Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of October (the 21st pay period), Aisha decides to cash out her accumulated vacation pay of $2800 (no time taken). This will

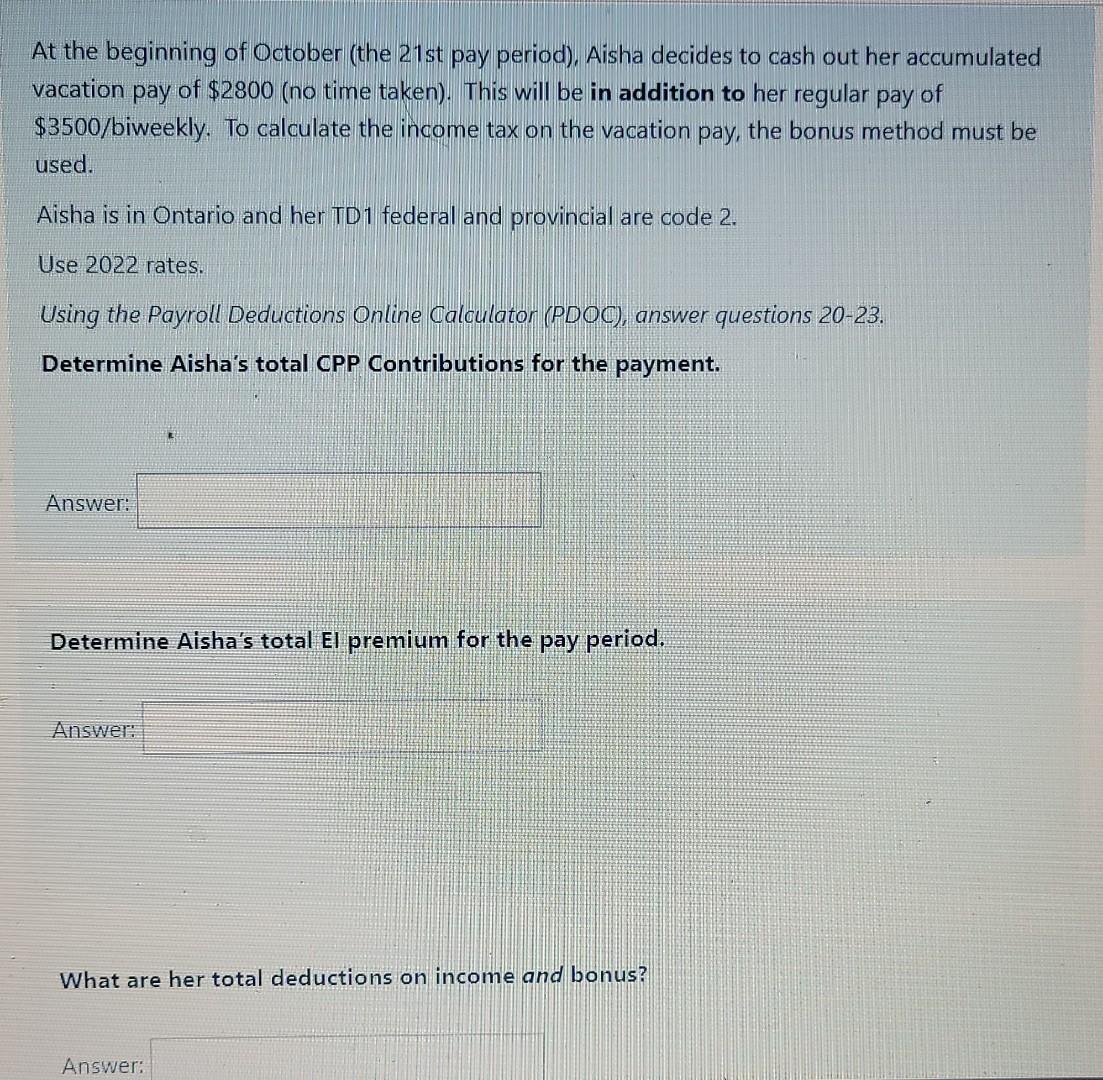

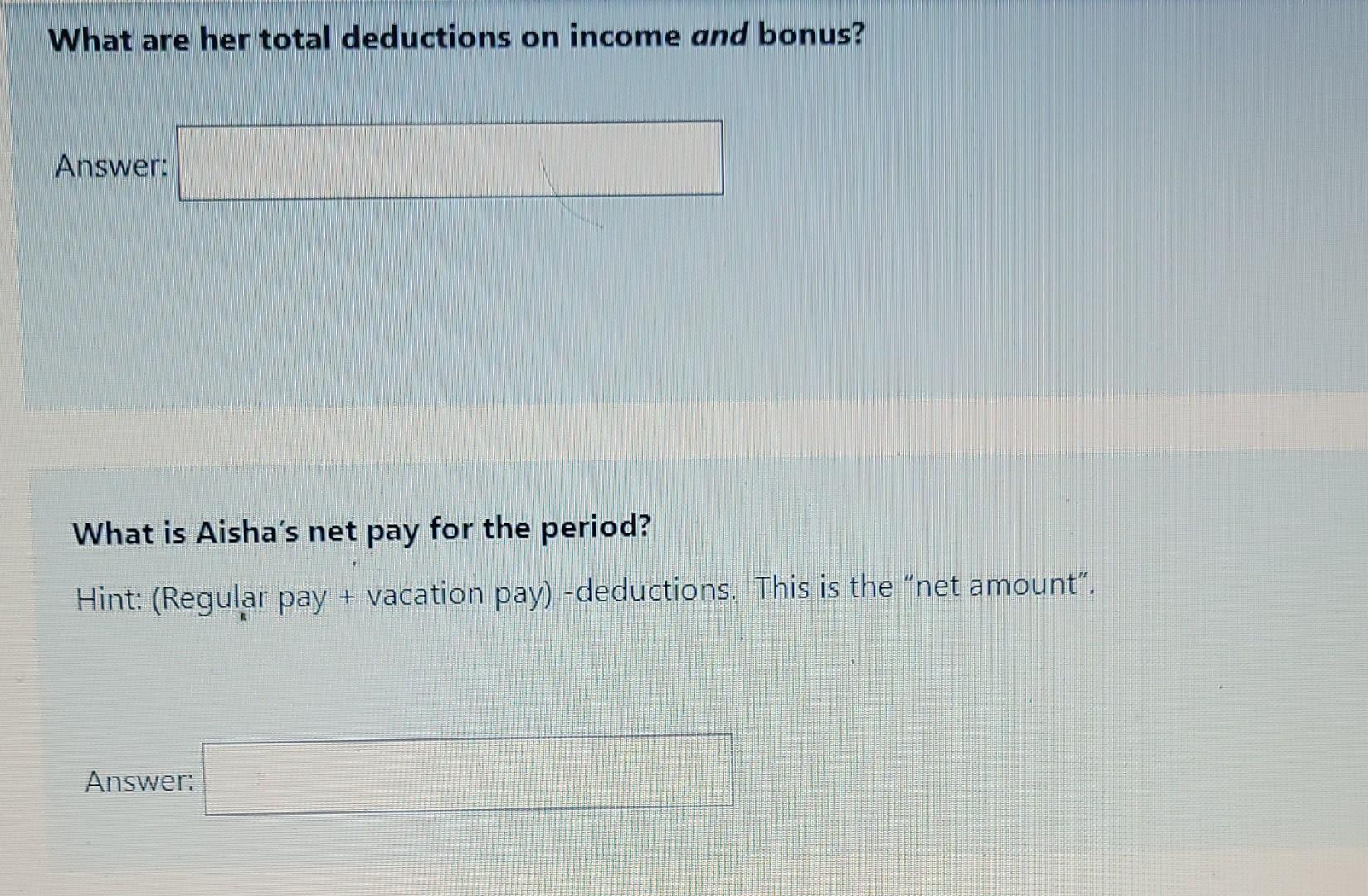

At the beginning of October (the 21st pay period), Aisha decides to cash out her accumulated vacation pay of $2800 (no time taken). This will be in addition to her regular pay of $3500/biweekly. To calculate the income tax on the vacation pay, the bonus method must be used. Aisha is in Ontario and her TD1 federal and provincial are code 2. Use 2022 rates. Using the Payroll Deductions Online Calculator (PDOC), answer questions 20-23. Determine Aisha's total CPP Contributions for the payment. Answer: Determine Aisha's total El premium for the pay period. Answer: What are her total deductions on income and bonus? Answer: What are her total deductions on income and bonus? Answer: What is Aisha's net pay for the period? Hint: (Regular pay + vacation pay) -deductions. This is the "net amount". +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started