Answered step by step

Verified Expert Solution

Question

1 Approved Answer

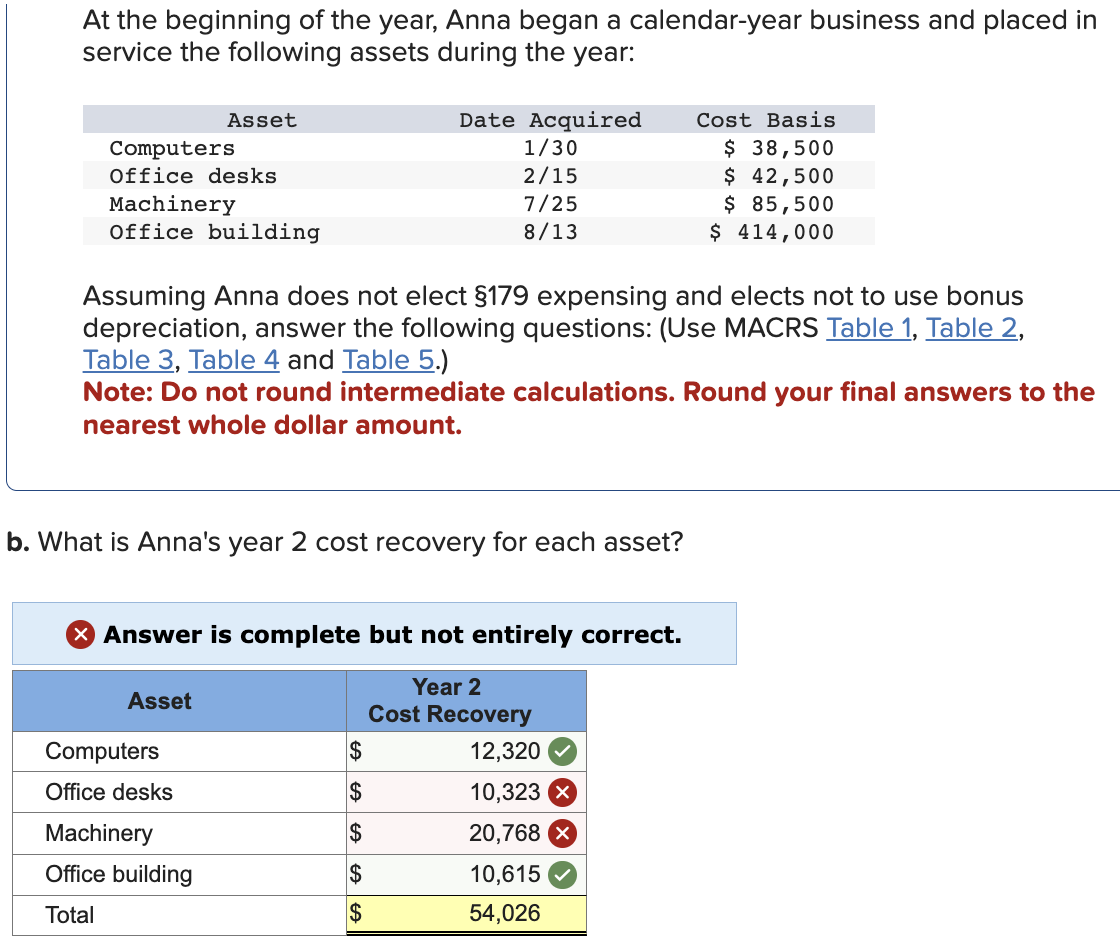

At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Assuming Anna does not

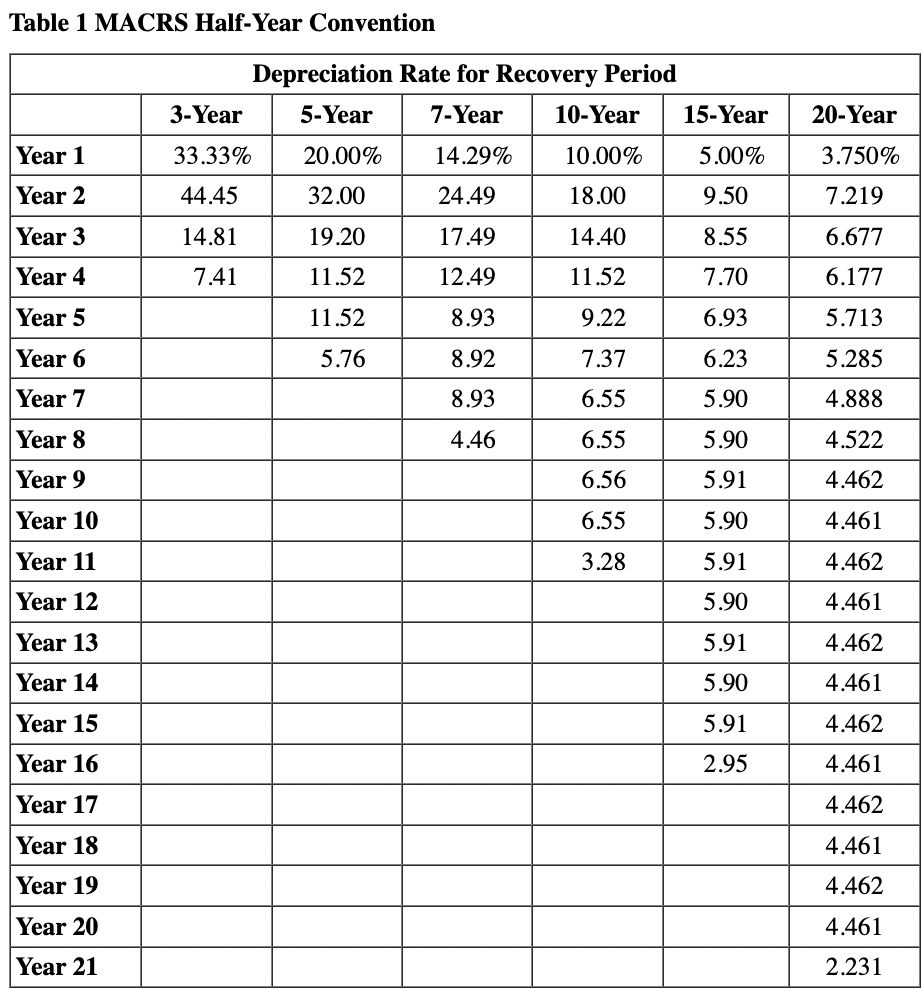

