costs are debited to expense when cash is paid and unearned revenues are credited to revenue when the cash is received. During January of the current year, the following transactions occurred. Jan. 2 2 (a) 10 Received $10,300 for services to be performed in the future. Paid $3,636 for casualty insurance protection for the year. Paid $5,300 for supplies. On January 31, it is determined that $3,780 of the service revenue has been earned and that $2,700 of supplies are on hand. Journalize the January transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date (To received cash for services to be performed in the future) (Paid cash for casualty insurance) Debit 10 Credit

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To journalize the transactions for Sandhill Ltd in January well need to follow the doubleentry bookkeeping system where every transaction affects at l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started