Question

At the beginning of 2019, Zetta Corp Garment Company reported in a footnote to its financial statements that the cost of the machine was

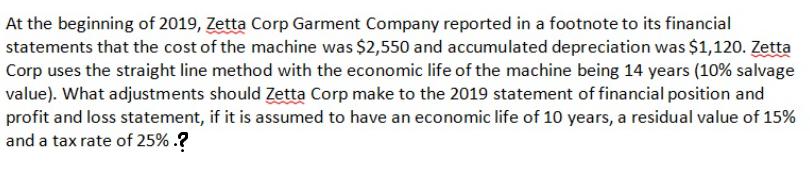

At the beginning of 2019, Zetta Corp Garment Company reported in a footnote to its financial statements that the cost of the machine was $2,550 and accumulated depreciation was $1,120. Zetta Corp uses the straight line method with the economic life of the machine being 14 years (10% salvage value). What adjustments should Zetta Corp make to the 2019 statement of financial position and profit and loss statement, if it is assumed to have an economic life of 10 years, a residual value of 15% and a tax rate of 25% .?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image contains a question related to accounting adjustments for a machines depreciation It states that at the beginning of 2019 Zetta Corp Garment Company reported a machines cost at 2550 and its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App