Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 2014, Empire Inc. underwent a leveraged buy-out. Tax loss carry forwards are expected to eliminate income tax liabilities in 2014 but

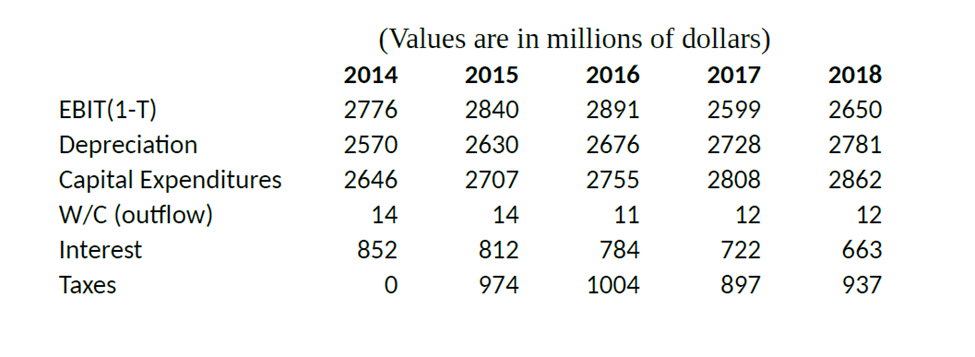

At the beginning of 2014, Empire Inc. underwent a leveraged buy-out. Tax loss carry forwards are expected to eliminate income tax liabilities in 2014 but from 2015 onwards a 30% tax rate will apply. Assume 3% risk-free rate, a 5.5% market risk premium, and an industry average unleveraged beta of 0.9. The interest rate on debt is 6.7%. Using the APV methodology and the data below, what is the enterprise value of expected cash flows through the end of 2018? (Today is Jan 1, 2014)

EBIT(1-T) Depreciation Capital Expenditures W/C (outflow) Interest Taxes (Values are in millions of dollars) 2015 2016 2017 2840 2891 2599 2630 2676 2728 2707 2755 2808 2014 2776 2570 2646 14 852 0 14 812 974 11 784 1004 12 722 897 2018 2650 2781 2862 12 663 937

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the enterprise value using the Adjusted Present Value APV methodology we need to consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started