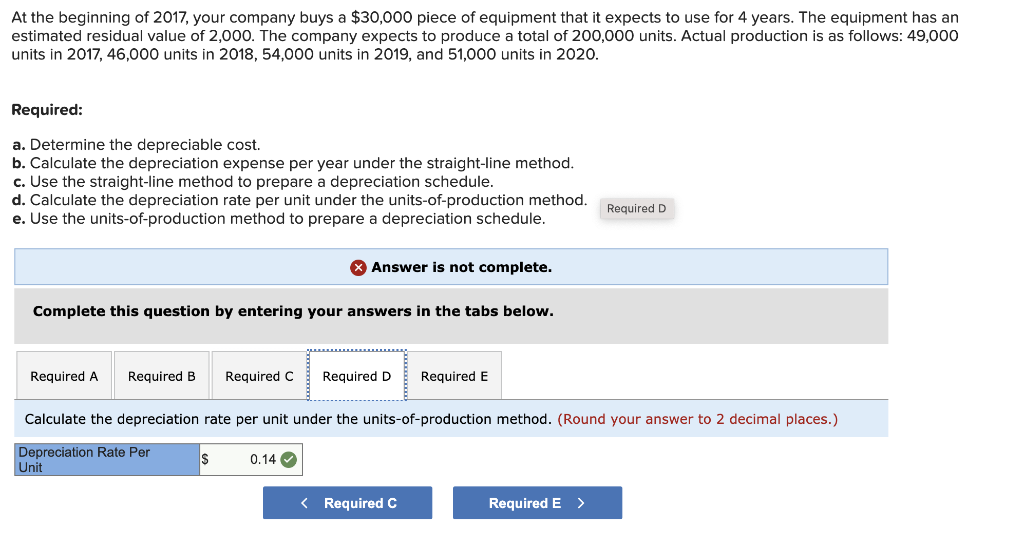

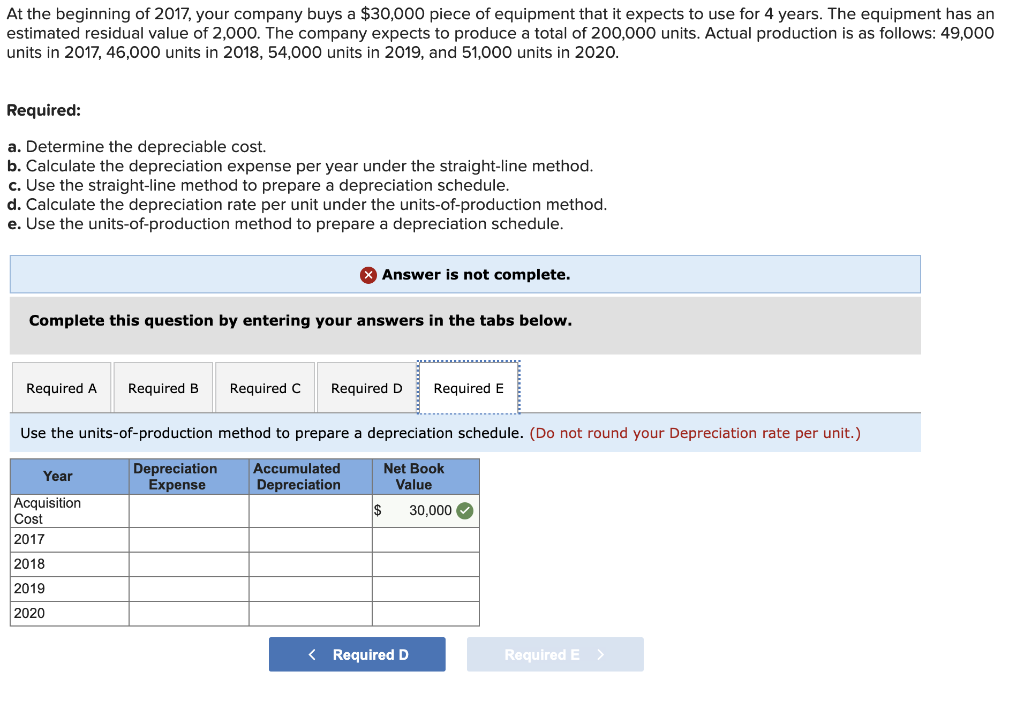

At the beginning of 2017, your company buys a $30,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 49,000 units in 2017, 46,000 units in 2018, 54,000 units in 2019, and 51,000 units in 2020. Required: Determine the depreciable cost. Calculate the depreciation expense per year under the straight-line method. Use the straight-line method to prepare a depreciation schedule. Calculate the depreciation rate per unit under the units-of-production method. Use the units-of-production method to prepare a depreciation schedule.

