Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a nine-year operating lease agreement. The contract calls

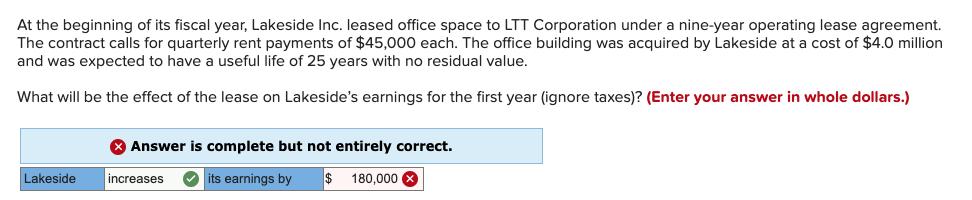

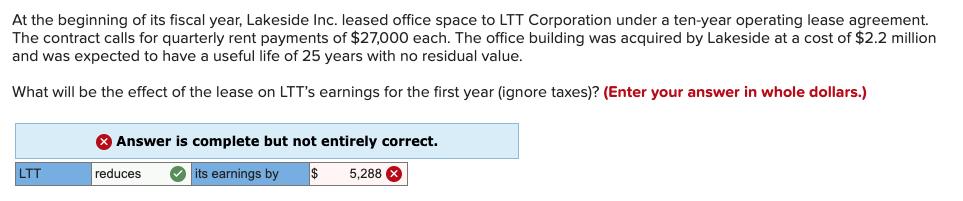

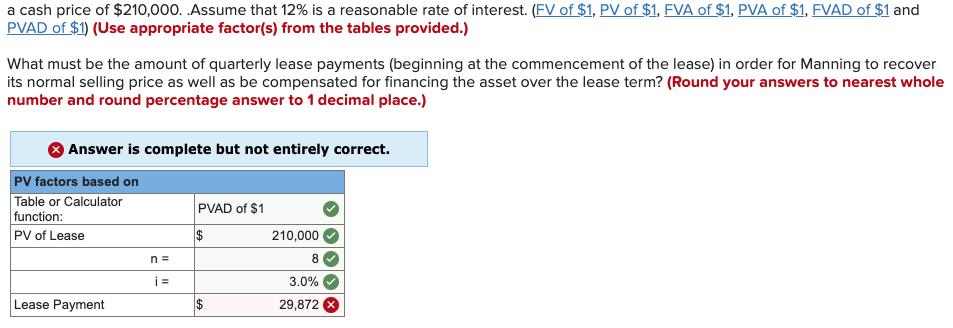

At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a nine-year operating lease agreement. The contract calls for quarterly rent payments of $45,000 each. The office building was acquired by Lakeside at a cost of $4.0 million and was expected to have a useful life of 25 years with no residual value. What will be the effect of the lease on Lakeside's earnings for the first year (ignore taxes)? (Enter your answer in whole dollars.) Answer is complete but not entirely correct. Lakeside increases A its earnings by 180,000 At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a ten-year operating lease agreement. The contract calls for quarterly rent payments of $27,000 each. The office building was acquired by Lakeside at a cost of $2.2 million and was expected to have a useful life of 25 years with no residual value. What will be the effect of the lease on LTT's earnings for the first year (ignore taxes)? (Enter your answer in whole dollars.) O Answer is complete but not entirely correct. LTT reduces O its earnings by 5,288 X a cash price of $210,000. Assume that 12% is a reasonable rate of interest. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What must be the amount of quarterly lease payments (beginning at the commencement of the lease) in order for Manning to recover its normal selling price as well as be compensated for financing the asset over the lease term? (Round your answers to nearest whole number and round percentage answer to 1 decimal place.) Answer is complete but not entirely correct. PV factors based on Table or Calculator function: PVAD of $1 PV of Lease 2$ 210,000 n = 8 i = 3.0% Lease Payment $ 29,872 At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a ten-year operating lease agreement. The contract calls for quarterly rent payments of $27,000 each. The office building was acquired by Lakeside at a cost of $2.2 million and was expected to have a useful life of 25 years with no residual value. What will be the effect of the lease on LTT's earnings for the first year (ignore taxes)? (Enter your answer in whole dollars.) O Answer is complete but not entirely correct. LTT reduces O its earnings by 5,288 X a cash price of $210,000. Assume that 12% is a reasonable rate of interest. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What must be the amount of quarterly lease payments (beginning at the commencement of the lease) in order for Manning to recover its normal selling price as well as be compensated for financing the asset over the lease term? (Round your answers to nearest whole number and round percentage answer to 1 decimal place.) Answer is complete but not entirely correct. PV factors based on Table or Calculator function: PVAD of $1 PV of Lease 2$ 210,000 n = 8 i = 3.0% Lease Payment $ 29,872

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started