Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of March, Blossom Software Company had Cash of $11,621, Accounts Receivable of $18,343, Accounts Payable of $3,977, and G. Blossom, Capital of

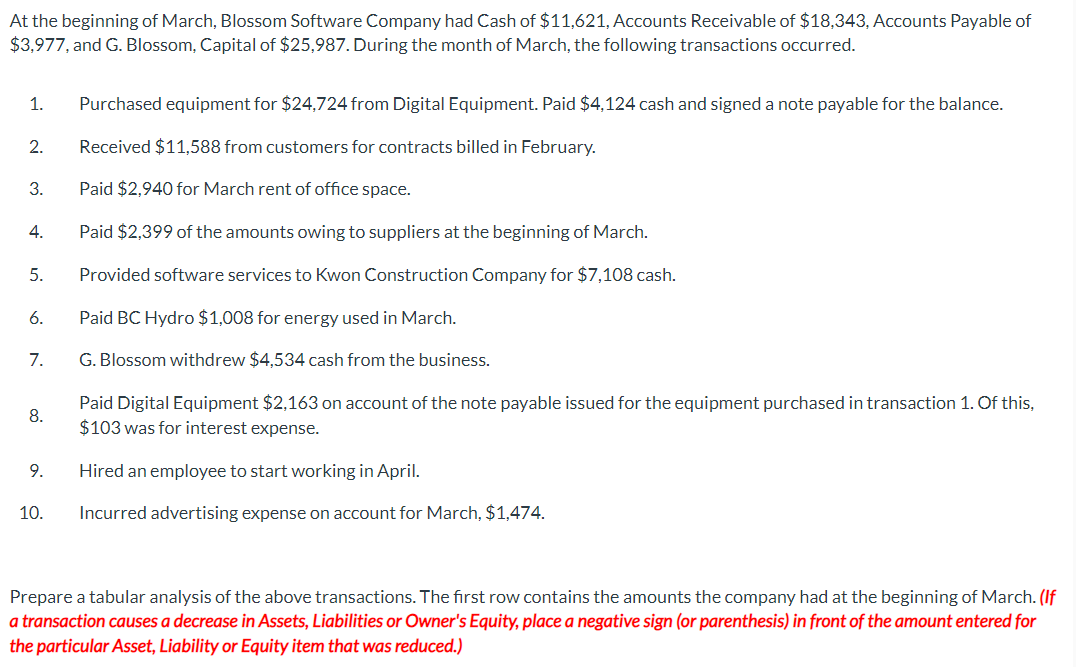

At the beginning of March, Blossom Software Company had Cash of $11,621, Accounts Receivable of $18,343, Accounts Payable of $3,977, and G. Blossom, Capital of $25,987. During the month of March, the following transactions occurred. 1. Purchased equipment for $24,724 from Digital Equipment. Paid $4,124 cash and signed a note payable for the balance. 2. Received $11,588 from customers for contracts billed in February. 3. Paid $2,940 for March rent of office space. 4. Paid $2,399 of the amounts owing to suppliers at the beginning of March. 5. Provided software services to Kwon Construction Company for $7,108 cash. 6. Paid BC Hydro $1,008 for energy used in March. 7. G. Blossom withdrew $4,534 cash from the business. 8. Paid Digital Equipment $2,163 on account of the note payable issued for the equipment purchased in transaction 1 . Of this, $103 was for interest expense. 9. Hired an employee to start working in April. 10. Incurred advertising expense on account for March, $1,474. Prepare a tabular analysis of the above transactions. The first row contains the amounts the company had at the beginning of March. (If a transaction causes a decrease in Assets, Liabilities or Owner's Equity, place a negative sign (or parenthesis) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

At the beginning of March, Blossom Software Company had Cash of $11,621, Accounts Receivable of $18,343, Accounts Payable of $3,977, and G. Blossom, Capital of $25,987. During the month of March, the following transactions occurred. 1. Purchased equipment for $24,724 from Digital Equipment. Paid $4,124 cash and signed a note payable for the balance. 2. Received $11,588 from customers for contracts billed in February. 3. Paid $2,940 for March rent of office space. 4. Paid $2,399 of the amounts owing to suppliers at the beginning of March. 5. Provided software services to Kwon Construction Company for $7,108 cash. 6. Paid BC Hydro $1,008 for energy used in March. 7. G. Blossom withdrew $4,534 cash from the business. 8. Paid Digital Equipment $2,163 on account of the note payable issued for the equipment purchased in transaction 1 . Of this, $103 was for interest expense. 9. Hired an employee to start working in April. 10. Incurred advertising expense on account for March, $1,474. Prepare a tabular analysis of the above transactions. The first row contains the amounts the company had at the beginning of March. (If a transaction causes a decrease in Assets, Liabilities or Owner's Equity, place a negative sign (or parenthesis) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started