Answered step by step

Verified Expert Solution

Question

1 Approved Answer

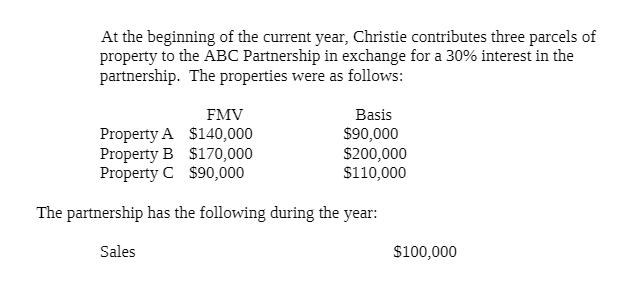

At the beginning of the current year, Christie contributes three parcels of property to the ABC Partnership in exchange for a 30% interest in

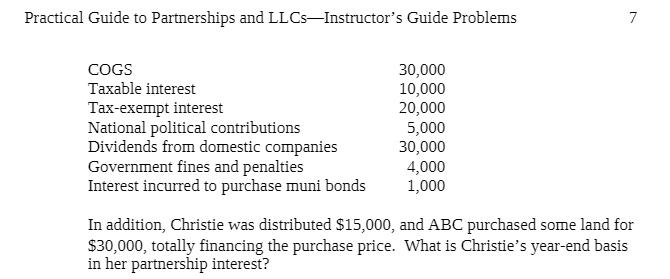

At the beginning of the current year, Christie contributes three parcels of property to the ABC Partnership in exchange for a 30% interest in the partnership. The properties were as follows: FMV Basis Property A $140,000 Property B $170,000 Property C $90,000 $90,000 $200,000 $110,000 The partnership has the following during the year: Sales $100,000 Practical Guide to Partnerships and LLCS-Instructor's Guide Problems 7 COGS Taxable interest Tax-exempt interest National political contributions Dividends from domestic companies Government fines and penalties Interest incurred to purchase muni bonds 30,000 10,000 20,000 5,000 30,000 4,000 1,000 In addition, Christie was distributed $15,000, and ABC purchased some land for $30,000, totally financing the purchase price. What is Christie's year-end basis in her partnership interest?

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e0ec59afda_181086.pdf

180 KBs PDF File

635e0ec59afda_181086.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started