Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of the first quarter, your company borrows $20,000 for four years at 8% interest and has to repay 55,000 of principal each

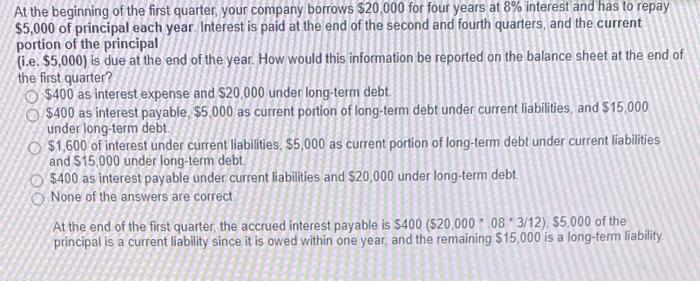

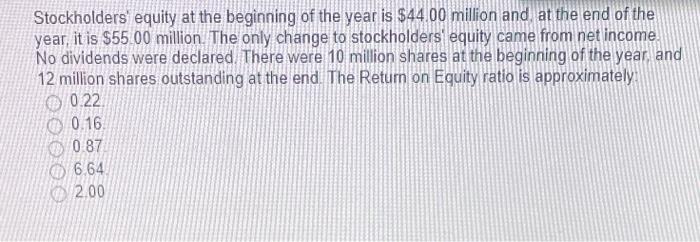

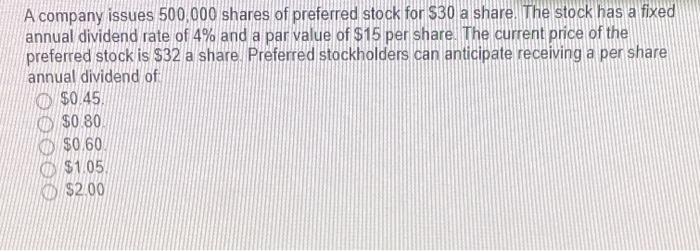

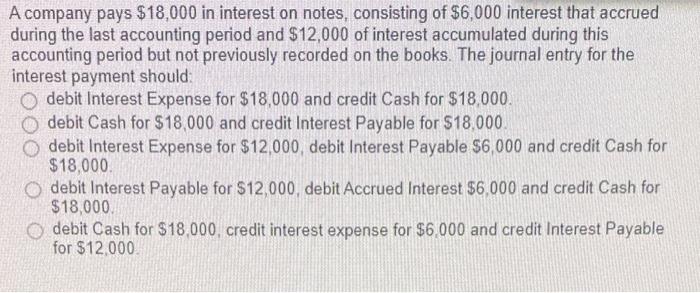

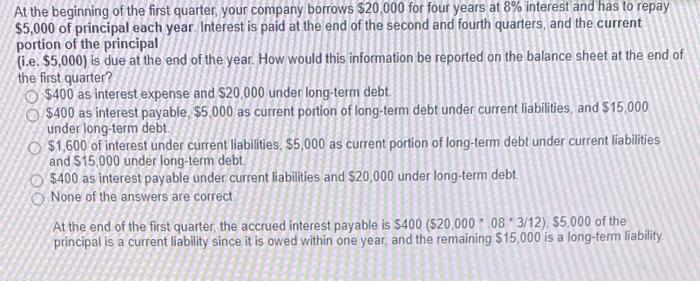

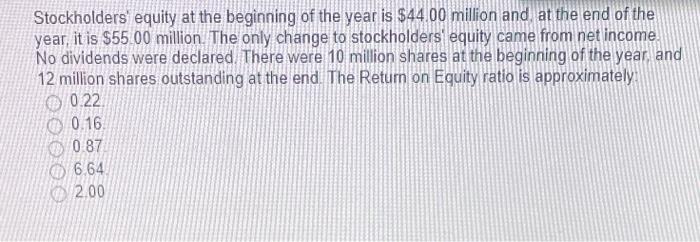

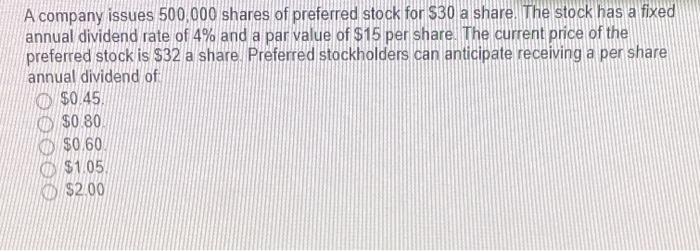

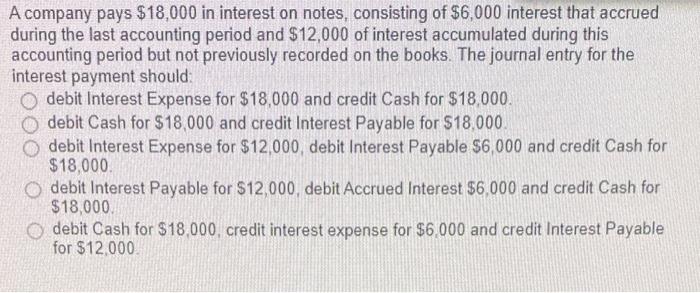

At the beginning of the first quarter, your company borrows $20,000 for four years at 8% interest and has to repay 55,000 of principal each year. Interest is paid at the end of the second and fourth quarters, and the current portion of the principal (i.e. $5,000) is due at the end of the year. How would this information be reported on the balance sheet at the end of the first quarter? $400 as interest expense and $20,000 under long-term debt. $400 as interest payable, $5,000 as current portion of long-term debt under current liabilities, and $15,000 under long-term debt. $1,600 of interest under current liabilities, $5,000 as current portion of long-term debt under current liabilities and $15,000 under long-term debt. $400 as interest payable under current liabilities and $20,000 under long-term debt. None of the answers are correct At the end of the first quarter, the accrued interest payable is $400($20,000,083/12),$5,000 of the principal is a current liability since it is owed within one year, and the remaining $15,000 is a long-term liability. Stockholders' equity at the beginning of the year is $44.00 million and at the end of the year it is $55.00 million. The only change to stockholders' equity came from net income. No dividends were declared There were 10 million shares at the beginning of the year, and 12 million shares outstanding at the end. The Return on Equity ratio is approximately: 0.220.160.876.642.00 A company issues 500,000 shares of preferred stock for 530 a share. The stock has a fixed annual dividend rate of 4% and a par value of $15 per share. The current price of the preferred stock is $32 a share. Preferred stockholders can anticipate receiving a per share annual dividend of $0.45$0.80$0.60$1.05$2.00 A company pays $18,000 in interest on notes, consisting of $6,000 interest that accrued during the last accounting period and $12,000 of interest accumulated during this accounting period but not previously recorded on the books. The journal entry for the interest payment should: debit Interest Expense for $18,000 and credit Cash for $18,000. debit Cash for $18,000 and credit Interest Payable for $18,000. debit Interest Expense for $12,000, debit Interest Payable $6,000 and credit Cash for $18,000 debit Interest Payable for $12,000, debit Accrued Interest $6,000 and credit Cash for $18,000. debit Cash for $18,000, credit interest expense for $6,000 and credit Interest Payable for $12,000

