Answered step by step

Verified Expert Solution

Question

1 Approved Answer

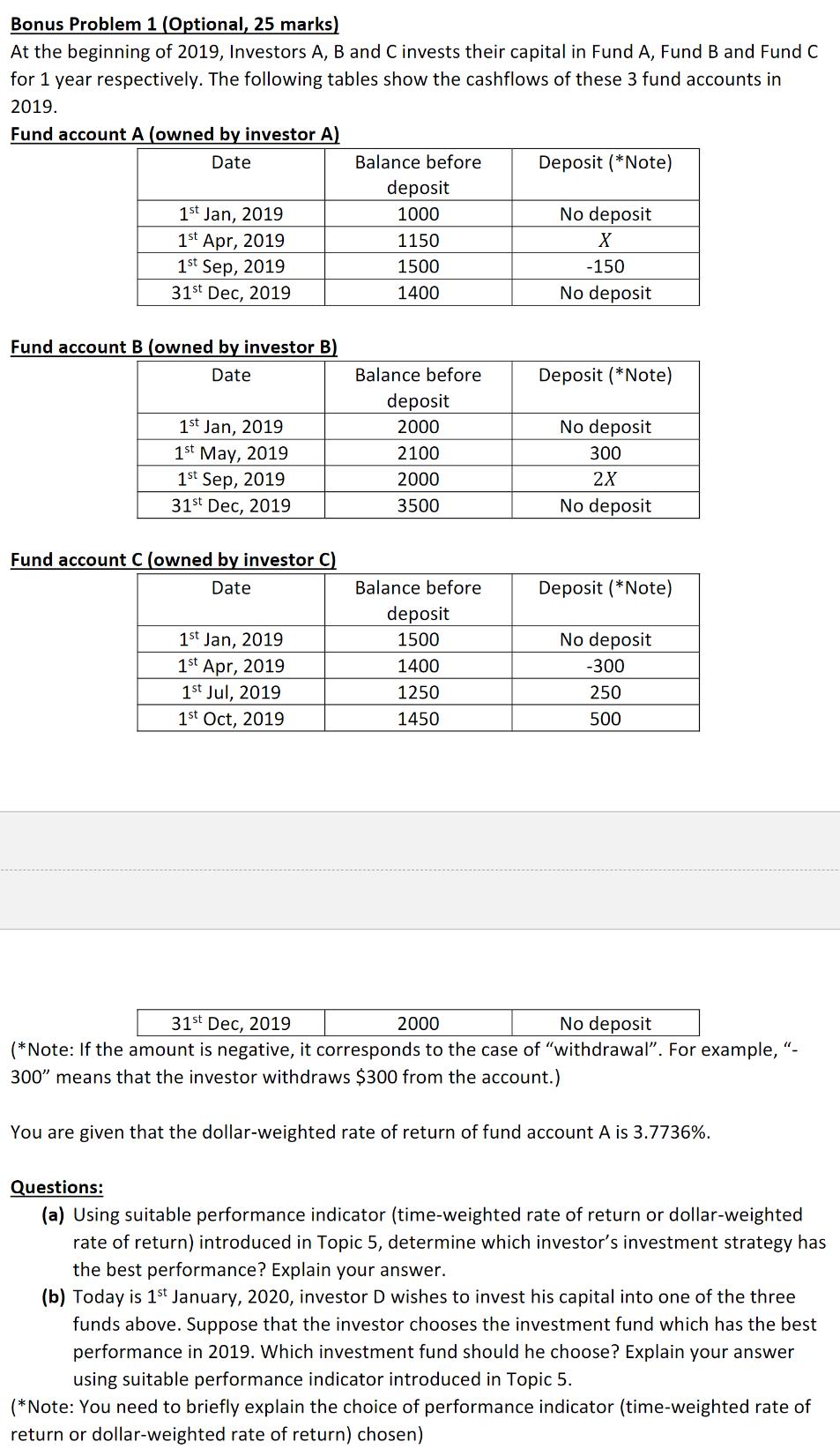

Bonus Problem 1 (Optional, 25 marks) At the beginning of 2019, Investors A, B and C invests their capital in Fund A, Fund B

Bonus Problem 1 (Optional, 25 marks) At the beginning of 2019, Investors A, B and C invests their capital in Fund A, Fund B and Fund C for 1 year respectively. The following tables show the cashflows of these 3 fund accounts in 2019. Fund account A (owned by investor A) Date 1st Jan, 2019 1st Apr, 2019 1st Sep, 2019 31st Dec, 2019 Fund account B (owned by investor B) Date 1st Jan, 2019 1st May, 2019 1st Sep, 2019 31st Dec, 2019 Fund account C (owned by investor C) Date 1st Jan, 2019 1st Apr, 2019 1st Jul, 2019 1st Oct, 2019 Balance before deposit 1000 1150 1500 1400 Balance before deposit 2000 2100 2000 3500 Balance before deposit 1500 1400 1250 1450 Deposit (*Note) No deposit X -150 No deposit Deposit (*Note) No deposit 300 2X No deposit Deposit (*Note) No deposit -300 250 500 31st Dec, 2019 2000 No deposit (*Note: If the amount is negative, it corresponds to the case of "withdrawal". For example, "- 300" means that the investor withdraws $300 from the account.) You are given that the dollar-weighted rate of return of fund account A is 3.7736%. Questions: (a) Using suitable performance indicator (time-weighted rate of return or dollar-weighted rate of return) introduced in Topic 5, determine which investor's investment strategy has the best performance? Explain your answer. (b) Today is 1st January, 2020, investor D wishes to invest his capital into one of the three funds above. Suppose that the investor chooses the investment fund which has the best performance in 2019. Which investment fund should he choose? Explain your answer using suitable performance indicator introduced in Topic 5. (*Note: You need to briefly explain the choice of performance indicator (time-weighted rate of return or dollar-weighted rate of return) chosen)

Step by Step Solution

★★★★★

3.57 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

a If we use the timeweighted rate of return then we would say that investor As investment strategy o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started