Answered step by step

Verified Expert Solution

Question

1 Approved Answer

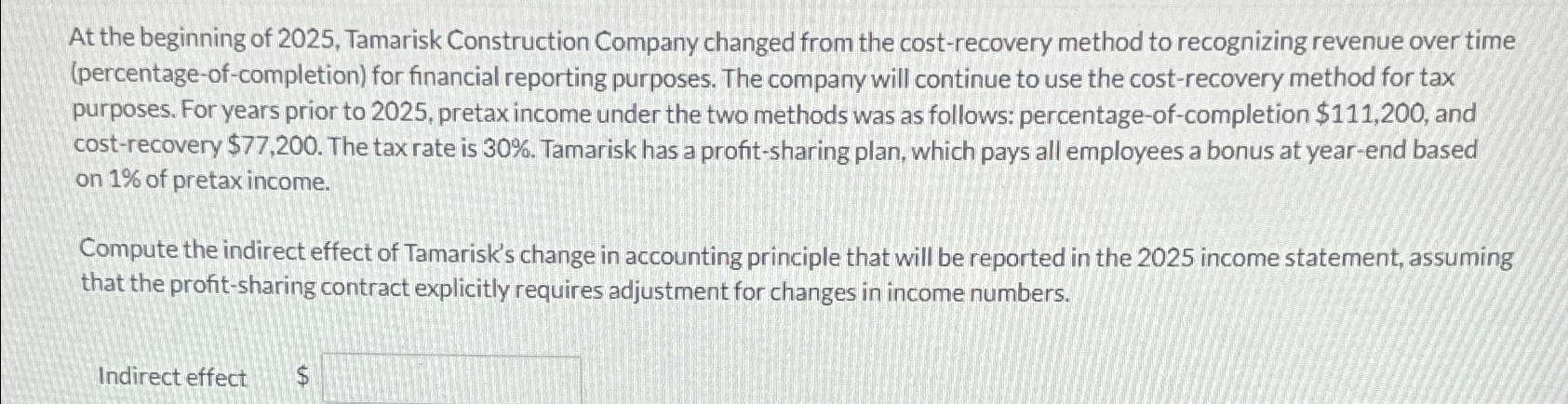

At the beginning of 2 0 2 5 , Tamarisk Construction Company changed from the cost - recovery method to recognizing revenue over time (

At the beginning of Tamarisk Construction Company changed from the costrecovery method to recognizing revenue over time percentageofcompletion for financial reporting purposes. The company will continue to use the costrecovery method for tax purposes. For years prior to pretax income under the two methods was as follows: percentageofcompletion $ and costrecovery $ The tax rate is Tamarisk has a profitsharing plan, which pays all employees a bonus at yearend based on of pretax income.

Compute the indirect effect of Tamarisk's change in accounting principle that will be reported in the income statement, assuming that the profitsharing contract explicitly requires adjustment for changes in income numbers.

Indirect effect $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started