At the beginning of the first quarter, your company borrows $20,000 for four years at 8% interest and has to repay 55,000 of principal each year. Interest is paid at the end of the second and fourth quarters, and the current portion of the principal (i.e. $5,000) is due at the end of the year. How would this information be reported on the balance sheet at the end of the first quarter? $400 as interest expense and $20,000 under long-term debt. $400 as interest payable, $5,000 as current portion of long-term debt under current liabilities, and $15,000 under long-term debt. $1,600 of interest under current liabilities, $5,000 as current portion of long-term debt under current liabilities and $15,000 under long-term debt. $400 as interest payable under current liabilities and $20,000 under long-term debt. None of the answers are correct At the end of the first quarter, the accrued interest payable is $400($20,000,083/12),$5,000 of the principal is a current liability since it is owed within one year, and the remaining $15,000 is a long-term liability. Stockholders' equity at the beginning of the year is $44.00 million and at the end of the year it is $55.00 million. The only change to stockholders' equity came from net income. No dividends were declared There were 10 million shares at the beginning of the year, and 12 million shares outstanding at the end. The Return on Equity ratio is approximately: 0.220.160.876.642.00 A company issues 500,000 shares of preferred stock for 530 a share. The stock has a fixed annual dividend rate of 4% and a par value of $15 per share. The current price of the preferred stock is $32 a share. Preferred stockholders can anticipate receiving a per share annual dividend of $0.45$0.80$0.60$1.05$2.00 A company pays $18,000 in interest on notes, consisting of $6,000 interest that accrued during the last accounting period and $12,000 of interest accumulated during this accounting period but not previously recorded on the books. The journal entry for the interest payment should: debit Interest Expense for $18,000 and credit Cash for $18,000. debit Cash for $18,000 and credit Interest Payable for $18,000. debit Interest Expense for $12,000, debit Interest Payable $6,000 and credit Cash for $18,000 debit Interest Payable for $12,000, debit Accrued Interest $6,000 and credit Cash for $18,000. debit Cash for $18,000, credit interest expense for $6,000 and credit Interest Payable for $12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started