Question

At the beginning of 2016 Hassan Company sold a land to Ali Company at $90,000. The land originally costs S70,000. During 2018, Ali Company

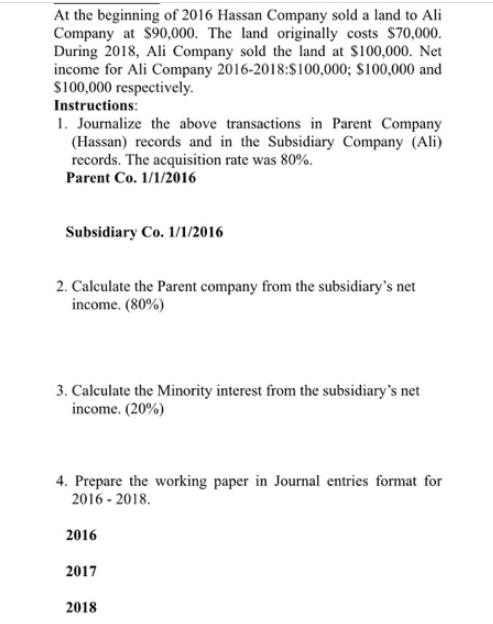

At the beginning of 2016 Hassan Company sold a land to Ali Company at $90,000. The land originally costs S70,000. During 2018, Ali Company sold the land at $100,000. Net income for Ali Company 2016-2018:$100,000; $100,000 and S100,000 respectively. Instructions: 1. Journalize the above transactions in Parent Company (Hassan) records and in the Subsidiary Company (Ali) records. The acquisition rate was 80%. Parent Co. 1/1/2016 Subsidiary Co. 1/1/2016 2. Calculate the Parent company from the subsidiary's net income. (80%) 3. Calculate the Minority interest from the subsidiary's net income. (20%) 4. Prepare the working paper in Journal entries format for 2016 - 2018. 2016 2017 2018

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Jounar Enties On date of aeguistion In the Books of Hassan l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra Jeter, Paul Chaney

6th edition

978-1118742945, 111874294X, 978-1119045946, 1119045940, 978-1119119364

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App