Question

At the beginning of the 2022 (as of December 31, 2021), a pension plan portfolio has the following allocation, namely 45% US Large Cap Equities

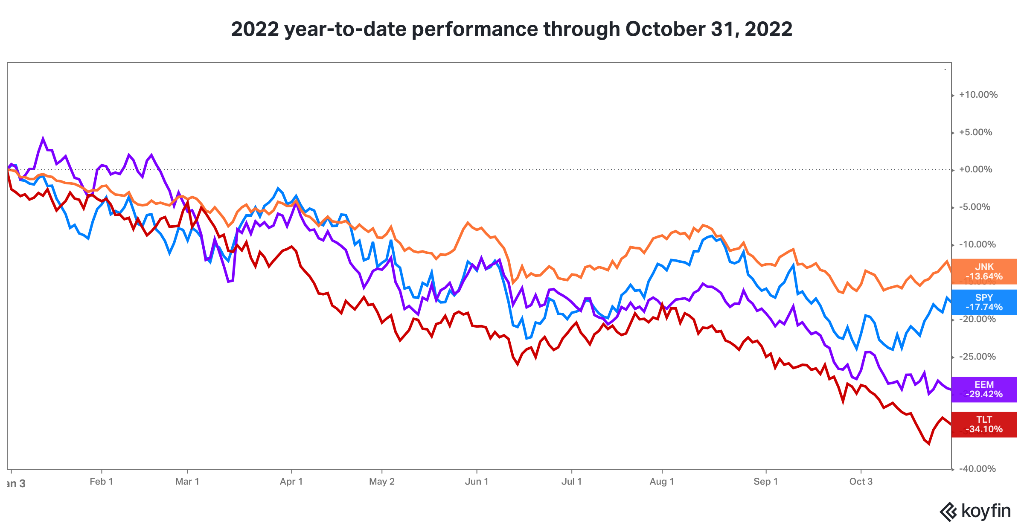

At the beginning of the 2022 (as of December 31, 2021), a pension plan portfolio has the following allocation, namely 45% US Large Cap Equities (SPY ETF), 15% Emerging Markets Equities (EEM), 10% High Yield Debt (JNK ETF), and 30% US Treasuries Long Maturities (TLT ETF).

In late December 2021, you meet with your boss, who is the investment officer for the pension fund. Assume you are the derivatives expert on the team of investment professionals.

Your boss has the following worries.

1) Interest rates may increase as the Federal Reserve fights inflation.

2) Credit risk may increase as US economic growth slows.

3) US equities may decline as profit margins decline due to inflation, revenue growth slows as the economic growth slows, and market discount rates increase as interest rates increase.

4) Emerging markets equities are especially at risk if the US dollar appreciates in value and emerging markets currencies depreciate in value.

For each of these four worries, recommend a derivatives transaction to hedge the risk.

(a) Name the type of derivative,

(b) state whether you will be going long (purchase) or short (sell), and

(c) explain what risk you are hedging.

[several sentences]

See the chart with the year-to-date performance through October 31. The boss has a crystal ball (unlikely, but let's pretend).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started