Question

At the 50-year reunion of their high-school class at Midvale School for the Gifted, Ingenia, CA, renowned investor and philanthropist Harry H. Hindsight, CEO and

At the 50-year reunion of their high-school class at Midvale School for the Gifted, Ingenia, CA, renowned investor and philanthropist Harry H. Hindsight, CEO and chief investment officer of HHH, Inc. (Hindsight Hyper Hedge-Fund) ran into his old flame, Felicity F. Foresight. His old feelings rekindled, Harry soon realizes that Felicity,

never really a wallflower, had become the creative force behind one of the most successful mutual fund companies in the country, the Foresight Future Fund (FFF). Still smarting from her earlier rejection, Harry, once a shy and introverted star among Midvales geniuses,1 loses little time trying to impress her with his investment acumen and success so that, to the general irritation of their former classmates, the conversation quickly turns to alphas, betas, and other Greek letters, and to a philosophical discussion of risk and reward.

As it turns out, both Felicity and Harry have long invested in the same type of assets following an investment style called tactical asset allocation. Rater than picking individual stocks or bonds, one uses broad asset classes and shifts the portfolio allocation between investment categories based on quantitative models (Harrys forte) or intuition (Felicitys competitive advantage) to time the market and ride fundamentals.

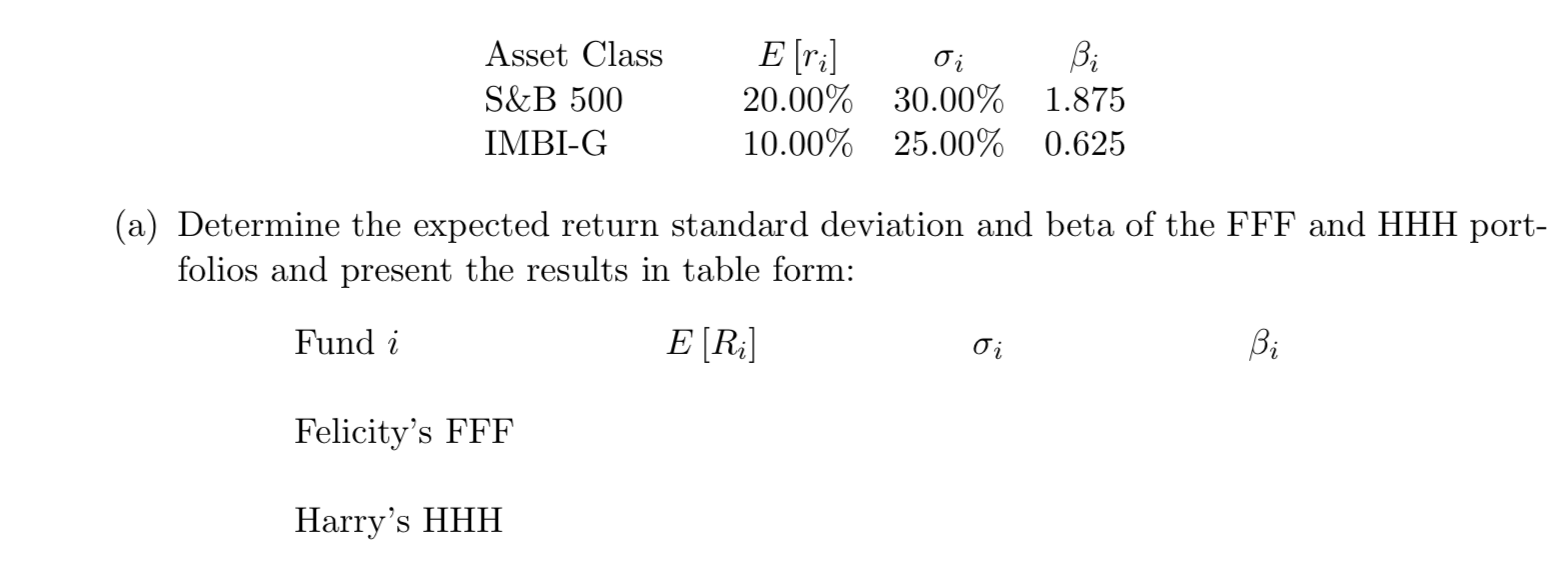

Both FFF and HHH are currently invested in the S&B 500 (the Sell&Buy 500 stock index of the 500 most day-traded stocks) and the IMBI Global Sovereign (Intriguing Markets Bond Index - Global Sovereign: the most intriguing global sovereign bonds) with Felicity currently holding 25% in the IMBI-G and 75% in the S&B 500 and Harrys portfolio equally weighted between the two investment categories. The correlation (coefficient) between the two asset classes is 0.20 and the one-year risk-free rate 5.00%. Further key statistics (one-year expected return, standard deviation and beta) for the two investment categories are as follows

(b) S. Avy Nvestor, Felicitys best friend in high school and a very successful (and very wealthy) IT executive, becomes intrigued by all the finance talk at their table and wonders which of the two funds really offers the better risk-return trade-off. Can you help her?

(c) Sketch the efficient frontier and capital market line indicating where the FFF and HHH portfolios are roughly located. You do not need to carry out any additional calculations beyond the preceding ones but have to clearly label the axes. Next, assuming that Harry and Felicity can borrow and lend at the risk-free rate (e.g., using the net asset value of their portfolios as collateral), indicate the new efficient frontier under two scenarios:

institutional investors such as FFF or HHH may both borrow and lend at the risk- free rate;

investors may only lend at the risk-free rate but, because of credit-risk concerns, cannot borrow.

(d) Impressed by the beauty of Felicitys portfolio, Harry proposes a merger of equals of the two companies to form the FHFHF (Foresight-Hindsight Future Hedge Fund), whose assets would be equally split between current portfolios of FFF and HHH. Leaving the current asset allocations unchanged, what is the beta of the FHFHF? From a systematicrisk perspective, should Felicity accept Harrys proposal or reject him again?

e) Optional. A year has passed and the FHFHF become a reality. Harry has retired as inaugural CEO to devote more time to his quest to win the Americas Cup, the oldest international sporting event in modern times.3 Newly promoted CEO Felicity Foresight has asked you to prepare a forecast for next years return performance; busy with integrating the two companies, the funds asset allocation has not changed from the last year. If next years expected return on the S&P 500 E [Rm] is 11.20% and the one year the risk-free rate (US T-bill) rf = 3.70%, what would you expect the combined FHFHF to return next year?

Asset Class S&B 500 IMBI-G Eri] 20.00% 10.00% Oi 30.00% 25.00% Bi 1.875 0.625 (a) Determine the expected return standard deviation and beta of the FFF and HHH port- folios and present the results in table form: Fund i E[Ri] Oi Bi Felicity's FFF Harry's HHH Asset Class S&B 500 IMBI-G Eri] 20.00% 10.00% Oi 30.00% 25.00% Bi 1.875 0.625 (a) Determine the expected return standard deviation and beta of the FFF and HHH port- folios and present the results in table form: Fund i E[Ri] Oi Bi Felicity's FFF Harry's HHHStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started