Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 2021, Jasco Enterprises asks you to estimate its equity price per share and provides the following data: Jasco's CEO tells you

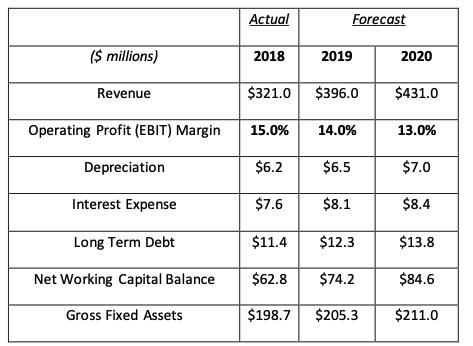

At the beginning of 2021, Jasco Enterprises asks you to estimate its equity price per share and provides the following data:

Jasco's CEO tells you that after 2022, the company's operations will grow at 3.5% forever and provides you with the following data:

Tax Rate = 35%

rWACC = 8.5%

Cost of Equity = 10.4%

Shares = 6.0 million

Debt = $128 million

Cash = $7.5 million

What is Jasco's share price at the beginning of 2019?

($ millions) Revenue Operating Profit (EBIT) Margin Depreciation Interest Expense Long Term Debt Net Working Capital Balance Gross Fixed Assets Actual 2018 Forecast 2019 $321.0 $396.0 15.0% 14.0% $6.2 $6.5 $7.6 $8.1 $11.4 $12.3 $62.8 $74.2 $198.7 $205.3 2020 $431.0 13.0% $7.0 $8.4 $13.8 $84.6 $211.0

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Share Price Equity ValueShares Equity Value Net Income Inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started