Answered step by step

Verified Expert Solution

Question

1 Approved Answer

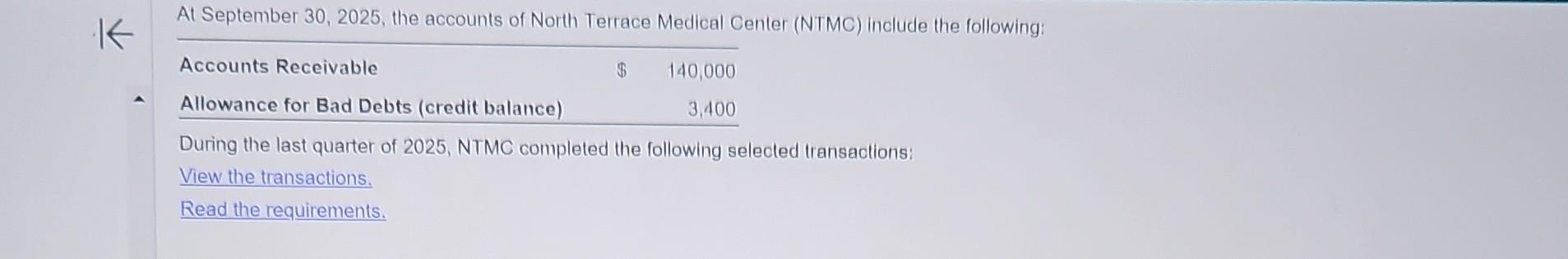

At September 30, 2025, the accounts of North Terrace Medical Center (NTMC) include the following: Accounts Receivable $ 140,000 Allowance for Bad Debts (credit

