Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of January 2023, ABC Corporation decided to raise $100 million in zero coupon bonds. These $10,000 face value bonds would have

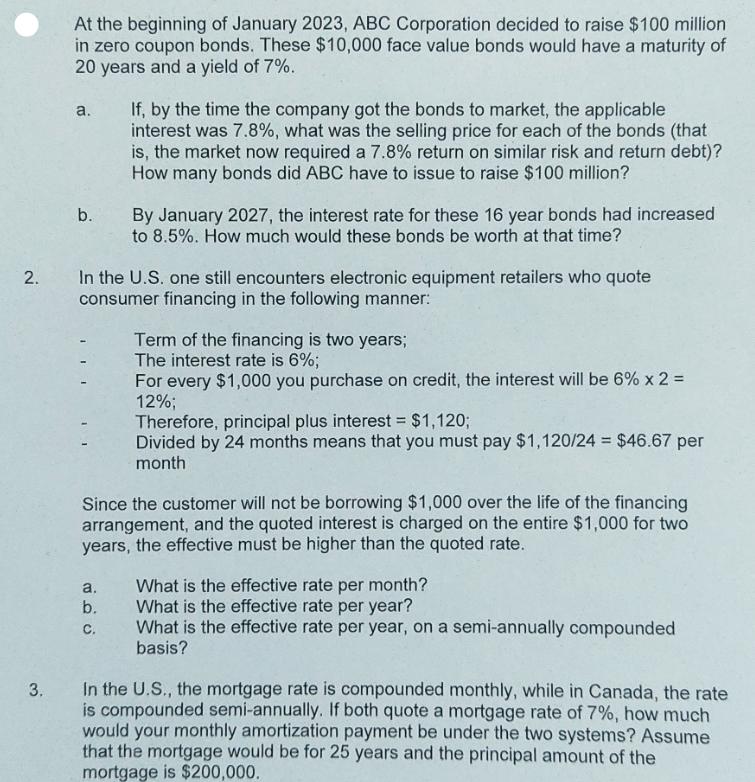

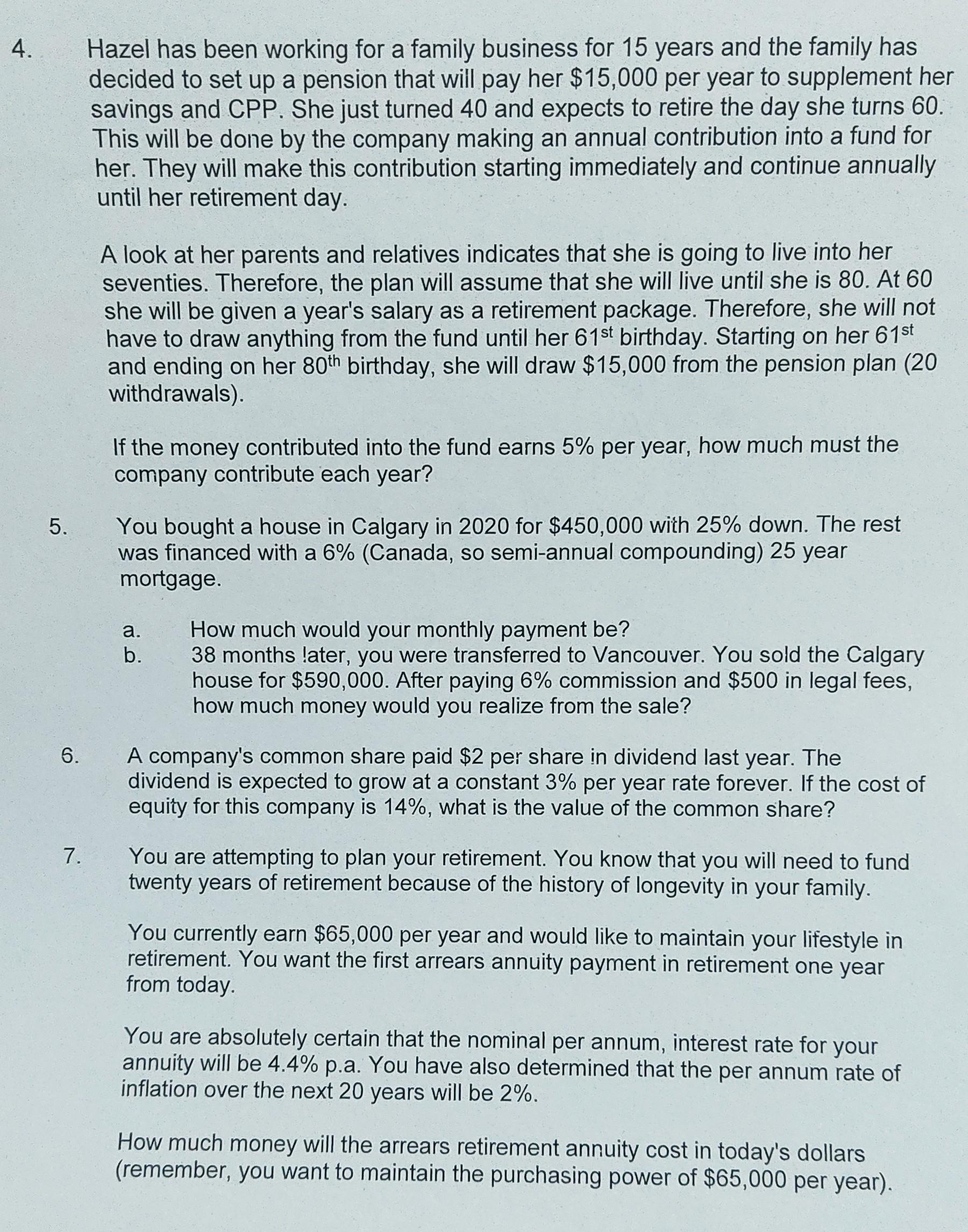

At the beginning of January 2023, ABC Corporation decided to raise $100 million in zero coupon bonds. These $10,000 face value bonds would have a maturity of 20 years and a yield of 7%. 3. a. If, by the time the company got the bonds to market, the applicable interest was 7.8%, what was the selling price for each of the bonds (that is, the market now required a 7.8% return on similar risk and return debt)? How many bonds did ABC have to issue to raise $100 million? b. By January 2027, the interest rate for these 16 year bonds had increased to 8.5%. How much would these bonds be worth at that time? 2. In the U.S. one still encounters electronic equipment retailers who quote consumer financing in the following manner: a. b. C. Term of the financing is two years; The interest rate is 6%; For every $1,000 you purchase on credit, the interest will be 6% x 2 = 12%; Therefore, principal plus interest = $1,120; Divided by 24 months means that you must pay $1,120/24 = $46.67 per month Since the customer will not be borrowing $1,000 over the life of the financing arrangement, and the quoted interest is charged on the entire $1,000 for two years, the effective must be higher than the quoted rate. What is the effective rate per month? What is the effective rate per year? What is the effective rate per year, on a semi-annually compounded basis? In the U.S., the mortgage rate is compounded monthly, while in Canada, the rate is compounded semi-annually. If both quote a mortgage rate of 7%, how much would your monthly amortization payment be under the two systems? Assume that the mortgage would be for 25 years and the principal amount of the mortgage is $200,000. 4. 5. 6. 