Question

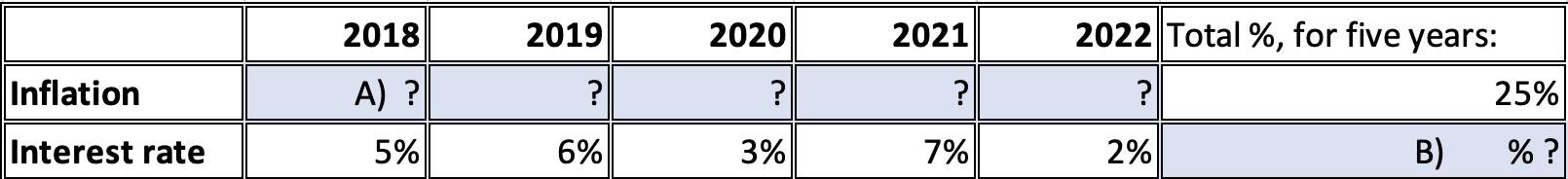

At the beginning of 2018 you deposit 1000 compounded annually. The interest rate is floating, i.e. it is changing every year (see data in table).

At the beginning of 2018 you deposit 1000 compounded annually. The interest rate is floating, i.e. it is changing every year (see data in table).

You know only the total (compounded) rate of inflation on the end of five years, but don’t know the exact rates of inflation of each year.

A) Please calculate average rates of inflation yearly. Use both GEOMEAN function and mathematical calculation of the root.

B) What is the number of total compounded interest on the end of five years?

C) What is the average interest a year (this is also an effective interest)?

D) What is the nominal value of your investment after 5 years?

E) What is the real value of your investment after 5 years? (adjusted to inflation)

Inflation Interest rate 2018 A) ? 5% 2019 ? 6% 2020 ? 3% 2021 ? 7% 2022 Total %, for five years: ? 2% B) 25% % ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Calculate the average rates of inflation yearly Using the GEOMEAN function Average inflation rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started