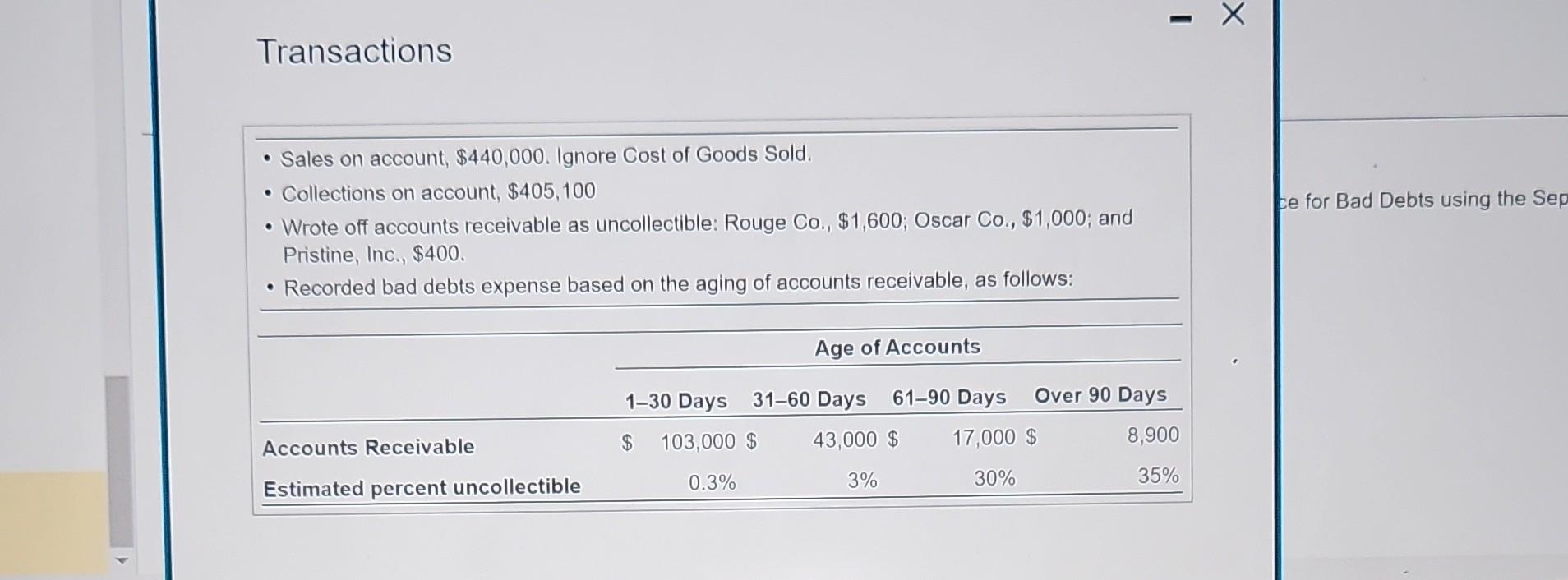

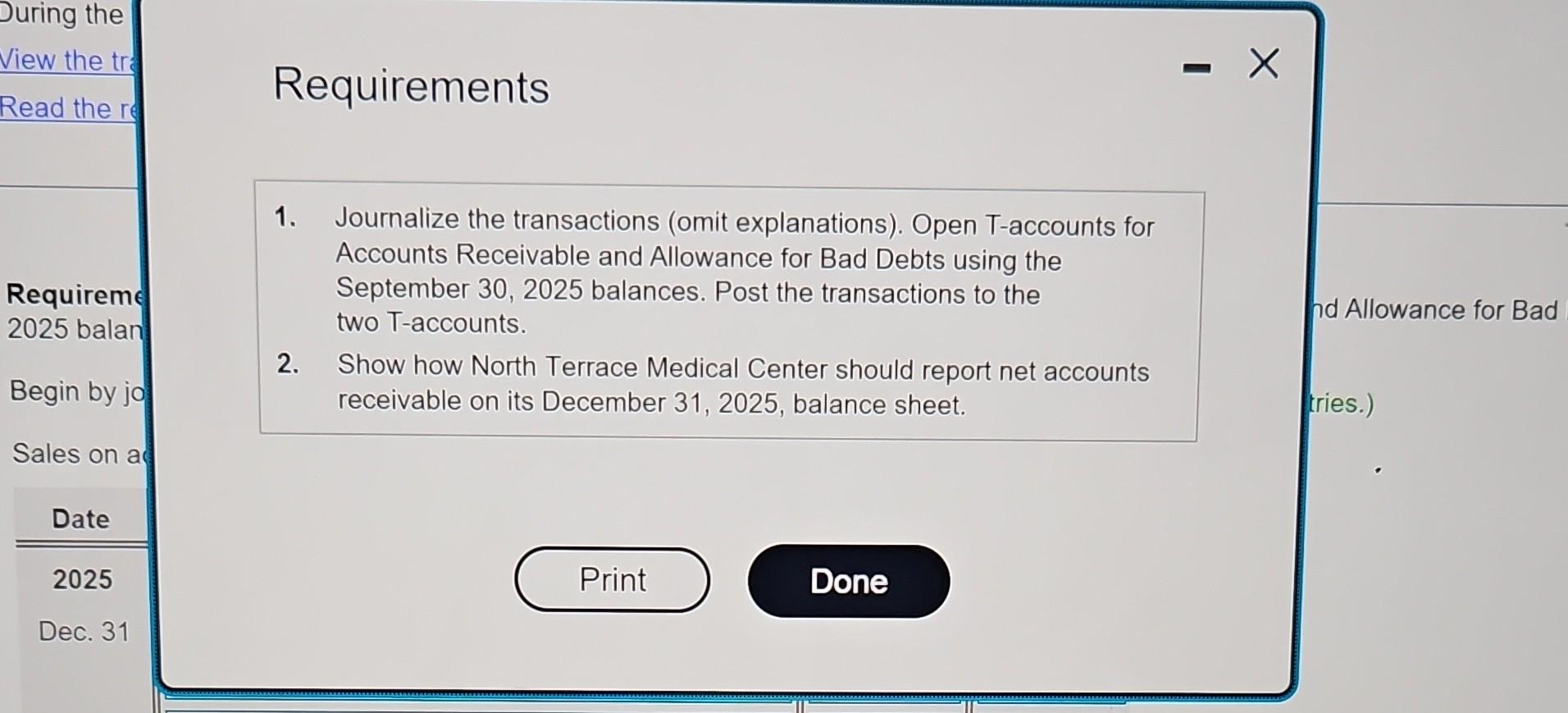

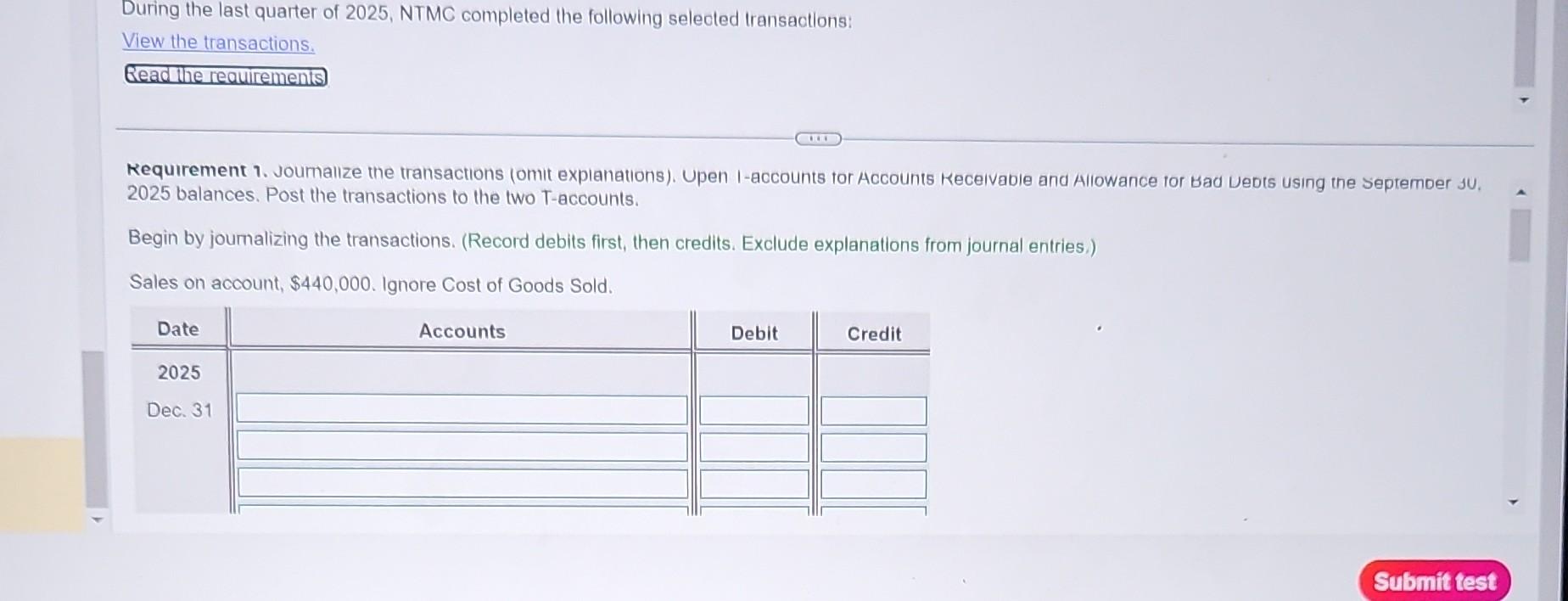

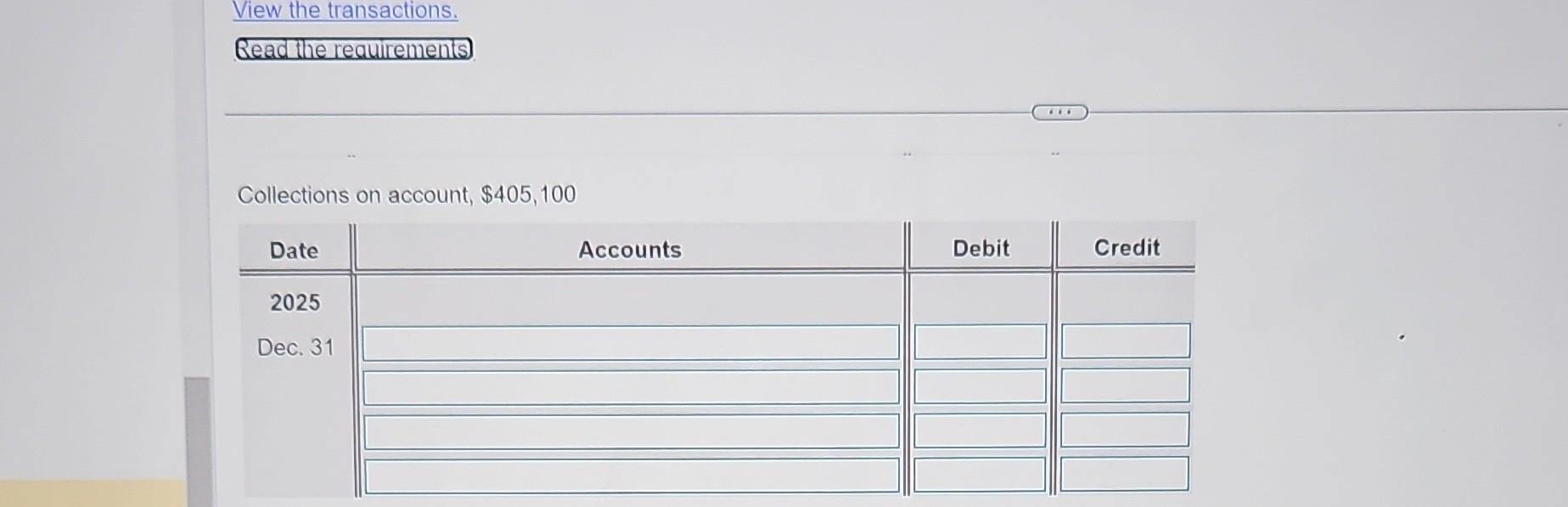

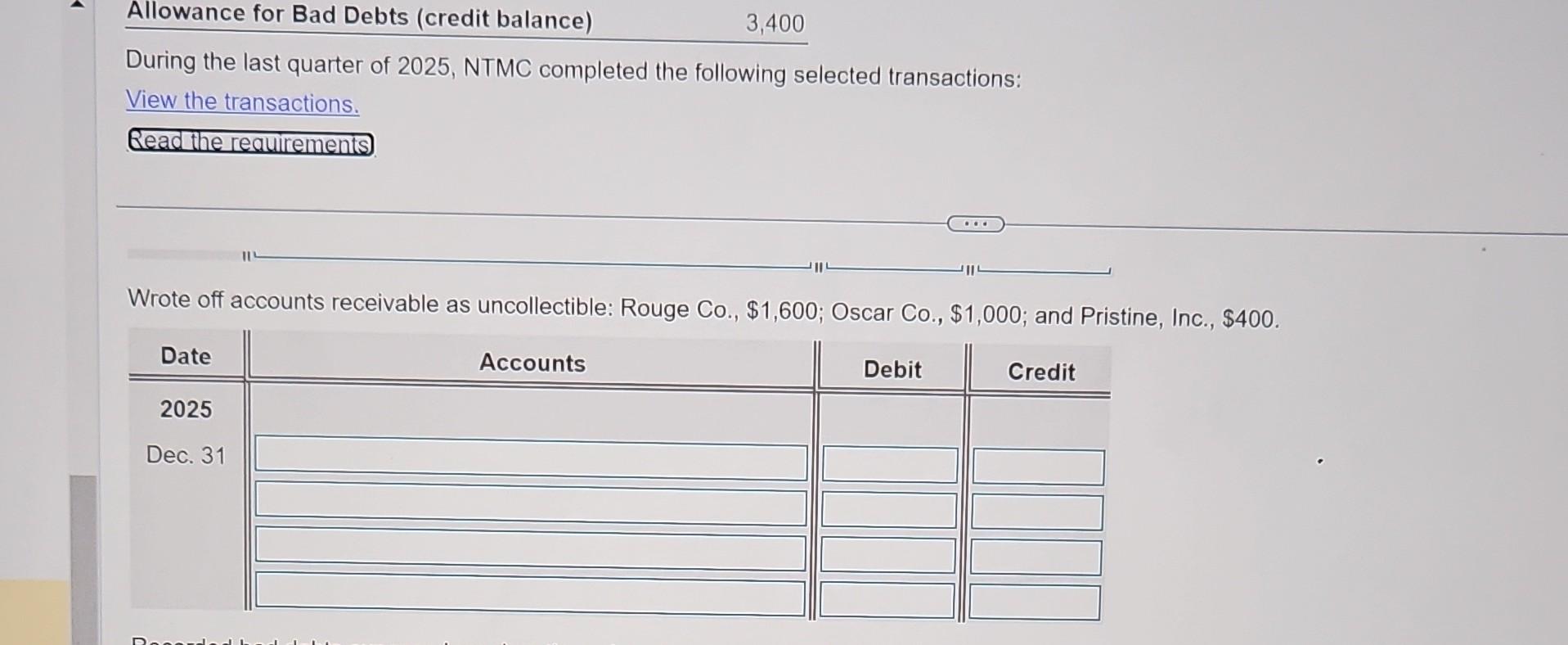

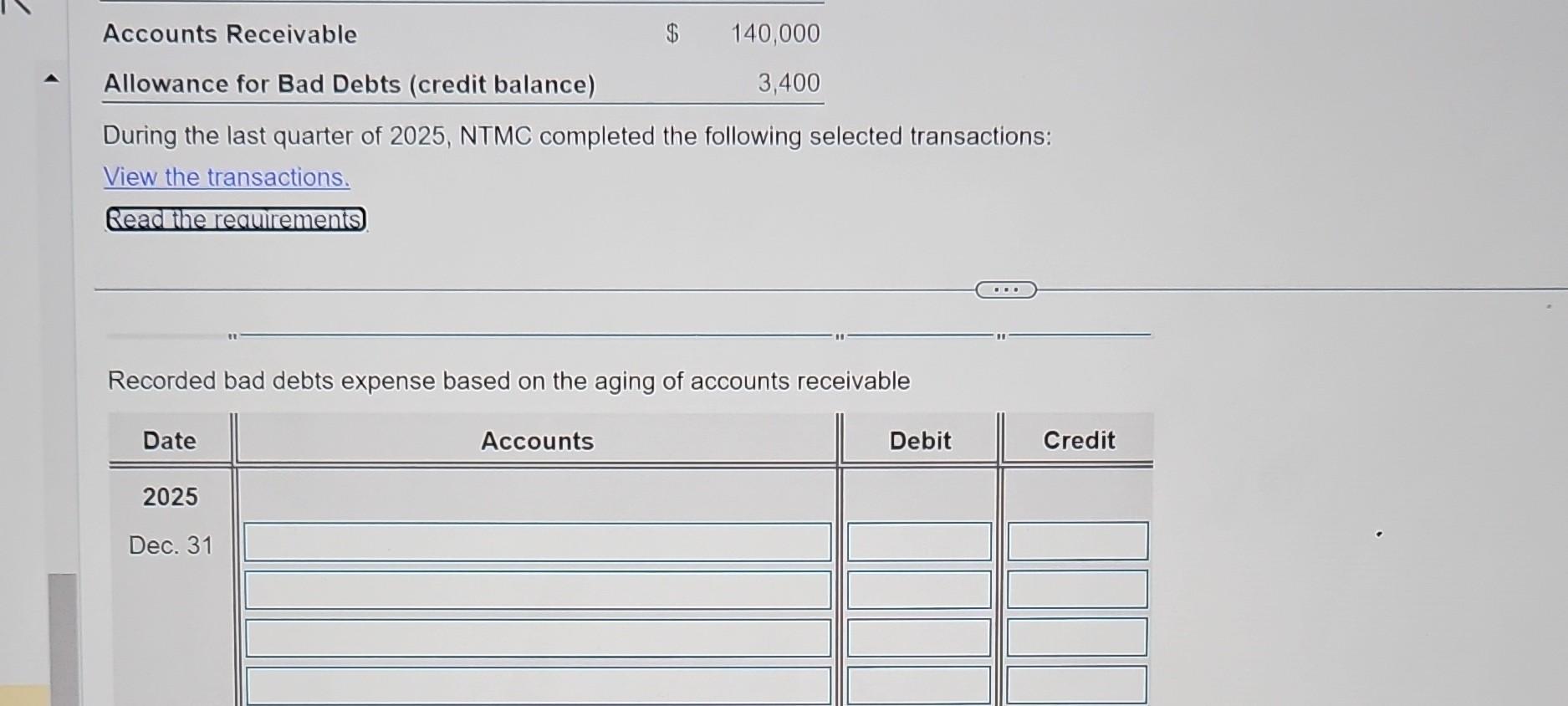

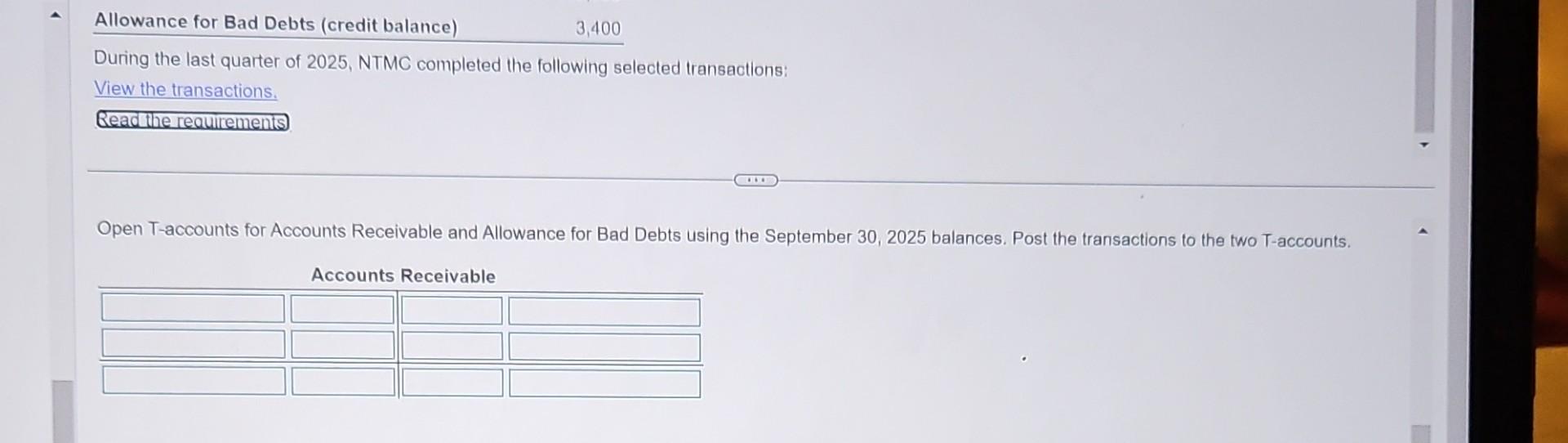

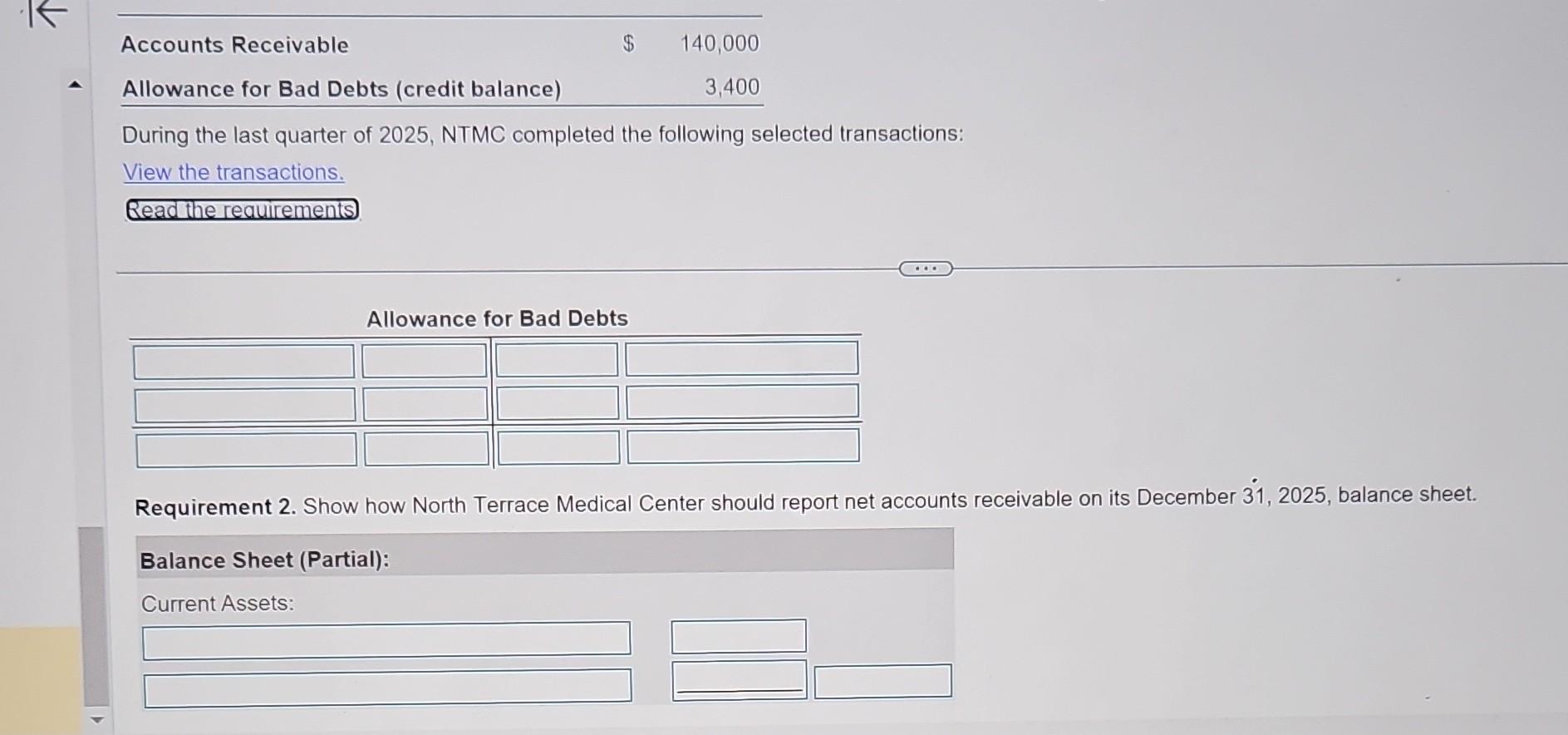

At September 30, 2025, the accounts of North Terrace Medical Center (NTMC) include the following: Accounts Receivable $ 140,000 Allowance for Bad Debts (credit balance) 3,400 During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions. Read the