7. Hazel has been working for a family business for 15 years and the family has decided to set up a pension that will pay her $15,000 per year to supplement her savings and CPP. She just turned 40 and expects to retire the day she turns 60. This will be done by the company making an annual contribution into a fund for her. They will make this contribution starting immediately and continue annually until her retirement day. A look at her parents and relatives indicates that she is going to live into her seventies. Therefore, the plan will assume that she will live until she is 80. At 60 she will be given a year's salary as a retirement package. Therefore, she will not have to draw anything from the fund until her 61st birthday. Starting on her 61st and ending on her 80th birthday, she will draw $15,000 from the pension plan (20 withdrawals). If the money contributed into the fund earns 5% per year, how much must the company contribute each year? You bought a house in Calgary in 2020 for $450,000 with 25% down. The rest was financed with a 6% (Canada, so semi-annual compounding) 25 year mortgage. a. b. How much would your monthly payment be? 38 months later, you were transferred to Vancouver. You sold the Calgary house for $590,000. After paying 6% commission and $500 in legal fees, how much money would you realize from the sale? A company's common share paid $2 per share in dividend last year. The dividend is expected to grow at a constant 3% per year rate forever. If the cost of equity for this company is 14%, what is the value of the common share? You are attempting to plan your retirement. You know that you will need to fund twenty years of retirement because of the history of longevity in your family. You currently earn $65,000 per year and would like to maintain your lifestyle in retirement. You want the first arrears annuity payment in retirement one year from today. You are absolutely certain that the nominal per annum, interest rate for your annuity will be 4.4% p.a. You have also determined that the per annum rate of inflation over the next 20 years will be 2%. How much money will the arrears retirement annuity cost in today's dollars (remember, you want to maintain the purchasing power of $65,000 per year).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the solutions 1a Given Face value of bonds 10000 Issuance amount 100 million Original yield ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started