Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 20X7, Midland Corporation purchased a 9% bond with a face value of $100,000 for $96,209, i.e. a YTM of 10%.

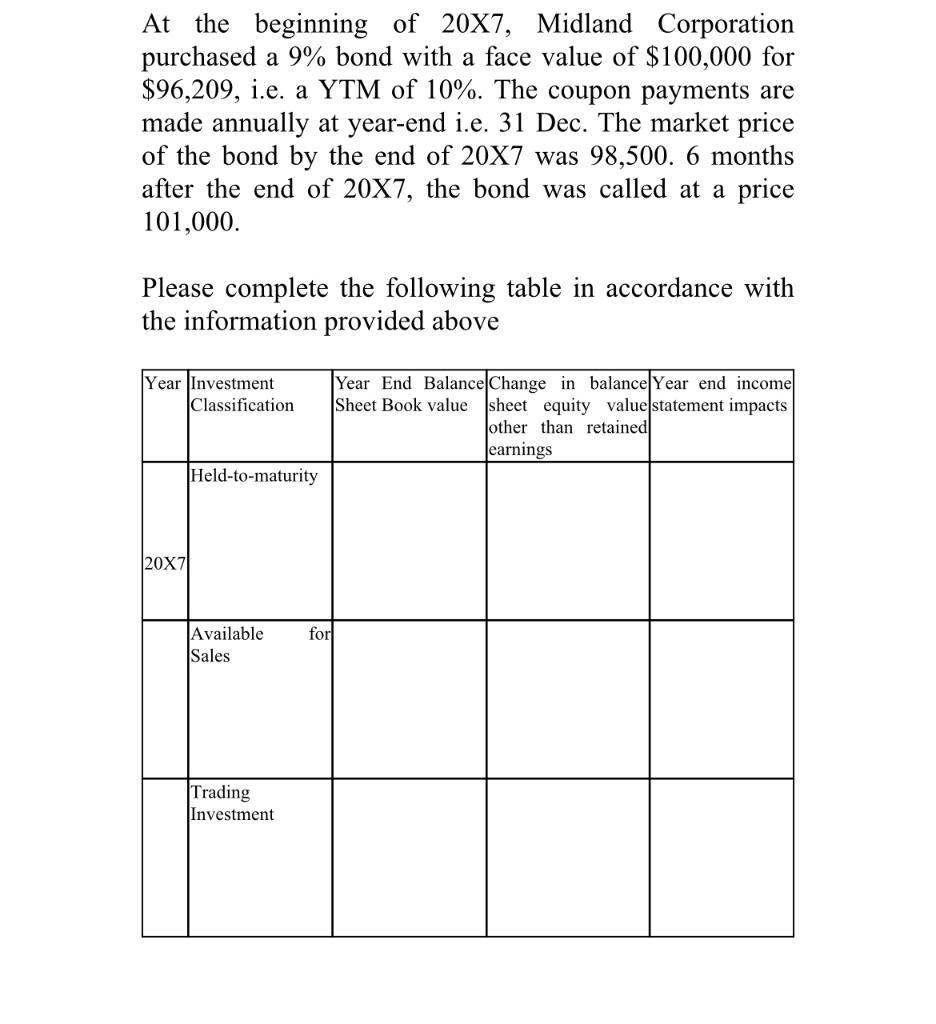

At the beginning of 20X7, Midland Corporation purchased a 9% bond with a face value of $100,000 for $96,209, i.e. a YTM of 10%. The coupon payments are made annually at year-end i.e. 31 Dec. The market price of the bond by the end of 20X7 was 98,500. 6 months after the end of 20X7, the bond was called at a price 101,000. Please complete the following table in accordance with the information provided above Year Investment Classification 20X7 Held-to-maturity Available Sales Trading Investment for Year End Balance Change in balance Year end income Sheet Book value sheet equity value statement impacts other than retained earnings

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Given Face Value of Bond 100000 Purchase Price 96209 Coupon Rate 9 Yield to Maturity YTM 10 Market P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started