Question

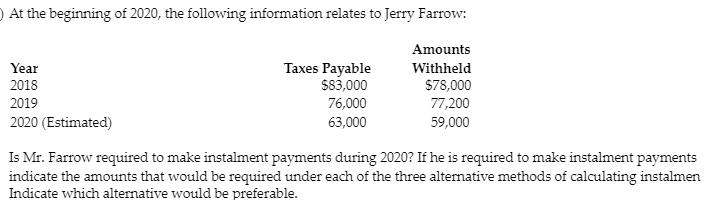

) At the beginning of 2020, the following information relates to Jerry Farrow: Amounts Year Taxes Payable $83,000 Withheld 2018 S78,000 77,200 2019 76,000

) At the beginning of 2020, the following information relates to Jerry Farrow: Amounts Year Taxes Payable $83,000 Withheld 2018 S78,000 77,200 2019 76,000 2020 (Estimated) 63,000 59,000 Is Mr. Farrow required to make instalment payments during 2020? If he is required to make instalment payments indicate the amounts that would be required under each of the three alternative methods of calculating instalmen Indicate which alternative would be preferable.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The net tax owing amounts are often calculated as follows 2018 5000 83000 78000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

3rd edition

9781337909402, 978-1337788281

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App