Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 2020, the Museum of History receives a documented promise to contribute $20,000 at the end of each year for the next

At the beginning of 2020, the Museum of History receives a documented promise to contribute $20,000 at the end of each year for the next four years. The appropriate discount rate is 3 percent, and the promise is considered fully collectible. At the end of 2020, the museum receives the first payment.

Required

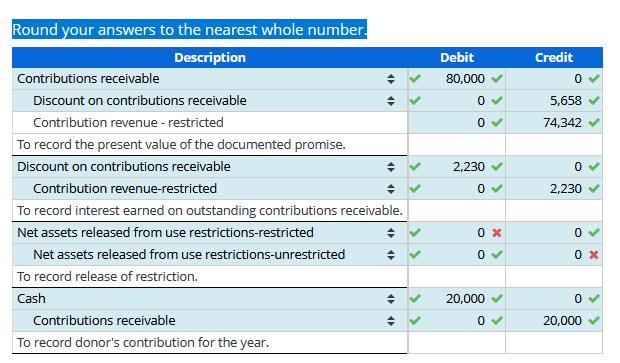

Journal entries to record the promise and the first year's contribution. If the museum's net assets are affected, indicate the appropriate category of net assets.

Round your answers to the nearest whole number.

Round your answers to the nearest whole number. Description Contributions receivable Discount on contributions receivable Contribution revenue - restricted To record the present value of the documented promise. Discount on contributions receivable Contribution revenue-restricted To record interest earned on outstanding contributions receivable. Net assets released from use restrictions-restricted Net assets released from use restrictions-unrestricted To record release of restriction. Cash Contributions receivable To record donor's contribution for the year. Debit 80,000 0 0 2,230 0 0x 0 20,000 0 Credit 0 5,658 74,342 0 2,230 0 0x 0 20,000

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Promisory Note Value 20000 per year Duration of promise 4 years Annual discount rate 3 pa Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started