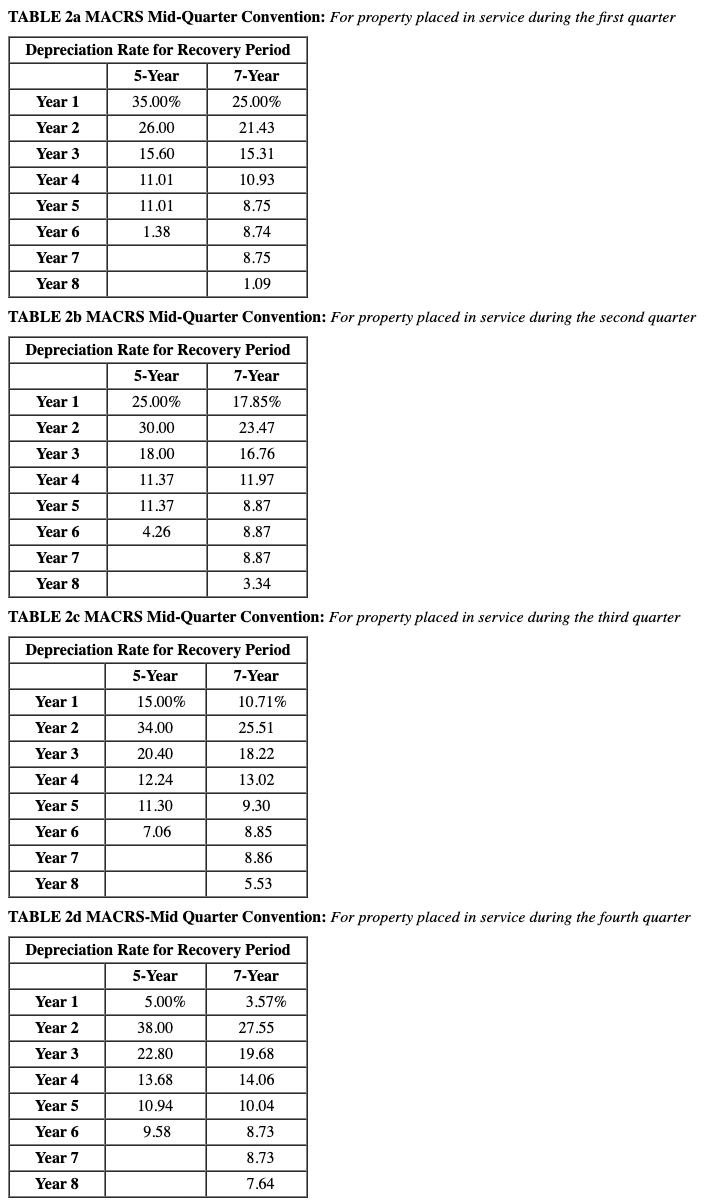

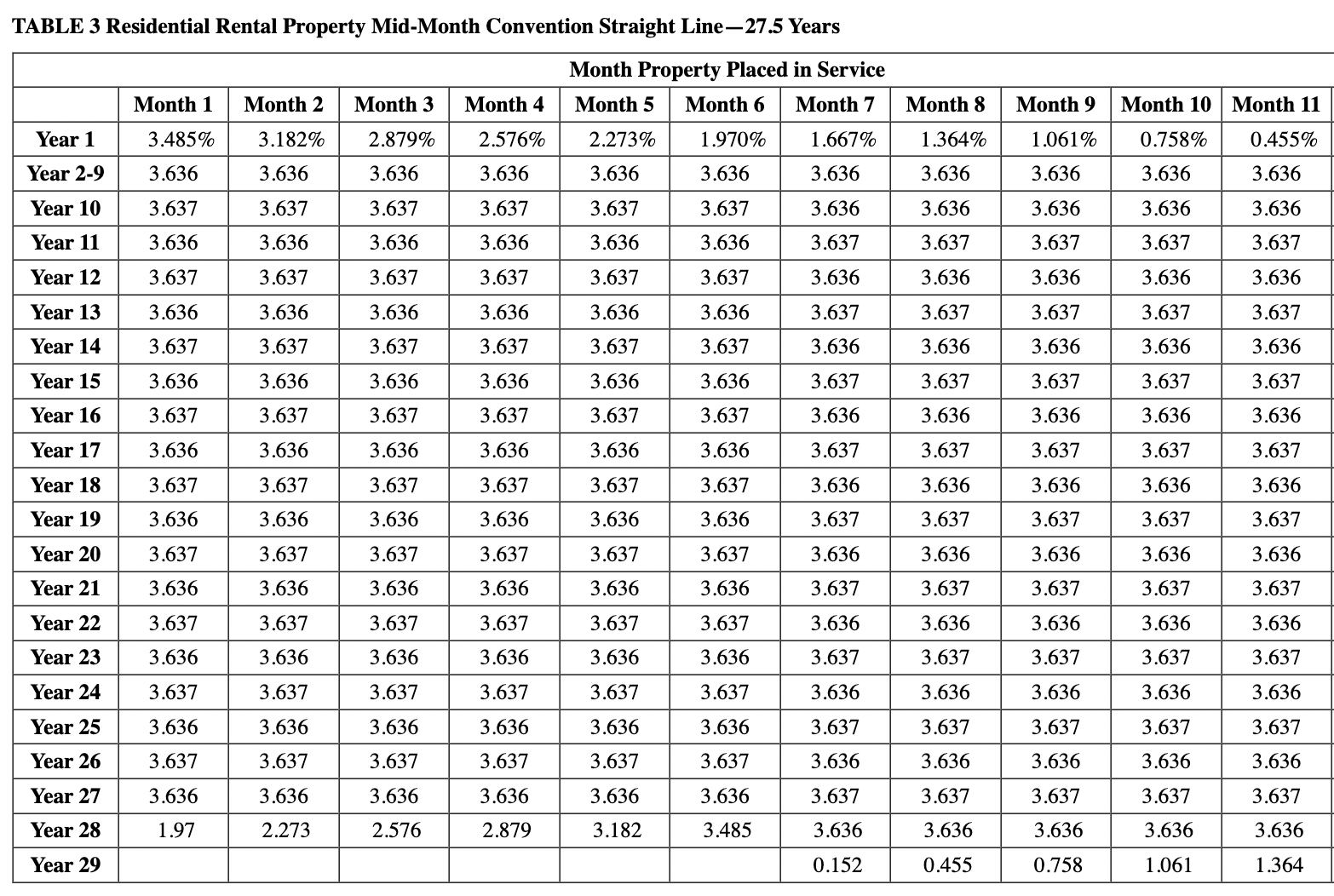

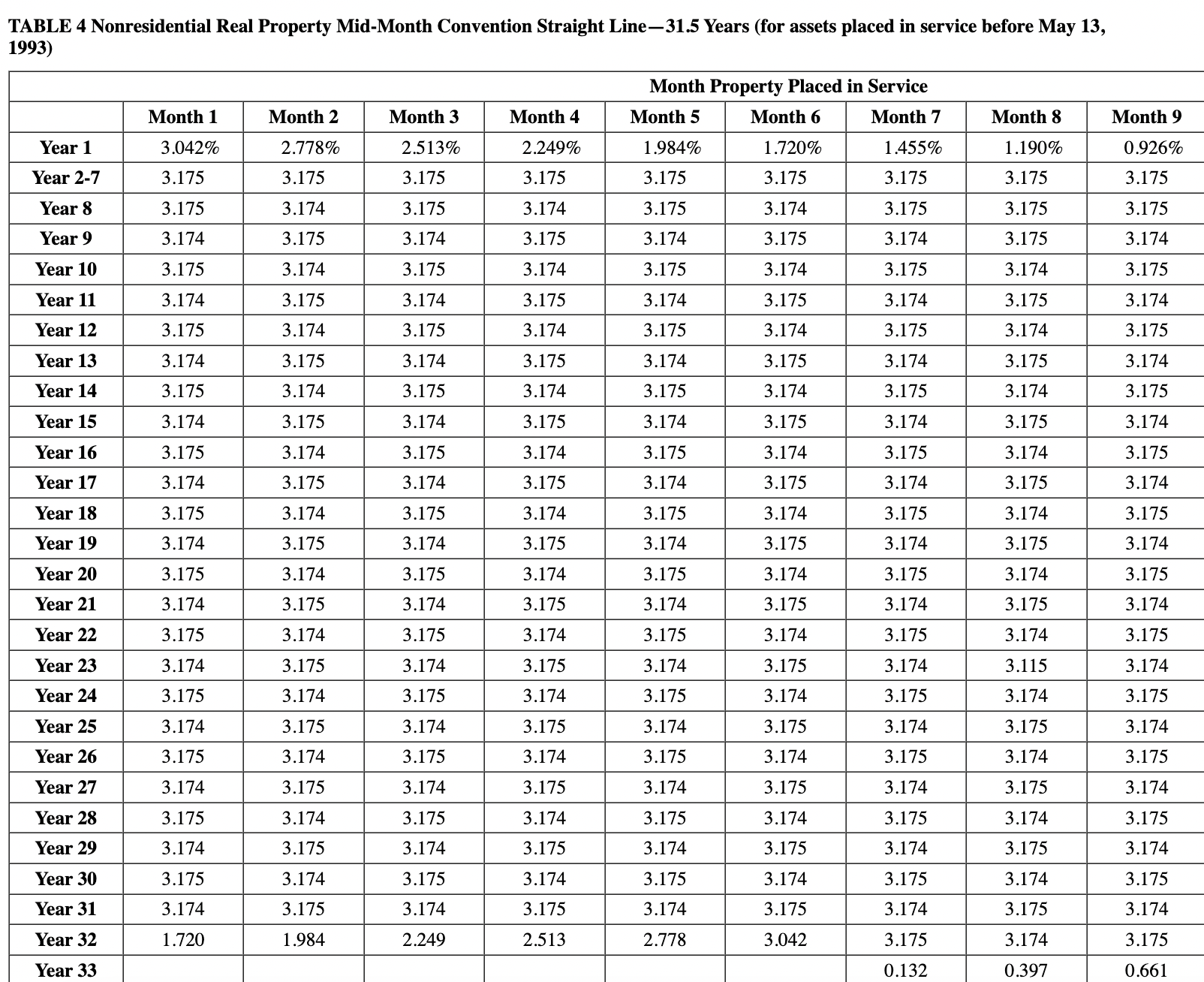

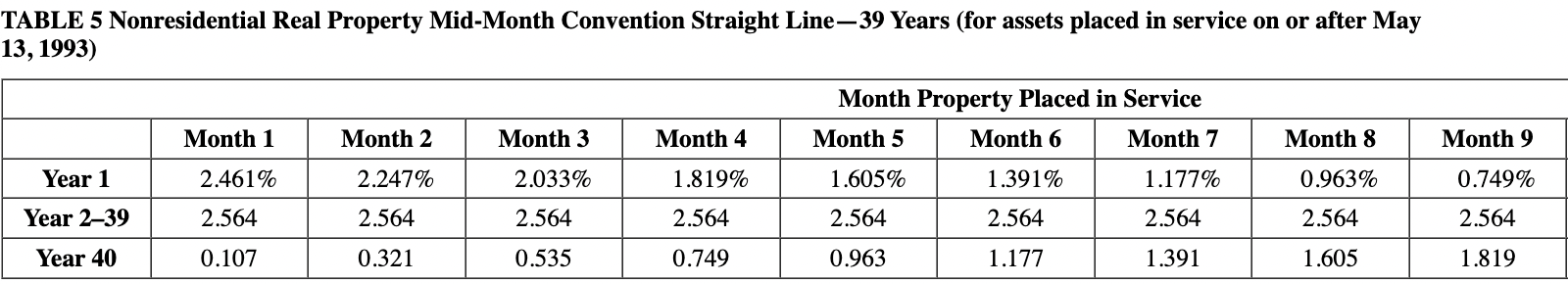

At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Assuming Anna does not elect 179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3 , Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. b. What is Anna's year 2 cost recovery for each asset? Answer is complete but not entirely correct. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13, 1993) ABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 3, 1993)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started