Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 2019, Harold Cox had an $8,900 [(1/2)($17,800)] net capital loss carry forward from 2018. During the year 2019 Mr. Cox

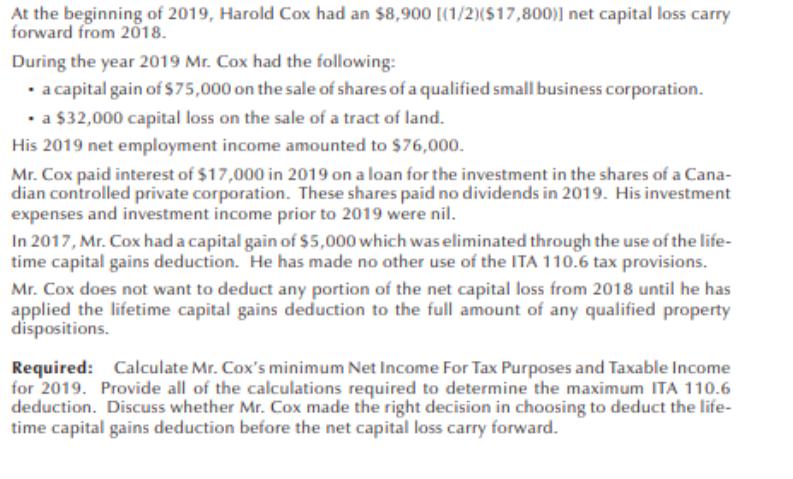

At the beginning of 2019, Harold Cox had an $8,900 [(1/2)($17,800)] net capital loss carry forward from 2018. During the year 2019 Mr. Cox had the following: a capital gain of $75,000 on the sale of shares of a qualified small business corporation. a $32,000 capital loss on the sale of a tract of land. His 2019 net employment income amounted to $76,000. Mr. Cox paid interest of $17,000 in 2019 on a loan for the investment in the shares of a Cana- dian controlled private corporation. These shares paid no dividends in 2019. His investment expenses and investment income prior to 2019 were nil. In 2017, Mr. Cox had a capital gain of $5,000 which was eliminated through the use of the life- time capital gains deduction. He has made no other use of the ITA 110.6 tax provisions. Mr. Cox does not want to deduct any portion of the net capital loss from 2018 until he has applied the lifetime capital gains deduction to the full amount of any qualified property dispositions. Required: Calculate Mr. Cox's minimum Net Income For Tax Purposes and Taxable Income for 2019. Provide all of the calculations required to determine the maximum ITA 110.6 deduction. Discuss whether Mr. Cox made the right decision in choosing to deduct the life- time capital gains deduction before the net capital loss carry forward.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Mr Coxs minimum Net Income For Tax Purposes and Taxable In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started