Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of November 2017, Olivia Labelle invested her savings in 20 American call option contracts on shares of common stock of Bank of

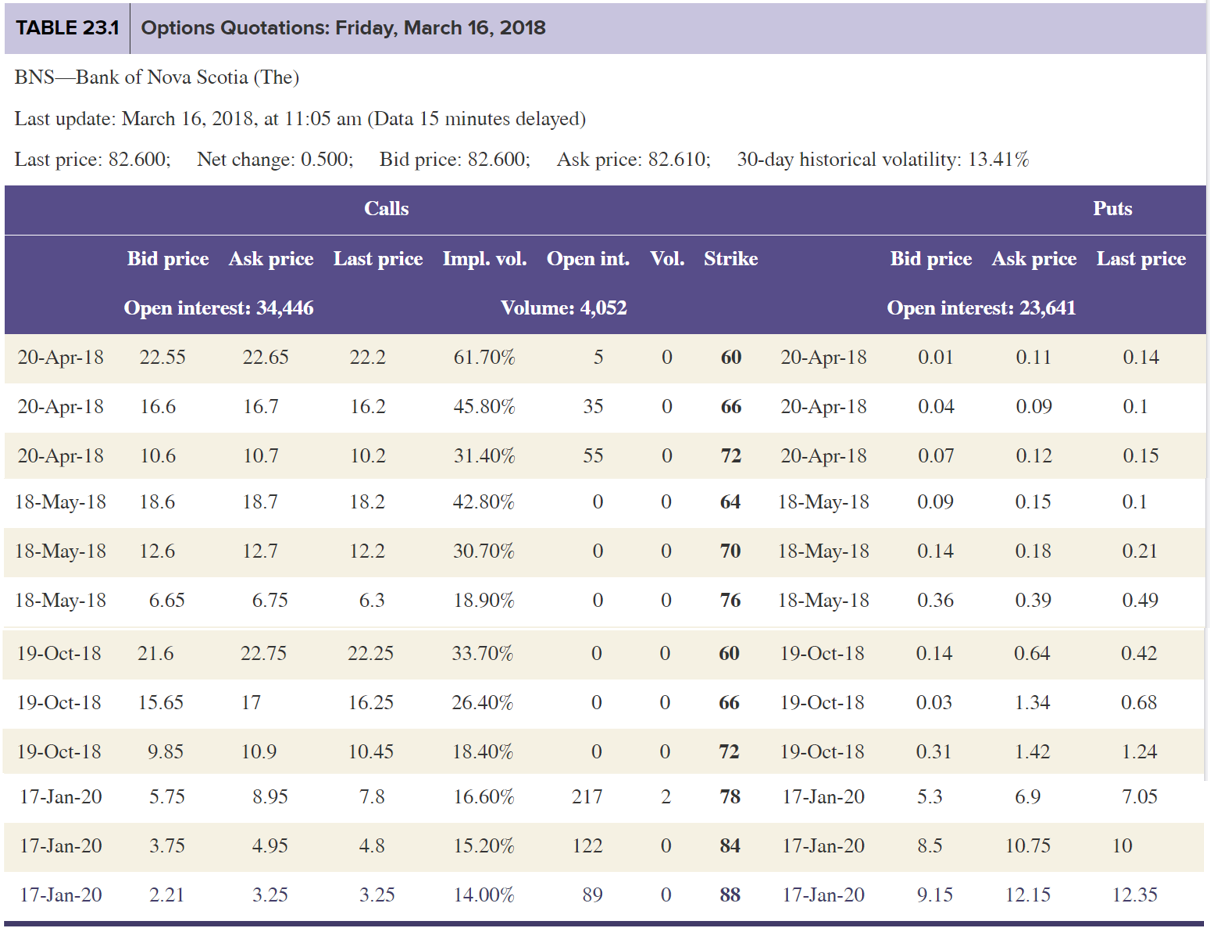

At the beginning of November 2017, Olivia Labelle invested her savings in 20 American call option contracts on shares of common stock of Bank of Nova Scotia (BNS) with a call price (Co) of $4.00 per-share, an exercise (strike) price (E) of $78 and expiry on 17-Jan-2020.

Assume on March 16, 2018, Olivia needed money urgently to pay medical bills of $10,000. The only alternative was getting the money from her investment on option contracts. Given this information answer the following questions:

- If Olivia had exercised her call options, was she able to cover her medical expenses based on the quotations reported on slides 26/27?

- Was there a better alternative to maximize her revenues? If she had chosen this alternative, was she able to cover her medical bills?

TABLE 23.1 Options Quotations: Friday, March 16, 2018 BNS-Bank of Nova Scotia (The) Last update: March 16, 2018, at 11:05 am (Data 15 minutes delayed) Last price: 82.600; Net change: 0.500; Bid price: 82.600; Ask price: 82.610; 30-day historical volatility: 13.41% Calls Puts Bid price Ask price Last price Impl. vol. Open int. Vol. Strike Bid price Ask price Last price Open interest: 34,446 Volume: 4,052 Open interest: 23,641 20-Apr-18 20-Apr-18 20-Apr-18 22.55 16.6 10.6 22.65 16.7 10.7 22.2 16. 2 10. 2 61.70% 4 5.80% 3 1.40% 5 35 55 0 0 0 0 0 0 0 60 66 72 64 70 20-Apr-18 20-Apr-18 20-Apr-18 18-May-18 18-May-18 0.01 0.04 0.07 0.09 0.14 0.11 0.09 0.12 0.14 0.1 0.15 18-May-18 18.6 18.7 18.2 42.80% 0.15 0.1 18-May-18 12.6 12.7 12.2 30.70% 0.18 0.21 18-May-18 6.65 6.75 6.3 18.90% 0 0 76 18-May-18 0.36 0.39 0.49 19-Oct-18 21.6 22.75 22.25 33.70% 0.64 0.42 19-Oct-18 15.65 17 16.25 26.40% 0.68 19-Oct-18 9.85 10.9 10.45 18.40% 0 0 0 217 122 0 0 0 2 0 60 66 72 78 84 19-Oct-18 19-Oct-18 19-Oct-18 17-Jan-20 17-Jan-20 0.14 0.03 0.31 5.3 8.5 1.24 1.34 1.42 6.9 10.75 17-Jan-20 5.75 8.95 7.8 16.60% 15.20% 7.05 10 17-Jan-20 3.75 4.95 4.8 17-Jan-20 2.21 3.25 3.25 14.00% 89 0 88 17-Jan-209 .15 12.15 12.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started