I NEED LAST QUESTION ANSWERS

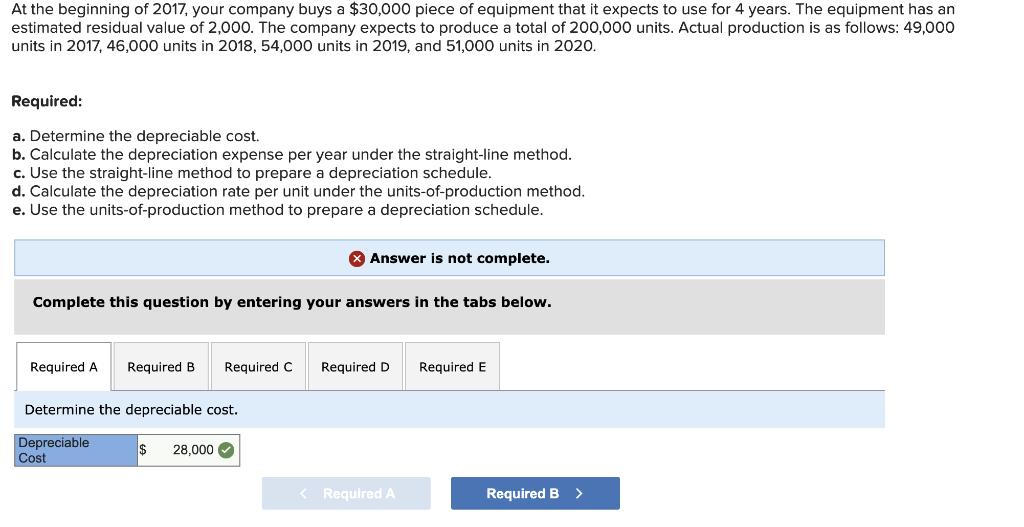

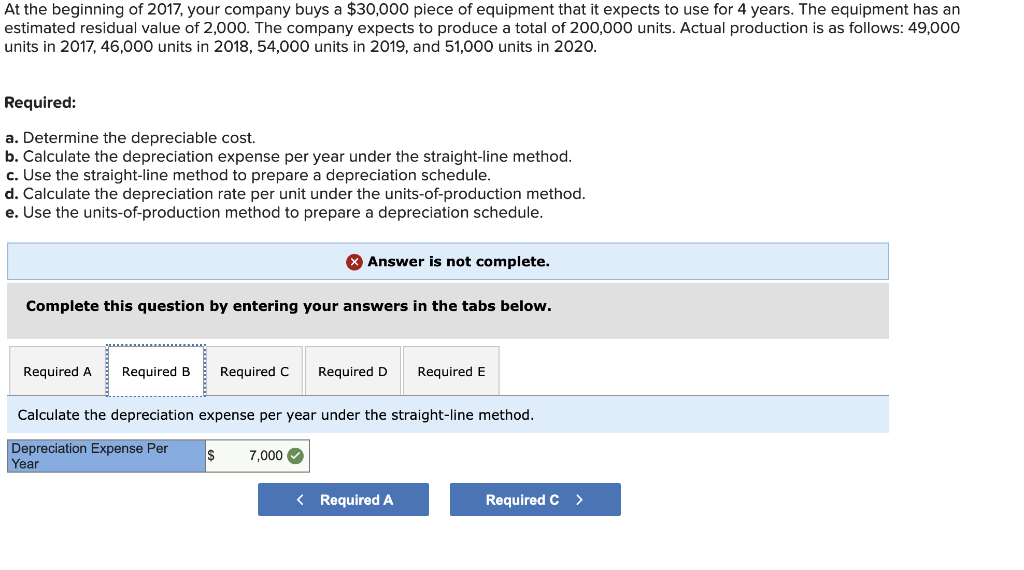

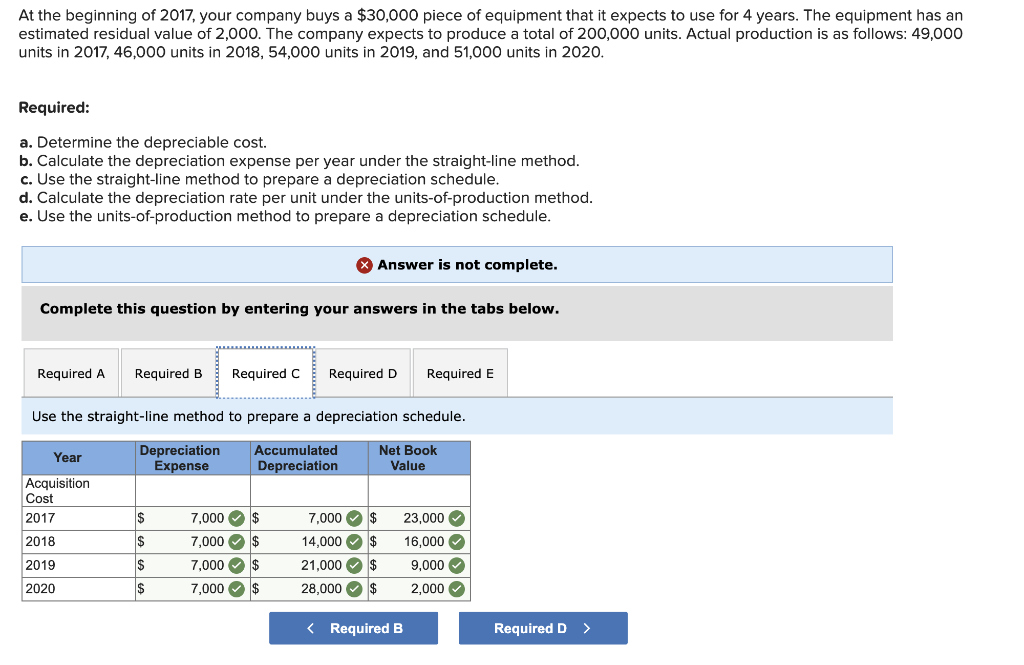

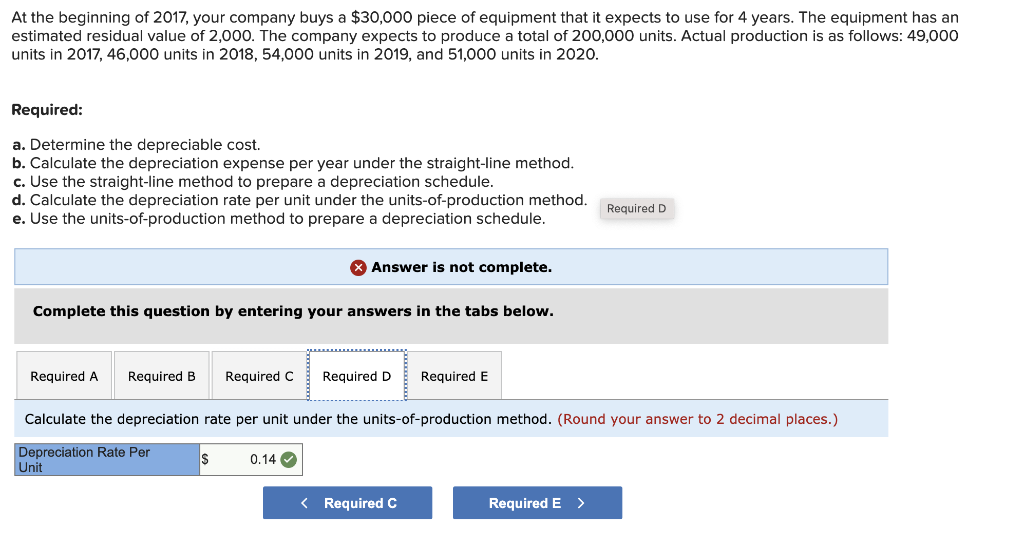

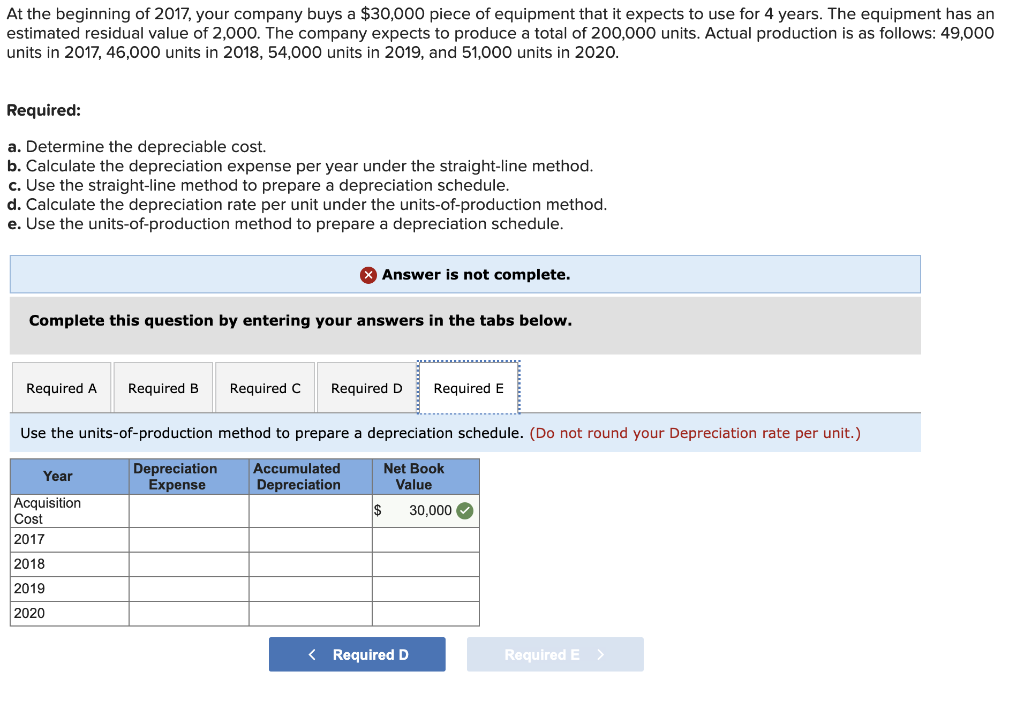

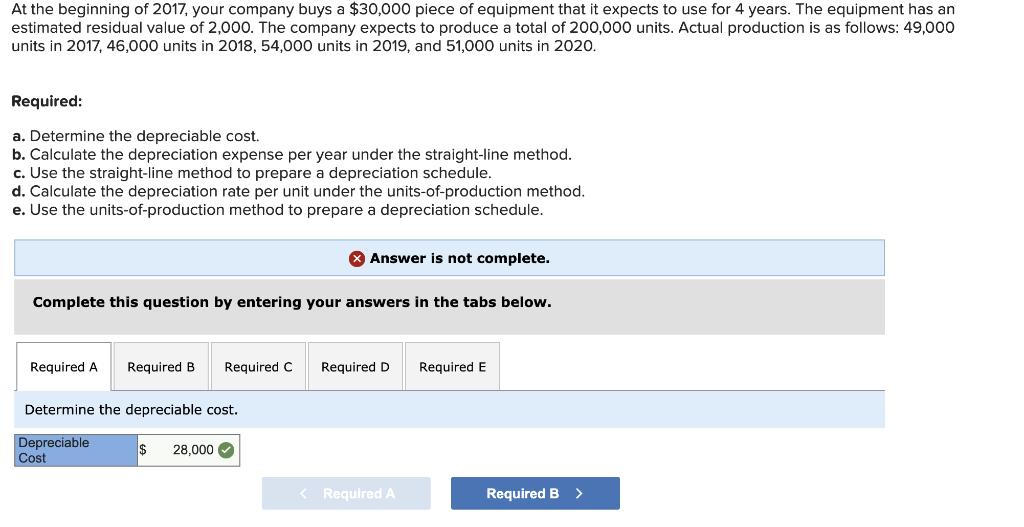

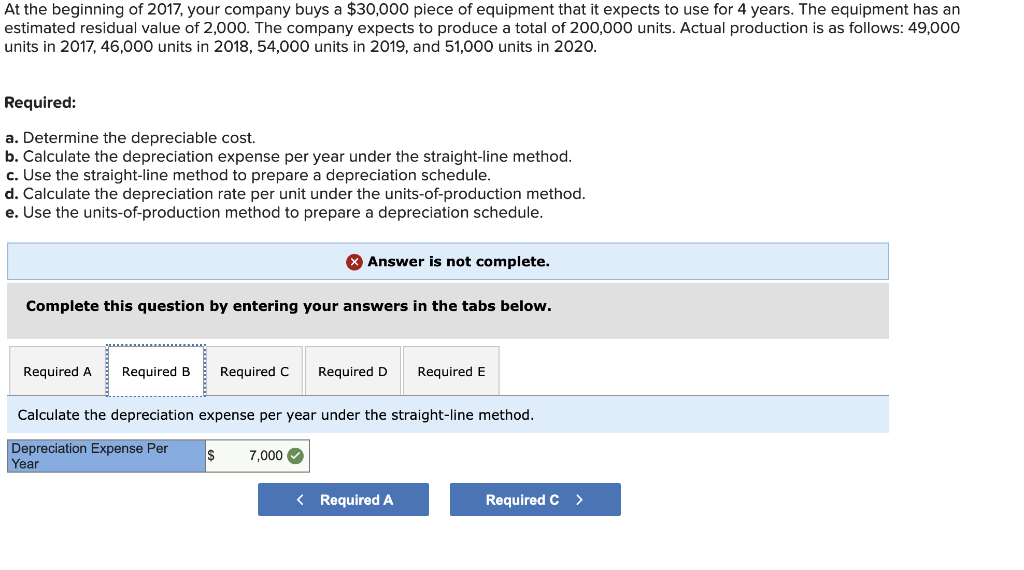

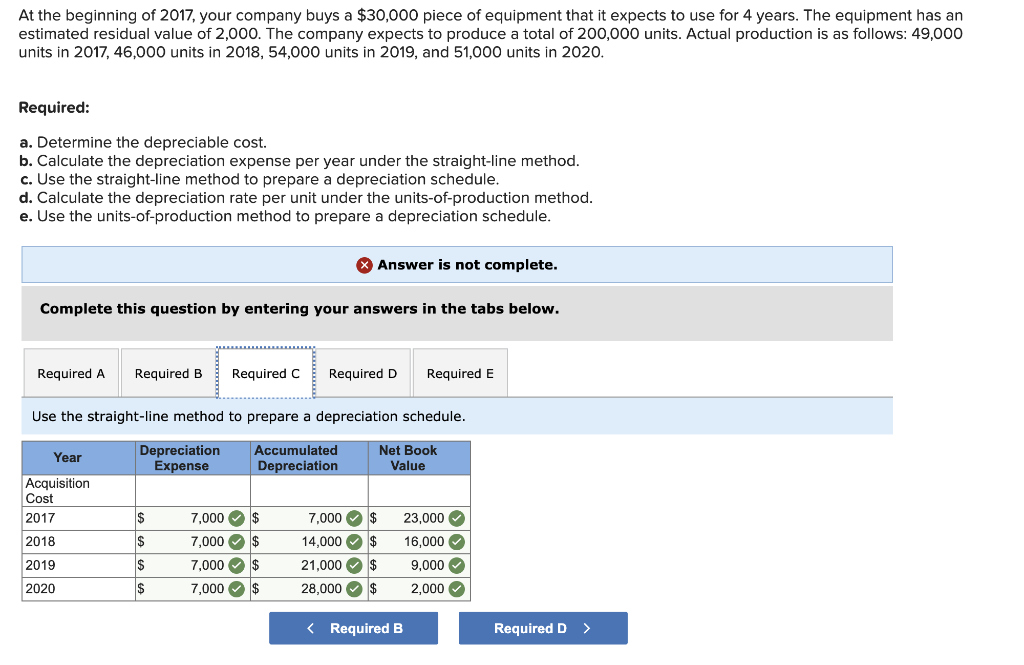

At the beginning of 2017, your company buys a $30,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 49,000 units in 2017, 46,000 units in 2018, 54,000 units in 2019, and 51,000 units in 2020. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Determine the depreciable cost. Depreciable Cost $ 28,000 Required A Required B > At the beginning of 2017, your company buys a $30,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 49,000 units in 2017, 46,000 units in 2018, 54,000 units in 2019, and 51,000 units in 2020. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Calculate the depreciation expense per year under the straight-line method. Depreciation Expense Per Year $ 7,000 At the beginning of 2017, your company buys a $30,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 49,000 units in 2017, 46,000 units in 2018, 54,000 units in 2019, and 51,000 units in 2020. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Use the straight-line method to prepare a depreciation schedule. Year Depreciation Expense Accumulated Depreciation Net Book Value Acquisition Cost 2017 $ 2018 $ 7,000 $ 7,000 $ 7,000$ 7,000 $ 7,000 $ 14,000 $ 21,000 $ 28,000 $ 23,000 16,000 9,000 2,000 2019 $ $ 2020 At the beginning of 2017, your company buys a $30,000 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 2,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 49,000 units in 2017, 46,000 units in 2018, 54,000 units in 2019, and 51,000 units in 2020. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Use the units-of-production method to prepare a depreciation schedule. (Do not round your Depreciation rate per unit.) Year Depreciation Expense Accumulated Depreciation Net Book Value $ 30,000 Acquisition Cost 2017 2018 2019 2020