requirements. Transactions Sales on account, $440,000. Ignore Cost of Goods Sold. Collections on account, $405,100 Wrote off accounts receivable as uncollectible: Rouge Co., $1,600; Oscar Co., $1,000; and Pristine, Inc., $400. Recorded bad debts expense based on the aging of accounts receivable, as follows: ce for Bad Debts using the Sep Age of Accounts Accounts Receivable 1-30 Days 31-60 Days 61-90 Days $ 103,000 $ Over 90 Days Estimated percent uncollectible 0.3% 43,000 $ 3% 17,000 $ 8,900 30% 35% During the View the tra Read the re Requirements - X 1. Requireme 2025 balan Journalize the transactions (omit explanations). Open T-accounts for Accounts Receivable and Allowance for Bad Debts using the September 30, 2025 balances. Post the transactions to the two T-accounts. nd Allowance for Bad 2. Begin by jo Show how North Terrace Medical Center should report net accounts receivable on its December 31, 2025, balance sheet. tries.) Sales on a Date 2025 Dec. 31 Print Done During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions. Read the requirements Requirement 1. Journalize the transactions (omit explanations). Upen 1-accounts for Accounts Receivable and Allowance for Bad Debts using the September 30, 2025 balances. Post the transactions to the two T-accounts. Begin by journalizing the transactions. (Record debits first, then credits. Exclude explanations from journal entries.) Sales on account, $440,000. Ignore Cost of Goods Sold. Date 2025 Dec. 31 Accounts Debit Credit Submit test View the transactions. Read the requirements Collections on account, $405,100 Date 2025 Dec. 31 999 Accounts Debit Credit Allowance for Bad Debts (credit balance) 3,400 During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions. Read the requirements Wrote off accounts receivable as uncollectible: Rouge Co., $1,600; Oscar Co., $1,000; and Pristine, Inc., $400. Date 2025 Dec. 31 Accounts Debit Credit Accounts Receivable $ 140,000 Allowance for Bad Debts (credit balance) 3,400 During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions. Read the requirements Recorded bad debts expense based on the aging of accounts receivable Date 2025 Dec. 31 Accounts Debit Credit Allowance for Bad Debts (credit balance) 3,400 During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions, Read the requirements Open T-accounts for Accounts Receivable and Allowance for Bad Debts using the September 30, 2025 balances. Post the transactions to the two T-accounts. Accounts Receivable Accounts Receivable $ 140,000 Allowance for Bad Debts (credit balance) 3,400 During the last quarter of 2025, NTMC completed the following selected transactions: View the transactions. Read the requirements Allowance for Bad Debts Requirement 2. Show how North Terrace Medical Center should report net accounts receivable on its December 31, 2025, balance sheet. Balance Sheet (Partial): Current Assets:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started